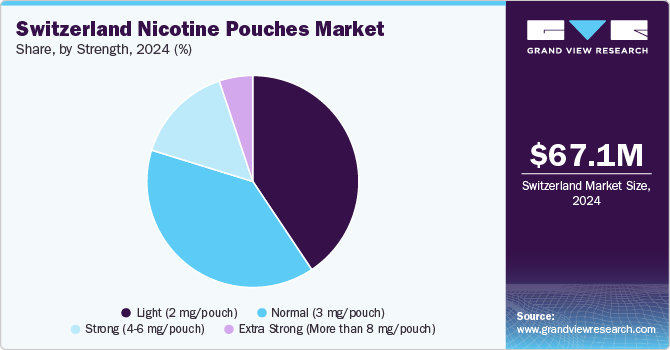

The Switzerland nicotine pouches market size was valued at USD 67.1 million in 2024 and is forecasted to reach USD 120.3 million by 2030, advancing at a CAGR of 9.7% from 2025 to 2030. Market expansion is being propelled by rising consumer preference for discreet, smoke-free nicotine products. Growing awareness around harm reduction and tighter smoking regulations are further fueling adoption, as health-conscious users increasingly turn to nicotine pouches for convenience and product variety. Additionally, the ongoing transition from smoking to alternative nicotine consumption methods continues to support industry growth.

The Switzerland nicotine pouches industry is anticipated to thrive as more consumers opt for smoke-free alternatives. With heightened focus on wellness and stricter rules surrounding traditional smoking, nicotine pouches provide a practical, discreet substitute for individuals reducing or quitting smoking. Their usability in public places where smoking is banned enhances their attractiveness, offering consumers a flexible way to satisfy nicotine needs without the stigma linked to cigarettes.

An expanding assortment of flavors and nicotine strengths is widening the consumer base, appealing both to smokers switching from combustible products and to experienced nicotine users. The ease of use, combined with their reputation as a reduced-harm option, is driving demand. Broader retail presence and the rapid growth of online sales further reinforce the upward trajectory of the Swiss nicotine pouch market.

Key Market Dynamics:

- By product: The tobacco-derived segment dominated the market with a revenue share of 97.22% in 2024.

- By flavor: Flavored nicotine pouches led with the largest revenue share of 90.02% in 2024.

- By strength: The light (2 mg/pouch) strength category captured the highest revenue share of 40.63% in 2024.

- By distribution channel: Offline sales channels accounted for the largest revenue share of 92.51% in 2024.

Order a free sample PDF of the Switzerland Nicotine Pouches Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 67.1 Million

- 2030 Market Size Projection: USD 120.3 Million

- CAGR (2025–2030): 9.7%

Key Companies & Market Share Insights

The Swiss nicotine pouch market is shaped by a blend of multinational tobacco leaders and niche brands specializing in smokeless nicotine products. These companies leverage strong brand portfolios, continuous product innovation, and robust distribution networks to stay competitive.

With growing demand for discreet and tobacco-free products, competition is intensifying. Leading players are consistently innovating with new flavors, improved nicotine delivery, and enhanced product experiences. Both global players and emerging local brands are anticipated to compete for share, primarily targeting health-aware consumers and smokers seeking to transition away from cigarettes.

Recent Developments

- October 2024: TACJA launched its nicotine pouches across Switzerland, the United Kingdom, and Sweden. The brand introduced eight flavors under two collections—Mellow and Frozen—available in 20 mg/g, 18 mg/g, and 12 mg/g strengths. The company highlighted the use of pharmaceutical-grade ingredients and adherence to EU Good Manufacturing Practice standards.

Key Players

- Swedish Match (Philip Morris International)

- British American Tobacco (BAT)

- Imperial Brands

- Japan Tobacco International (JTI)

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The Switzerland nicotine pouches market is poised for steady growth, driven by rising health consciousness, stricter smoking regulations, and the increasing demand for smoke-free alternatives. With strong adoption of flavored and light-strength products, alongside wider retail and online availability, the market is set to expand at a notable CAGR of 9.7% through 2030. Backed by innovation from global tobacco giants and emerging niche brands, nicotine pouches are expected to solidify their position as a convenient and harm-reduction alternative for Swiss consumers.

No comments:

Post a Comment