The Poland household appliances market size was valued at USD 4.58 billion in 2024 and is projected to reach USD 5.86 billion by 2030, expanding at a CAGR of 4.3% from 2025 to 2030. Market growth is fueled by the presence of numerous household appliance manufacturers, alongside rising investments and facility expansions by leading players in the country. Poland’s growing share in global household appliance trade and improved availability of diverse products from international brands are expected to further accelerate demand during the forecast period.

Poland continues to be a preferred hub for appliance manufacturing. The country’s long-standing tradition in appliance production, availability of skilled labor, and well-developed infrastructure are key factors attracting new investments. For example, in January 2025, Panattoni, an industrial real estate developer, partnered with BSH Home Appliances to construct a new production facility in Rudna Wielka near Rzeszów. The facility will focus on manufacturing small appliances, highlighting the country’s growing role in the European appliance market. Such expansions and collaborations are expected to create lucrative growth opportunities in the years ahead.

The country also benefits from favorable demographics. Poland has one of the lowest unemployment rates in Europe, and a large portion of its population is between 35 and 50 years old, forming a core consumer base for household appliances. Products such as refrigerators, washing machines, dishwashers, and vacuum cleaners are increasingly popular in this segment, owing to the convenience and efficiency offered by advanced technologies in daily household tasks.

Key Market Dynamics:

- By product: The major appliances segment accounted for the largest revenue share of 86.0% in 2024, driven by rising demand for high-end built-in refrigerators, cost-efficient freestanding washing machines, dishwashers, and advanced vacuum cleaners.

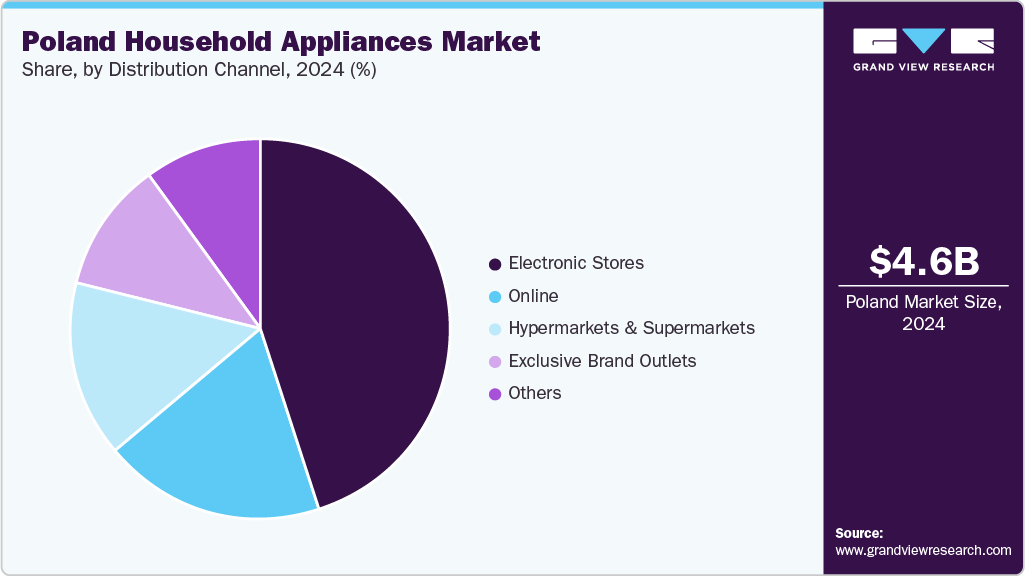

- By distribution channel: Electronic stores dominated the market in 2024, supported by factors such as brands showcasing products in retail outlets to boost visibility, easy consumer access to electronics stores, and increasing demand among urban buyers.

Order a free sample PDF of the Poland Household Appliances Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 4.58 Billion

- 2030 Market Size Projection: USD 5.86 Billion

- CAGR (2025–2030): 4.3%

Key Companies & Market Share Insights

The Poland household appliances market is moderately consolidated, with both global and domestic players actively expanding their presence. Leading companies focus on strengthening their production footprint within Poland and enhancing distribution networks through strategic collaborations.

- AMICA GROUP, headquartered in Wronki, Poland, is a global manufacturer specializing in appliances such as refrigerators, dishwashers, washing machines, and wine coolers. It operates under multiple brands, including Amica, Hansa, and FAGOR.

- Hisense serves more than 130 countries worldwide, offering a wide product portfolio that includes washing machines, refrigerators, air conditioners, and vacuum cleaners.

Key Players

- Electrolux AB

- Haier Inc.

- AMICA GROUP

- Samsung

- Beko

- Hisense

Explore Horizon Databook – the world’s most comprehensive market intelligence platform developed by Grand View Research.

Conclusion

The Poland household appliances market is poised for steady growth, supported by robust manufacturing activity, favorable demographics, and expanding global trade participation. With strong demand for major appliances and increasing investments from international brands, Poland is set to strengthen its position as a leading hub for household appliance production and consumption through 2030.

No comments:

Post a Comment