Veterinary Services Industry Overview

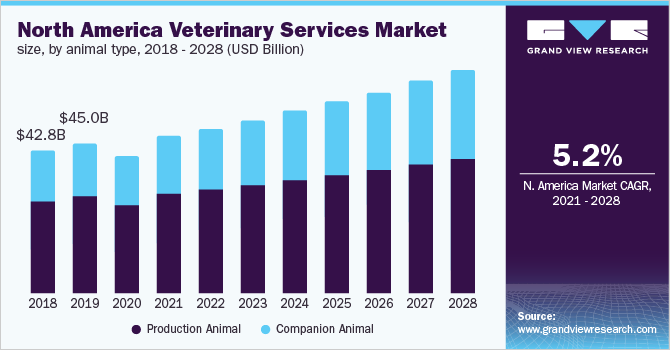

The global veterinary services market size is expected to reach USD 159.5 billion by 2028, registering a CAGR of 5.7% over the forecast years, according to a new report by Grand View Research, Inc. The market is predominantly driven by rising concerns regarding food security and safety thus encouraging the adoption of veterinary services to yield high-quality animal source foods. In addition, increasing pet adoption is a key contributing factor for the overall market growth.

The pet adoption rate spiked during the coronavirus pandemic as many individuals have been working from home. Many consider their pet as a family fellow. Thus, veterinary companies announced some new products, services, diagnostic tools, to cater to the demand. For example, in September 2020, Zoetis launched VetscanImagyst, a new diagnostic platform to detect intestinal parasites in pets.

Veterinary Services Market Segmentation

Grand View Research has segmented the global veterinary services market on the basis of animal type and region:

Based on the Animal Type Insights, the market is segmented into Production Animal, and Companion Animal

- The production animal type segment dominated the market in 2020 with a revenue share of more than 61%. The substantial share captured by the segment can be presumed a consequence of high concern for food safety and sustainability by government healthcare organizations globally.

- Cattle held the largest share of the production animals segment in 2020 owing to increased penetration of services, such as hoof care and artificial insemination

- The companion animal type segment is projected to grow at the fastest CAGR from 2021 to 2028 owing to an unprecedented increase in pet adoption due to associated health benefits for humans, such as greater psychological stability, lower blood pressure and reduced anxiety attacks

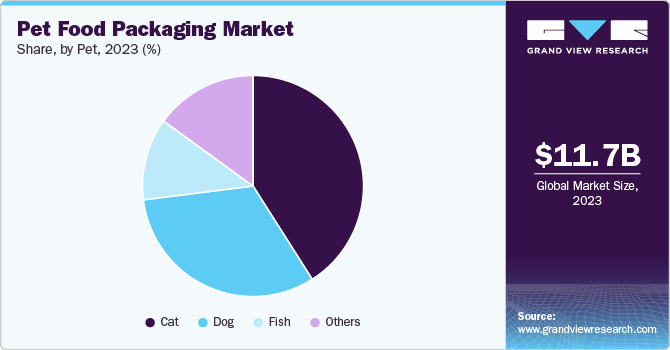

- Dogs accounted for the largest share amongst companion animals in 2020 owing to growing awareness amongst pet owners about pet hygiene, thus resulting in increased demand for grooming facilities

- COVID-19 pandemic is encouraging pet owners, healthcare providers, and even payers to adopt telehealth in veterinary

Veterinary Services Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

This was the company’s biggest acquisition in 2020 and strengthened its business operations in the U.K. Also, VetPartners Pty. Ltd. acquired National Veterinary Care Ltd. in April 2020, for USD 251.5 million. The two companies would combine their resources to improve veterinary health services across Australia and New Zealand. The initiatives like these are further contributing to the market growth over the forecast period.

Some prominent players in the global Veterinary Services market include:

- Mars Inc.

- Greencross Ltd.

- National Veterinary Care Ltd.

- Pets at Home Group PLC

- CVS Group PLC

- Ethos Veterinary Health

- Addison Biological Laboratory

- Armor Animal Health

- PetIQ, LLC

Order a free sample PDF of the Veterinary Services Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment