U.S. Digital Signage Industry Overview

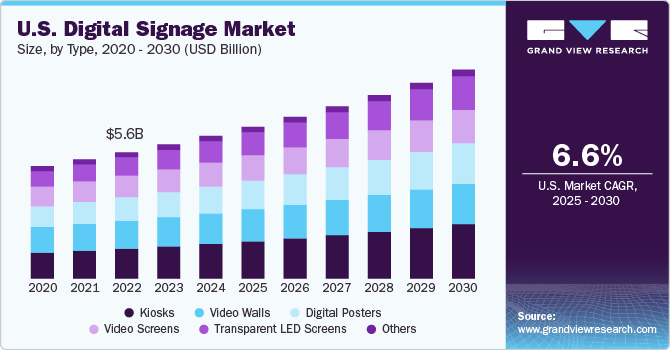

The U.S. digital signage market size was valued at USD 5.3 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 6.3% from 2022 to 2030.

Digital signage is used for displaying promotional and informative content in the form of images, graphics, design collaterals, videos, and creative advertising on digitized displays. Creative advertising content can attract customers and viewers, engage viewers through impactful content management, and influence consumers’ purchasing decisions. This is leading to increased adoption of digitized displaying technologies in various end-user verticals. Major end-user sectors include retail, hospitality, healthcare, education, transportation, corporate, and banking.

Gather more insights about the market drivers, restrains and growth of the U.S. Digital Signage Market

In addition, surging demand for providing concise and comprehensive information about products to consumers is boosting the implementation of digitized signs. Moreover, increasing adoption of advanced technologies such as single or multi-touch display technologies and gesture-based displays is likely to drive the market. These devices require guidance and digitized information management, which can be accessed from a remote location with signage. This is one of the significant drivers which is projected to boost the market over the coming seven years.

The advent of innovative displays, such as liquid crystal display (LCD), LED, OLED, and Super AMOLED display, is allowing advertisers to improve the clarity and quality of the content being presented. This is prompting digitized poster providers to provide content that is compatible with all types of displays. Besides, information is provided with the help of digitized display technologies, which include pictures and motion in a digitized format to gain the attention of customers. High investments are being made by marketers for the creation of new content to attract customers.

The U.S. is a prominent destination for market players as marketing and promotional techniques continue to evolve and advertisers prefer digitized promotion over conventional marketing. Other benefits associated with digitized signs, such as better audience engagement, reduced paper consumption, increased sales owing to improved influence on customers, and cost-effective advertising, are encouraging their adoption in the country. The increasing use of 3D digital signage for effective branding and promotion of the product is anticipated to provide a lucrative platform for market growth over the forecast period. In the U.S., the West American region held the largest share in 2021 owing to the presence of a well-developed and highly penetrated advertising segment that uses innovative digitized signs to attract an audience.

However, high initial investments associated with digitized signs have been poised for the adoption of digital signage. Adoption of digitized signs by small- and mid-sized enterprises is particularly limited owing to the initial investment involved in obtaining supportive software, hardware, and technology. In addition, the lack of research and awareness about the benefits of digitized signs is also another factor that is restraining the smooth growth of the market.

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

Digital Signage Market - The global digital signage market size was estimated at USD 23.12 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 7.7% from 2022 to 2030.

Computer Aided Engineering Market - The global computer aided engineering market size was valued at USD 8,904.2 million in 2021 and is expected to expand at a CAGR of 8.8% from 2022 to 2030, owing to the increased outsourcing of manufacturing processes to emerging economies such as China, India, and Russia, among others.

Market Share Insights

May 2022 - NEC Display Solutions of America announced the availability of the next generation of its PE Series entry-installation laser projectors, the PE506UL and PE506WL. The ideal projection solution for K-12, higher education and corporate applications, the upgraded PE Series projectors deliver powerful brightness with 5,200 lumens, accommodating larger screens and delivering more value to customers needing dynamic, high-resolution imaging at an affordable price.

Key Companies profiled:

Some prominent players in the U.S. Digital Signage market include

- NEC Display Solutions of America, Inc.

- BrightSign LLC

- Planar System Inc.

- Cisco Systems, Inc.

- Intel Corporation

- Microsoft Corporation

- Keywest Technology, Inc.

- Scala, Inc.

- Visix, Inc.

- Panasonic Corporation of North America

- Hughes Network Systems LLC

Order a free sample PDF of the U.S. Digital Signage Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment