Aluminum Extrusion Industry Overview

The global aluminum extrusion market size was valued at USD 87.84 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 7.5% from 2022 to 2030.

The automotive & transportation sector is witnessing an increase in aluminum content in internal combustion as well as Electrical Vehicles (EVs), which is likely to boost the market growth over the forecast period. Automobile manufacturers are under increasing pressure to meet the regulatory requirements pertaining to the environmental impact of vehicles. Agencies, such as the U.S. Environmental Protection Agency (EPA), California Air Resource Board (CARB), and National Highway Traffic Safety Administration (NHTSA), have enacted rules and regulations regarding Greenhouse Gas (GHG) emissions.

Gather more insights about the market drivers, restrains and growth of the Global Aluminum Extrusion Market

For instance, emission regulations issued by the NHTSA. As per these regulations, stringency for carbon dioxide standards and fuel economy increased by 1.5% from model years 2021 to 2026. This is projected to boost the demand for various aluminum components in automobiles over the coming years. The U.S. is a prominent producer and consumer of aluminum extrusion. The country is one of the severely hit countries due to the COVID-19 pandemic, which has resulted in major consequences in the manufacturing activities, thereby, negatively affecting the product demand. In the first half of 2020, various non-essential businesses were compelled to operate at lower capacity, thereby affecting the demand for raw materials and creating disruptions in the supply chain.

The aerospace & defense, automotive, and construction industries have been majorly impacted due to the pandemic in the U.S., observing a decline in demand for extruded products. However, construction activities were provided some relaxation post the first quarter of 2020. The construction activities were acknowledged under essential businesses, which led to the opening of material inflow for construction purposes. Depressing sentiments in new construction activities directly reduced the volume flow of aluminum extrusion in the U.S. during FY 2020. Low costs and weight of extrusion products contribute to their rising demand in various industrial applications, mainly in the automotive and aerospace & defense sectors.

Browse through Grand View Research's Advanced Materials Industry Related Reports

- MEA Aluminum Extrusion Market - The MEA aluminum extrusion market size was valued at USD 1.6 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 4.0% from 2021 to 2028. The increasing use of aluminum products in vehicles is projected to drive market growth over the forecast period.

- Carbon Dioxide Market - The global carbon dioxide market size was valued at USD 3.68 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 7.3% from 2022 to 2030. Increasing utilization of Carbon Dioxide (CO2) for Enhanced Oil Recovery (EOR) and its surging usage in food & beverages and medical industries are anticipated to fuel the growth of the global market during the forecast period.

Aluminum Extrusion Market Segmentation

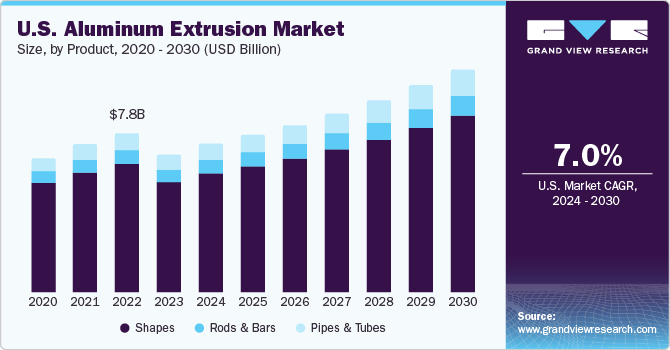

Grand View Research has segmented the global aluminum extrusion market on the basis of product, application, and region:

- Aluminum Extrusion Product Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

- Shapes

- Rods & Bars

- Pipes & Tubes

- Aluminum Extrusion Application Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

- Building & Construction

- Automotive & Transportation

- Consumer Goods

- Electrical & Energy

- Others

- Aluminum Extrusion Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East & Africa

Market Share Insights

October 2020: Canada unveiled a new infrastructural plan worth CAD 7.5 billion (~USD 5.8 billion) for pushing an array of renewable energy initiatives and creating jobs in the country, which were impacted by the pandemic.

December 2019: China Zhongwang Holdings Ltd. supplied aluminum body parts to urban rail projects in Shanghai, Guangzhou, Xiamen, Hangzhou, Hefei, and Jinhua and Beijing-Zhangjiakou Smart High-speed Rail.

Key Companies profiled:

Some prominent players in the global Aluminum Extrusion market include

- Hindalco Industries Ltd.

- Arconic Corp.

- Norsk Hydro ASA

- Constellium N.V.

- Kaiser Aluminum

- QALEX

Order a free sample PDF of the Aluminum Extrusion Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment