Inflammatory Bowel Disease Treatment Industry Overview

The global inflammatory bowel disease treatment market size is expected to reach USD 27.8 billion by 2028, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 4.8% from 2021 to 2028. Increasing awareness about the disease, rise in geriatric population, and favorable initiatives undertaken by regulatory bodies are anticipated to drive the market growth over the forecast period. For instance, in January 2020, the U.S. FDA allowed ABIVAX to conduct a phase 2B clinical trial of ABX464 on U.S. patients living with moderate-to-severe ulcerative colitis.

Increasing adoption of strategies such as new product development and expansion is expected to drive market growth. For instance, in June 2020, Takeda Pharmaceutical received U.S. FDA approval to manufacture Entyvio (vedolizumab) in its U.S.-based manufacturing facility. The approval is expected to support the growing demand for the drug in the U.S. and nearby countries. Moreover, Takeda pharmaceutical is heavily investing in the development of the market in China.

Inflammatory Bowel Disease Treatment Market Segmentation

Grand View Research has segmented the global inflammatory bowel disease treatment market on the basis of type, drug class, route of administration, distribution channel, and region:

Based on the Type Insights, the market is segmented into Crohn's Disease and Ulcerative Colitis

- Crohn’s disease dominated the market for inflammatory bowel disease treatment and accounted for the largest revenue share of 61.3% in 2020.

- The ulcerative colitis segment is anticipated to witness significant growth over the forecast period due to the high patient base and increasing approval of biologics for the treatment of ulcerative colitis.

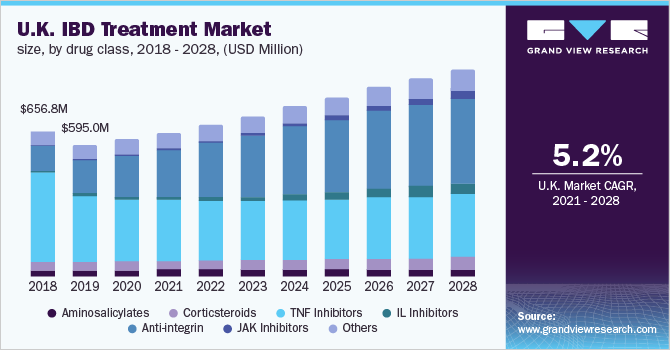

Based on the Drug Class Insights, the market is segmented into Aminosalicylates, Corticosteroids, TNF inhibitors, IL inhibitors, Anti-integrin, JAK inhibitors, and Others

- The TNF inhibitors segment dominated the market for inflammatory bowel disease treatment and accounted for the largest revenue share of 47.8% in 2020.

- JAK inhibitors are expected to grow at the fastest rate over the forecast period. The recent approval of Pfizer’s Xeljanz for the treatment of ulcerative colitis and the presence of late-phase pipeline candidates such as upadacitinib, tofacitinib, and filgotinib are expected to drive the JAK inhibitors segment growth over the forecast period.

Based on the Route of Administration Insights, the market is segmented into Oral and Injectable

- The injectable segment dominated the market for inflammatory bowel disease treatment and accounted for a revenue share of more than 75.0% in 2020.

- The oral route of drug administration is estimated to witness the highest growth rate over the forecast period.

Based on the Distribution Channel Insights, the market is segmented into Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy

- The hospital pharmacy segment dominated the market for inflammatory bowel disease treatment and accounted for the largest revenue share of 46.8% in 2020.

- The online pharmacy segment is expected to grow at the fastest rate in the next 6 to 8 years.

Inflammatory Bowel Disease Treatment Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

Major pharmaceutical companies are largely involved in the development of novel therapies to treat the severe condition of inflammatory bowel disease.

Some prominent players in the global Inflammatory Bowel Disease Treatment market include:

- AbbVie Inc.

- Biogen

- Johnson & Johnson Services, Inc.

- Amgen Inc.

- UCB S.A.

- Novartis AG

- Takeda Pharmaceutical Company Limited

- Merck & Co., Inc.

- Pfizer Inc.

- Lilly

Order a free sample PDF of the Inflammatory Bowel Disease Treatment Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment