U.S. Automotive Wrap Films Industry Overview

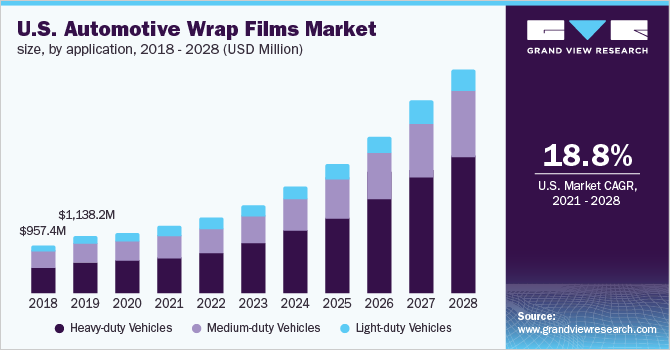

The U.S. automotive wrap films market size to be valued at USD 4.32 billion by 2028 and is expected to grow at a compound annual growth rate (CAGR) of 18.8% during the forecast period. The rising trend of consumer spending on automobile customization coupled with the rising number of medium-duty vehicles used as transportation vehicles, food trucks, and others is expected to drive the demand for automotive wrap films in the country over the forecast period.

Automotive wrap films are of two types: cast vinyl films and calendered vinyl films. The raw materials used for manufacturing wrap films include PVC and other added ingredients such as plasticizers, pigments, and UV absorbers. PVC is generally a very rigid polymer and requires plasticizers to make it flexible for use. Plasticizers can be classified as monomeric and polymeric. Pigments and UV absorbers are used to improve films’ resistance and against UV radiation.

Gather more insights about the market drivers, restraints, and growth of the U.S. Automotive Wrap Films market

Growing advertising industry with the use of sign and graphics, increasing demand for advertising on automobiles and low cost associated with vehicle wraps compared to vehicle paint are the major factors driving the market growth. However, stringent government regulations dictating the use of polyvinyl chloride (PVC) are expected to restrain market growth over the forecast period.

Automotive wrap films protect the vehicle from scratches, scuffs, and sun fading, thus encapsulating the vehicle finish and maintaining its resale value. Fleet wraps are most suitable for promotion and advertising for new product launches and marketing events as well as increase name recognition 15 times as compared to other advertising mediums.

Hydro dipping is gaining popularity for use in bumpers, as the automotive wrap films get easily torn in bad road conditions due to stones. The processing time required for hydro dipping is less as compared to the installation of automotive wrap films. Various automotive enthusiasts have started using hydro dripping as their primary option for customization due to the low cost compared to automotive wrap films.

Browse through Grand View Research's Plastics, Polymers & Resins Industry Research Reports

Polycarbonate Market - The global polycarbonate market size was valued at USD 21.8 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.6% from 2022 to 2030.

Plastic Resins Market - The global plastic resins market size was estimated at USD 731.25 billion in 2021, projected to grow at a compound annual growth rate (CAGR) of 4.5% from 2022 to 2030.

U.S. Automotive Wrap Films Market Segmentation

Grand View Research has segmented the U.S. automotive wrap films market based on application and location:

U.S. Automotive Wrap Films Application Outlook (Revenue, USD Million, 2017 - 2028)

- Heavy-duty Vehicles

- Medium-duty Vehicles

- Light-duty Vehicles

U.S. Automotive Wrap Films Location Outlook (Revenue, USD Million, 2017 - 2028)

- Exterior

- Interior

Market Share Insights:

May 2022: Avery Dennison invested 60 million euros in expanding its capacity and increasing its efficiency in manufacturing plants based in Europe. This includes a new automated warehouse and 5 new logistical buildings which are expected to open in 2024.

June 2022: Hexis partnered with Bodyfence to launch 3 new adhesive films namely BFWIDE, DFENCEXTRM, and BODYFENCEXM.

Key Companies profiled:

Some prominent players in the U.S. Automotive Wrap Films market include

- Avery Dennison Corporation

- Arlon Graphics, LLC

- 3M

- VViViD Vinyl

- Hexis S.A.

Order a free sample PDF of the U.S. Automotive Wrap Films Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment