Regulatory Affairs Outsourcing Industry Overview

The global regulatory affairs outsourcing market size is expected to reach USD 13.9 billion by 2030, registering a CAGR of 8.9% over the forecast period, according to a new report by Grand View Research, Inc. Significant increase in the fixed costs of in-house resources for regulatory affairs & operation activities like training, technology, specialized knowledge, and facilities are driving outsourcing of regulatory affair functions. Addressing local regulatory challenges and constant changes in the regulations of the major markets, such as the U.S., Europe, and Asia, is creating demand for these services. Compliance with the current regulations has become an immense chore, leave alone trying to stay up to date with developments around the world. Amendments to current regulations are likely to simplify the regulatory pathway for the industry but in turn, complicate the operation for healthcare product manufacturing companies.

Regulatory Affairs Outsourcing Market Segmentation

Grand View Research has segmented the global regulatory affairs outsourcing market based on services, company size, category, indication, stage, end user, and region:

Based on the Services Insights, the market is segmented into Regulatory Consulting, Legal Representation, Regulatory Writing & Publishing, Product Registration & Clinical Trial Applications and Other Services.

- The regulatory writing & publishing segment led the market in 2021 and accounted for the highest share of more than 36.5% of the global revenue.

- The segment is also anticipated to dominate the market during the forecast period owing to the adoption of outsourcing of these services by large- and mid-sized biopharmaceutical and medical device companies.

- The legal representation services segment is anticipated to witness the fastest growth rate over the forecast period. This is due to the increasing demand for legal representatives across the globe on account of the globalization of medical devices and pharmaceutical companies.

Based on the Company Size Insights, the market is segmented into Small, Medium and Large.

- The large companies segment is projected to register the fastest growth rate of more than 9% over the forecast period.

- The medium-sized companies segment accounted for the maximum revenue share in 2021 and is estimated to expand further retaining the leading position over the forecast period.

Based on the Category Insights, the market is segmented into Drugs, Biologics and Medical Devices.

- The medical device segment accounted for the largest share of more than 37.5% of the global revenue in 2021. This can be attributed to the fact that medical devices companies are now focusing on their core competencies and outsourcing noncore functions to increase their productivity and operational efficiency.

- However, the biologics segment is projected to register the forecast CAGR over the forecast period. The R&D productivity of small molecule drugs is declining, hence the focus is shifting to biologics, which is expected to register productive growth in the years to come.

Based on the Stage Insights, the market is segmented into Preclinical, Clinical and PMA (Post Market Authorization).

- The clinical studies segment accounted for the largest share of more than 46.5% in 2021. This can be attributed to the increasing number of clinical trial registrations over the past few years.

- The preclinical segment is anticipated to grow at the fastest CAGR over the forecast period. The rising demand for novel disease treatments, such as COVID-19, Zika virus, and Ebola, and the increasing prevalence of existing diseases, such as CVDs, cancer, and neurological diseases are the key factors contributing to the preclincial segment’s growth.

Based on the Indication Insights, the market is segmented into Oncology, Neurology, Cardiology, Immunology and Others.

- The immunology segment is expected to grow at the fastest CAGR over the forecast. This is due to its potential in facilitating the treatment of various cardiovascular, neurological, oncological, and inflammatory diseases.

- The strategic initiatives undertaken by market players for immunology are anticipated to facilitate the segment growth.

- The oncology segment accounted for the largest share of more than 33% of the global revenue in 2021.

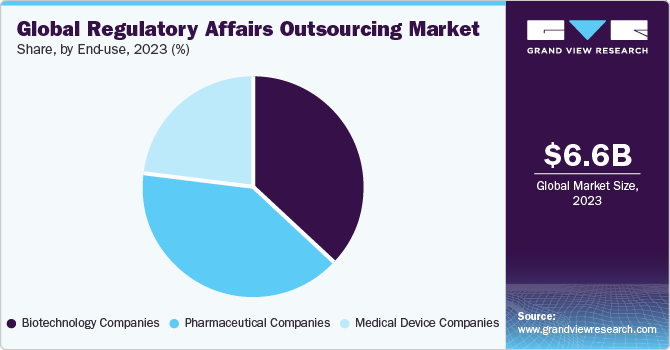

Based on the End-use Insights, the market is segmented into Medical Device Companies, Pharmaceutical Companies and Biotechnology Companies.

- The pharmaceutical companies end-use segment accounted for the largest share of more than 39% of the global revenue in 2021. The segment is anticipated to expand further at the fastest CAGR retaining its leading market position over the forecast period.

- The medical device and biotechnology segments both have registered a substantial share in the market in 2021. This can be attributed to the increased demand for biopharmaceuticals, vaccines, advanced medical devices, and others.

Regulatory Affairs Outsourcing Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

Market players are undertaking various strategic initiatives, such as partnerships, collaborations, mergers & acquisitions, geographic expansion, to strengthen their product portfolio, manufacturing capacities, and provide competitive differentiation.

Some prominent players in the Regulatory Affairs Outsourcing market include

- Accell Clinical Research, LLC

- GenPact Ltd.

- Criterium, Inc.

- PRA Health Sciences

- Promedica International

- Regenold GmbH

- BioMapas

- Zeincro Group

- Medpace

- ICON plc

- Covance

- Parexel International Corp.

- Freyr

Order a free sample PDF of the Regulatory Affairs Outsourcing Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment