Horizontal Directional Drilling Industry Overview

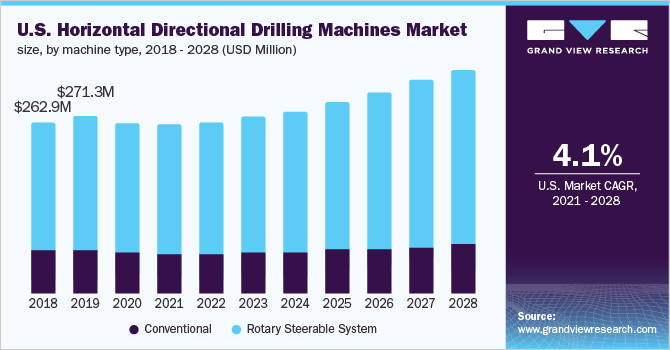

The global horizontal directional drilling market size was valued at USD 8.16 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 6.7% from 2021 to 2028.

The Horizontal Directional Drilling (HDD) technique is used to accurately undertake drilling operations and back ream the required pipe, sidelining various obstacles on the bore path without causing significant collateral damage to the subsurface ecosystems. Rising concerns about the need to minimalize environmental damage caused by rapid infrastructure development across the globe worldwide are contributing significantly to the increased adoption of horizontal directional drilling. Growing utility installations, burgeoning investments in shale gas development projects, and rising expenditures aimed at various developments across the telecom sector to offer high-speed connectivity are some of the other factors contributing to market growth.

Gather more insights about the market drivers, restrains and growth of the Global Horizontal Directional Drilling Market

Over the past few years, the horizontal directional drilling technique has emerged as one of the most popular trenchless drilling technologies. This horizontal boring method requires fewer boreholes to be drilled and maintained. Growth prospects of the industry are subject to heavy investments as the equipment needed for trenchless boring costs much higher than conventional open-cut methods. As the setups are costly, customers opt to rent out the entire setup from contractors. Furthermore, various mid-sized companies also hire service providers for end-to-end projects. As a result, both horizontal directional drilling machine manufacturers and service providers hold a strong position in the market.

Since its inception, the horizontal trenchless technique has gained significant traction owing to its deployment from a single location in extremely rough sub-surface and the ability to hit multiple target zones. The prevalence of disruptive digital technologies, including 3D visualization, 3D earth models, and automation, has led to faster implementation, reduced noise and waste, and enhanced underground accessibility. Additionally, these technologies have enabled engineers, geoscientists, and other related personnel to more accurately visualize and optimize the Rate of Penetration (ROP) of the bore path. Technological advancements have also played a major role in helping the horizontal trenchless technique achieve a prominent position in drilling applications across oilfields, renewable gas exploration, and long-distance optical fiber installations in offshore locations.

Horizontal directional drilling is primarily employed for applications such as the installation of electrical conductors, utility transmission and supply lines, and communication conduits and cables. The cross bore technique that enables the intersection of two or more pipelines underneath the surface poses a threat to these directional boring industry workers and the public. This may be attributed to the lack of visibility in determining the track of the drilling activities in sub-surface locations. The cross-bore intersection of various utilities can often result in explosions, resulting in injuries and death. To avoid this, Occupational Safety and Health Administration (OSHA) mandates directional boring operators to check for structures indicating subversive utility installations or any other obstructions along the drill path before physically drilling entry and exit holes in the required locations. Apart from this, the market is also subjected to various environmental norms that emphasize reducing the ecological impact during underground construction activities.

The COVID-19 pandemic resulted in a temporary shutdown of horizontal directional drilling activities at several sites in a range of industries owing to stringent government lockdown regulations to arrest the spread of the disease. The oilfield sector faced major operational concerns as companies temporarily halted upstream and downstream activities, resulting in the abrupt decline in oil and gas production. Furthermore, oil prices dropped owing to a significant reduction in the frequency of transportation worldwide on the heels of a price war among the U.S., Saudi Arabia, and Russia. As a result, incumbents of horizontal directional services and the machine industry faced a downturn in demand. However, continual measures taken by world governments for mitigating the impact of the pandemic on oil and gas exploration companies are expected to allow for recovery in the horizontal directional drilling market in the near future.

Browse through Grand View Research's Advanced Materials Related Reports

- Drilling Fluids Market - The global drilling fluids market size was valued at USD 8.0 billion in 2019 and is projected to register a CAGR of 4.2% from 2020 to 2027. Growing demand for crude oil and natural gas in various energy-intensive industries such as power generation, manufacturing, and transportation has urged exploration and production companies to increase their investments in onshore and offshore drilling activities.

- Mining Drills & Breakers Market - The global mining drills & breakers market size was valued at USD 8.04 billion in 2016. The increasing mineral exploration activities are expected to drive market growth over the next nine years, owing to the presence of several mineral reserves, particularly in China, India, and Australia.

Market Share Insights

November 2019: The Charles Machine Works Inc. Company announced the launch of the ride-on trencher, RT80, with a tier-4, 74.5-horsepower diesel engine. The trencher is targeted toward urban utility job sites.

April 2018: UEA was appointed by Telstra Corporation Limited, an Australia-based Telecommunications Company, to install directional bore telecommunications works for the Indigo-West cable system between Singapore and Perth.

Key Companies profiled:

Some prominent players in the global Horizontal Directional Drilling market include

- Nabors Industries Ltd.

- The Toro Company

- The Charles Machine Works, Inc.

- Vermeer Corporation

- Herrenknecht AG

- XCMG

Order a free sample PDF of the Horizontal Directional Drilling Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment