Mobile Phone Insurance Industry Overview

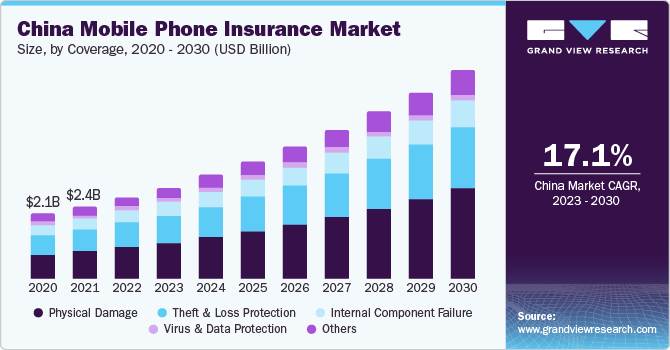

The global mobile phone insurance market size was valued at USD 23.3 billion in 2020. It is expected to expand a compound annual growth rate (CAGR) of 12.6% from 2021 to 2028. Increasing incidents of accidental damage, phone thefts, virus infection, and device malfunction are expected to drive market growth over the forecast period. These incidents have impelled customers to look for ways to safeguard their mobile phones and thereby, adopt mobile phone coverage policies. Mobile phone insurance helps consumers avoid high replacement costs in case their mobile phone is lost or faces a breakdown. A mobile phone insurance policy usually covers physical damage, internal coverage failure, theft and loss protection, and virus and data protection, among others.

Mobile phones serve as a platform for entertainment, education, and also an effective platform for conducting digital transactions. Increasing the use of smartphones for storing personal information and digital transactions has led to the need for safeguarding mobile devices. This trend is expected to escalate market growth over the forecast period. According to GSMA, approximately 75% of the total mobile phone owners are expected to own a smartphone by 2025. Mobile phone insurance service providers are collaborating with smartphone manufacturers to experiment with the success rate of insurance policies/schemes offered during the purchase of a mobile phone.

Gather more insights about the market drivers, restraints, and growth of the Global Mobile Phone Insurance market

Mobile phones are highly susceptible to physical and technical damages, such as damaged casing, and excessive dust and dirt, which may have a detrimental effect on the Printed Circuit Board (PCB) and coverages. Such damages may also incur enormous losses for users and hence, are expected to increase the demand for mobile phone insurance over the forecast period. The increasing costs of smartphones are also compelling consumers to opt for mobile phone coverage policies. Furthermore, the increasing collaborations among mobile phone manufacturers and insurance providers are also anticipated to drive market growth over the forecast period. Moreover, the provision of direct-to-consumer insurance assistance is expected to create substantial growth opportunities for market players over the forecast period. The direct-to-consumer insurance assistance model provides improved customer experience as opposed to insurance selling through traditional distribution channels.

The increasing adoption of Business Intelligence (BI) tools by market players is anticipated to propel the market growth over the forecast period. BI tools help market players to identify negative trends in the costs and performance of their products. BI is used either strategically or tactically. Strategic business intelligence is used for monitoring Key Performance Indicators (KPIs) about policy growth, incurred claims ratio, the average time to settle a claim, and so on. KPIs also help evaluate the development of the insurance companies and also enable potential investors to determine the effectiveness of a company’s operational strategies. Furthermore, the implementation of BI tools helps companies track data about customer buying behavior and gain insights on consumer trends, thereby helping them make informed decisions in terms of the services that can be introduced in the mobile phone insurance market.

The complexities associated with the terms and conditions make it difficult for consumers to opt for appropriate claim procedures and this is subsequently expected to hinder the market growth. Some market players offer coverage plans with a fixed premium and the coverage amount, thus leading to reluctance from customers for buying such policies. Such policies also mandate users to pay huge premium amounts for damage repair, irrespective of the nature of the damages covered. However, in recent years, insurance providers have worked toward the identification of such issues and have introduced policies with varying monthly premium amounts. They are also offering coverage based on customer requirements. The simplification of terms and conditions and claiming procedures is expected to increase the adoption of mobile insurance plans among customers across the globe.

The coronavirus pandemic has highly affected the mobile phone/smartphone market, thereby having a significant impact on the market across the globe. While most of the companies operating in the market reported revenue decline from the mobile phone insurance domain, the sales of the smartphones also saw a significant dip in the market. However, with the growing initiatives taken by governments across the globe to revive the economy, the market is anticipated to recover over the coming years. Additionally, the average life span of a smartphone is expected to rise, which in turn will positively impact the market over the forecast period.

Browse through Grand View Research's Communications Infrastructure Industry Research Reports.

Underwater Communication System Market - The global underwater communication system market size was worth USD 3.08 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 10.1% from 2022 to 2030.

Telecom Cloud Market - The global telecom cloud market size was valued at USD 20.4 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 19.9% from 2022 to 2030.

Mobile Phone Insurance Market Segmentation

Grand View Research has segmented the global mobile phone insurance market based on coverage, phone type, and region:

Mobile Phone Insurance Coverage Outlook (Revenue, USD Million, 2016 - 2028)

- Physical Damage

- Internal Component Failure

- Theft & Loss Protection

- Virus & Data Protection

- Others

Mobile Phone Insurance Phone Type Outlook (Revenue, USD Million, 2016 - 2028)

- Budget Phones

- Mid & High-end Phones

- Premium Smartphones

Mobile Phone Insurance Regional Outlook (Revenue, USD Million, 2016 - 2028)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Market Share Insights:

October 2018: Flipkart ventured into a partnership with Bajaj Allianz to offer customized insurance solutions and boost Bajaj Allianz mobile phone protection program. Moreover, these collaborations enable the partnered companies to increase their customer base across the globe.

Key Companies profiled:

Some prominent players in the global Mobile Phone Insurance market include

- Apple Inc.

- American International Group, Inc.

- Assurant, Inc.

- Asurion

- AT&T Inc.

- AmTrust Financial

- Brightstar Corp.

- GoCare Warranty Group

- SquareTrade, Inc.

- Taurus Insurance Services Limited

Order a free sample PDF of the Mobile Phone Insurance Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment