Chemical Distribution Industry Overview

The global chemical distribution market size was valued at USD 247.1 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 5.4% from 2020 to 2028.

Increasing consumption of chemicals across end-use industries such as construction, pharmaceutical, polymers, and resins coupled with high complexity in reaching the customers is likely to drive the opportunities for chemical distributors over the coming years.

Demand for specialty construction chemicals in the U.S. is driven by the rising trend of sustainable and green infrastructure. Specialty product distributors are thus benefiting from the demand for such chemicals even from developed economies such as U.S., Germany, and U.K.

Gather more insights about the market drivers, restraints, and growth of the Global Chemical Distribution Market

The chemical industry produces and supplies essential raw materials for companies in the industrial and manufacturing sectors. These feedstock’s are distributed to the end-users by third-party distributors or sold directly by manufacturers. Distribution of commodity and specialty chemicals by third parties is anticipated to witness significant growth than the sale of products directly to end-users owing to the outsourcing of value-added services, such as logistics, packaging, blending, waste removal, inventory management, and imparting technical training.

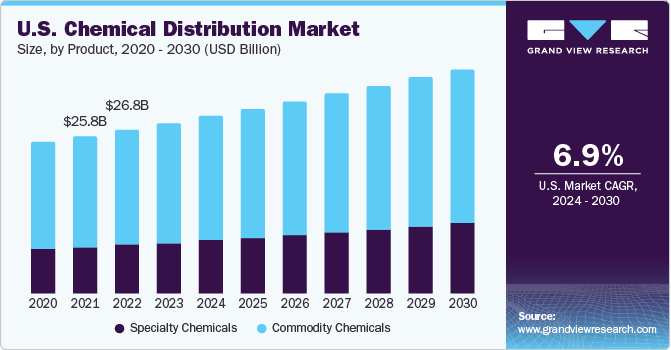

The U.S. market for chemical distribution is driven by sustained construction activities and strong consumer purchasing power. Business investments in the housing market are regaining traction and contributing to building momentum for the chemical industry. Furthermore, according to a report published by American Chemistry Council, Inc. in June 2019, 334 new production projects, valued at over USD 204 billion were announced, which demonstrates a constant rise in investments in the U.S. economy. This trend is anticipated to result in a significant expansion of the manufacturing sector, thus generating a positive impact on the overall market.

The growth in other end-use industries, such as automotive, pharmaceutical, and electronics coupled with strong growth in the industrial manufacturing sector is anticipated to drive the global demand for chemicals. This factor is further expected to benefit the third party distribution channel. Global distributors are adopting differentiated channel strategies such as product knowledge, local expertise and a strong logistics network to gain a competitive advantage in a highly fragmented market.

Along with a high industry rivalry, third-party distributors are also anticipated to face strong competition from direct suppliers. Some of these are multinational companies, such as BASF SE, Arkema, Honeywell International, and Lanxess AG. These companies possess high investment capacities as well as a strong network with end-users and a wide geographical presence. Direct distribution channels offer bulk discounts and reduce third-party profit margins.

Browse through Grand View Research's Petrochemicals Industry Research Reports.

Noble Gas Market - The global noble gas market size was valued at USD 2.47 billion in 2021 and is projected to expand at a compound annual growth rate (CAGR) of 5.6% from 2022 to 2030. Increasing application areas for noble gases in the healthcare and industrial sectors and supportive government policies are expected to boost the market growth.

Specialty Chemicals Market - The global specialty chemicals market size was valued at USD 586.5 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 4.3% from 2020 to 2028. Growing demand for high-performance and function-specific chemicals across the end-use industries such as oil and gas, pulp and paper, and personal care and cosmetics is expected to be one of the prime market growth factors.

Market Share Insights

April 2022 - Univar Solutions Inc a global chemical and ingredient distributor and provider of value-added services, In April month expanded its specialty ingredient portfolio in Mexico and Brazil through a new distribution agreement with Ashland, a focused additives and specialty ingredients company.

March 2019 - Univar Inc. announced that it has completed the acquisition of Nexeo Solutions creating a leading global chemical and ingredients solutions provider. The combined company will conduct business as Univar Solutions, reflecting a commitment to combining the ‘best of the best’ from each legacy organization.

Key Companies profiled:

Some prominent players in the global Chemical Distribution market include

- Univar AG

- Helm AG

- Brenntag AG

- Azelis Holdings SA

- IMCD Group

- BASF SE

- Biesterfeld AG

Order a free sample PDF of the Chemical Distribution Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment