The U.S. real estate market size was valued at USD 130.02 billion in 2024 and is projected to reach USD 172.13 billion by 2030, expanding at a CAGR of 4.1% between 2025 and 2030. The market has undergone substantial transformation, shaped by multiple economic, demographic, and technological influences such as population growth, urbanization, macroeconomic performance, employment conditions, millennial ownership trends, and financing dynamics including mortgage rates.

According to Sortis Capital, the U.S. population is anticipated to reach approximately 336.6 million in 2024, with 82.7% of residents already concentrated in urban areas as of 2020. This rapid urban growth continues to escalate the need for residential and commercial properties. To meet this demand, developers are increasingly focusing on high-density housing developments. Rising city populations also contribute to higher property valuations for existing owners and spur further investment in infrastructure and commercial assets. These combined dynamics highlight how demographic and urbanization trends drive real estate growth.

In Q2 2024, U.S. real GDP advanced by 2.8%, while the unemployment rate dropped to 3.5% in July 2023. Stronger economic expansion alongside lower unemployment has enhanced disposable income levels, thereby strengthening consumer and business purchasing capacity. This has fueled heightened demand across both residential and commercial real estate segments.

According to CRBE, declining property values and increasing cap rates are reshaping the market. Since early 2022, average property values across most categories have fallen by about 20%, while cap rates have risen 150–200 basis points. Multifamily and industrial assets are expected to be investor favorites in 2024, supported by robust fundamentals such as sustained demand, favorable vacancy rates, and consistent rent growth.

Key Market Insights

- By property: The residential property segment dominated in 2024, capturing 57.09% of total revenue. This category includes single-family homes, apartments, townhouses, and other living structures designed for individuals and families.

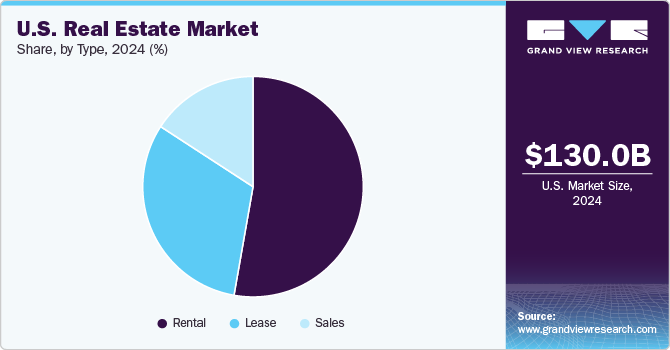

- By type: The rental model accounted for 52.77% of market share in 2024. CRBE Group noted that by late 2023, average monthly mortgage payments were roughly 38% higher than average rents, making rentals the more affordable choice for a large share of households.

Order a free sample PDF of the U.S. Real Estate Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 130.02 Billion

- 2030 Projected Market Size: USD 172.13 Billion

- CAGR (2025–2030): 4.1%

Key Companies & Market Share Insights

The U.S. real estate market is defined by a competitive yet fragmented structure, with national firms, regional developers, private equity, REITs, and independent brokerages all competing. Factors such as diversification across asset classes, geographic reach, funding strength, and adoption of technology for operational efficiency and client engagement shape competitiveness.

Large integrated service providers such as CBRE, JLL, and Cushman & Wakefield maintain significant presence in commercial real estate services due to their broad service range and global scale. The residential market, however, remains more fragmented, with nationwide names like Keller Williams, RE/MAX, and Compass operating alongside strong regional players. Competition here is driven by brand recognition, agent productivity, and use of proprietary technology.

In investment and development, institutional funds continue to target high-growth segments like logistics, multifamily, life sciences, and data centers. These areas remain competitive, pushing yields downward. REITs also hold an important position in public markets, benefiting from liquidity and scale, though they face rising competition from private and alternative capital vehicles.

- Prologis, Inc. leads globally in logistics real estate, with projects and properties totaling around 1.3 billion square feet (120 million square meters) across 20 countries. The firm serves about 6,500 customers, mainly in B2B and retail/online fulfillment sectors, and is committed to net-zero emissions across its value chain.

- Equinix Inc. operates as a global digital infrastructure leader, enabling organizations to interconnect critical infrastructure and scale digital services efficiently. With more than 85 data centers across the Americas—including the U.S., Brazil, Canada, Mexico, and Colombia—Equinix supports rapid deployment, sustainability goals, and world-class digital experiences.

Key Players

- Prologis, Inc.

- American Tower Corporation

- Equinix, Inc.

- Welltower Inc

- Simon Property Group, Inc

- Public Storage

- Digital Realty Trust, Inc

- Realty Income Corporation

- AvalonBay Communities, Inc

- CRBE Group Inc.

- Equity Residential

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The U.S. real estate market is poised for steady growth through 2030, supported by strong demographic trends, urbanization, economic expansion, and investor interest in resilient asset classes such as multifamily housing and industrial properties. Although challenges such as rising cap rates and fluctuating property values persist, the sector continues to evolve with increasing institutional investment, technological integration, and strategic development initiatives. With both residential and commercial segments driving demand, the market remains a cornerstone of the U.S. economy and a key focus for long-term investors and stakeholders.

No comments:

Post a Comment