5G Infrastructure Industry Overview

The global 5G infrastructure market size is estimated to reach USD 95.88 billion by 2030, registering a CAGR of 34.2% from 2022 to 2030, according to a new study by Grand View Research, Inc. Significant investments by communication service providers to deploy 5G infrastructure across the globe to offer improved data services are estimated to drive the market. Additionally, robust innovation in next-generation 5G network equipment and deployment module will help in bringing down the overall deployment costs for service providers, thus boosting 5G infrastructure deployment during the forecast period.

5G Infrastructure Market Segmentation

Grand View Research has segmented the global 5G infrastructure market on the basis of component, spectrum, network architecture, vertical, and region:

Based on the Component Insights, the market is segmented into Hardware and Services.

- In the hardware segment, RAN dominated the market for 5G infrastructure with a share of 48.5% in 2021. This is attributed to the robust deployment of 5G RAN with several small cells and macrocell base stations globally.

- The trend of deploying virtual and centralized RAN is rapidly rising among network service providers to reduce overall infrastructure costs and network complexities.

- Moreover, the use of Software-defined Networking (SDN) technology to improve the operational efficiency of virtual RANs is expected to play a crucial role in the segment growth from 2022 to 2030.

- The core network sub-segment under hardware is estimated to witness significant growth during the forecast period. The core network plays an essential part in handling network traffic and storing consumer information.

Based on the Spectrum Insights, the market is segmented into Sub-6 GHz and mmWave.

- In terms of revenue, the sub-6 GHz segment dominated the 5G infrastructure market with a share of 84.8% in 2021. This is attributed to the significant investments made by key communication service providers in acquiring low and mid-band frequencies, and consequently delivering high bandwidth services to consumers, businesses, and industries.

- mmWave frequencies are high band frequencies that provide enhanced bandwidth capacity with very low latency. These spectrum bands would be mainly helpful in applications where ultra-reliable connectivity is a prerequisite, especially in remote patient surgeries and Vehicle-to-Vehicle (V2V) connectivity.

Based on the Network Architecture Insights, the market is segmented into Standalone and Non-standalone.

- The non-standalone (NSA) network architecture dominated the global 5G infrastructure industry with a revenue share of over 91% in 2021. This is attributed to the early rollout of the non-standalone network across the globe.

- The need for unified bandwidth capacity with minimum latency to establish seamless communication between autonomous vehicles is expected to drive the demand for 5G infrastructure in the transportation and logistics segment.

- Therefore, the growing demand for faster data speed across the above-mentioned verticals is anticipated to boost the standalone segment growth from 2022 to 2030.

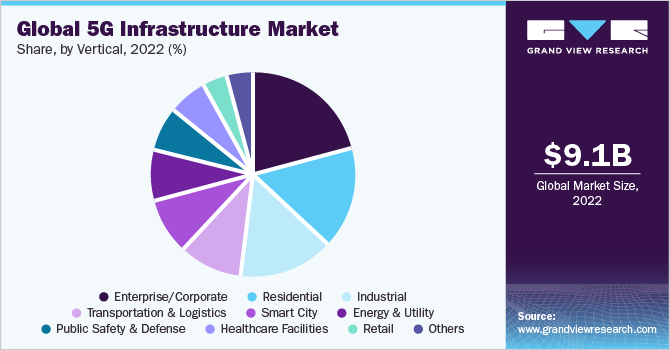

Based on the Vertical Insights, the market is segmented into Residential, Enterprise/Corporate, Smart City, Industrial, Energy & Utility, Transportation & Logistics, Public Safety and Defense, Healthcare Facilities, Retail, Agriculture and Others.

- The enterprise/corporate segment dominated the market with a revenue share exceeding 20% in 2021. This is attributed to the surging demand for faster data bandwidth for use cases, including uninterrupted virtual meetings, seamless connectivity during cloud computing, and creating a smart workplace by providing enhanced connectivity to IoT devices.

- The need to provide seamless connectivity to smart home applications, cloud-based Augmented Reality/Virtual Reality (AR/VR) gaming, and others, have raised the deployment of 5G infrastructure for residential or consumer applications.

- The rising demand to establish continual communication among industrial applications is expected to propel the growth of the industrial segment during the forecast period.

- The deployment of 5G infrastructure is increasing across government and public safety facilities owing to the imminent need to establish quick communication with first responders during emergencies.

- The energy and utility sector is anticipated to showcase enormous growth owing to the growing need for high-speed internet connectivity across energy generation and distribution applications.

5G Infrastructure Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

The market is highly consolidated with the top four players accounting for over 60% revenue share in 2021. Key players are striving to build strategic partnerships with service providers to deploy next-generation network infrastructure and gain an early mover’s advantage.

Some prominent players in the 5G Infrastructure market include

- Huawei Technologies Co., Ltd.

- Samsung Electronics Co., Ltd.

- Nokia Corporation

- Telefonaktiebolaget LM Ericsson

- ZTE Corporation

- NEC Corporation

- Cisco Systems, Inc.

- Fujitsu Limited

- CommScope Inc.

- Comba Telecom Systems Holdings Ltd.

- Altiostar

- Airspan Networks

- Casa Systems

- Hewlett Packard Enterprise Development LP

- Mavenir

- Parallel Wireless

- JMA Wireless

- Ceragon

- Aviat Networks, Inc.

Order a free sample PDF of the 5G Infrastructure Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment