U.S. Medical Device Manufacturers Industry Overview

The U.S. medical device manufacturers market size is expected to reach USD 262.4 billion by 2028 and is projected to expand at a CAGR of 5.0%, according to a new report by Grand View Research, Inc. The regional market is significantly driven by the high healthcare expenditure of the country. The increasing geriatric population coupled with the rising prevalence of chronic diseases is also expected to augment the market growth over the forecast period.

The COVID-19 pandemic triggered a drastic rise in demand for medical consumables and patient aids, such as gloves, syringes, masks, PPE kits, infrared thermometers, pulse oximeter, testing kits, etc. This resulted in an immense opportunity for the existing players as well as new entrants. However, the pandemic also resulted in a massive reduction in elective procedures, such as bariatric surgeries, joint replacement surgeries, cosmetic surgeries, etc., thus restricting the growth of medical devices used in the aforementioned procedures. The market recovery can be expected from mid-2021 onwards with favorable government initiatives to re-launch elective procedures.

U.S. Medical Device Manufacturers Market Segmentation

Grand View Research has segmented the U.S. medical device manufacturers market on the basis of type:

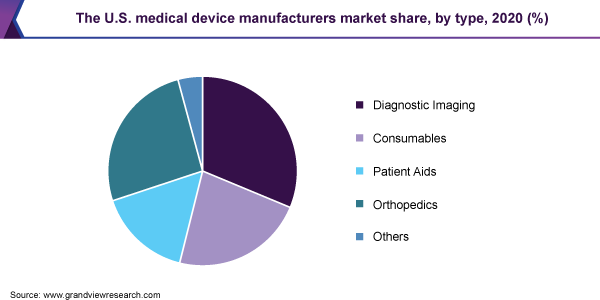

Based on the Type Insights, the market is segmented into Diagnostic Imaging, Consumables, Patient Aids, Orthopedics, and Others

- The diagnostic imaging segment captured the largest market share of over 31% in 2020 owing to the high demand for accurate diagnostic methods and devices.

- Chronic diseases accounted for a significant share of the country’s healthcare expenditure, as they require long-term medical care.

- Furthermore, an increase in the number of sports and trauma injuries is boosting demand for orthopedic devices, leading to market growth.

Key Companies Profile & Market Share Insights

New product launches, technological advancements, and capacity expansion are few strategic initiatives undertaken by key players to achieve competitive advantage. New technologies, such as 3D printing, can be used to increase production to meet the sudden upsurge in product demand due to the global coronavirus pandemic. The U.S. government is spending heavily to overcome the shortfalls in medical devices, such as pulse oximeter and N95 respirators.

Some prominent players in the U.S. Medical Device Manufacturers market include:

- 3M Healthcare

- Abbott

- Baxter International, Inc.

- Braun Melsungen AG

- GE Healthcare

- Johnson & Johnson Services, Inc.

- Medtronic PLC

- Boston Scientific Corp.

Order a free sample PDF of the U.S. Medical Device Manufacturers Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment