Veterinary Artificial Insemination Industry Overview

The global veterinary artificial insemination market size is anticipated to reach USD 7.4 billion by 2030, according to a new report by Grand View Research, Inc. The market is expected to expand at a lucrative CAGR of 6.5% from 2022 to 2030. The key factors driving the market growth include increasing consumption of animal protein, growing demand for livestock productivity, and adoption of sexed semen. In September 2021, LIC- an agritech co-operative based in New Zealand launched a sexed semen lab in the country to meet the growing demand. This boosted the co-operatives capabilities to artificially inseminate about 4.5 million cattle between Spring mating season of September to December 2021.

Veterinary Artificial Insemination Market Segmentation

Grand View Research has segmented the global veterinary artificial insemination market on the basis of animal type, product, end-user, and region:

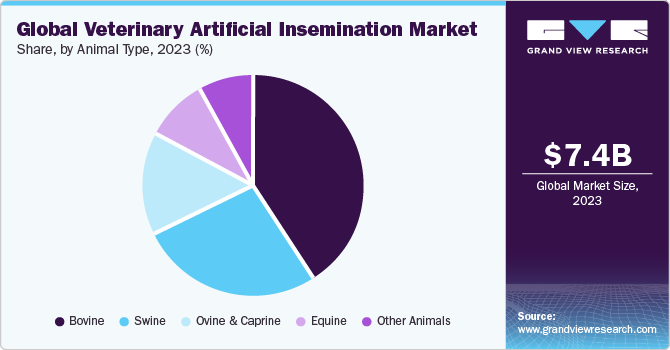

Based on the Animal Type Insights, the market is segmented into Cattle, Swine, Ovine & Caprine, Equine, and Others.

- The cattle segment dominated the market for veterinary artificial insemination and accounted for the largest revenue share of over 36.0% in 2021.

- The swine segment on the other hand is projected to grow at the fastest rate of over 6.0% over the forecast period.

Based on the Product Insights, the market is segmented into Normal Semen and Sexed Semen.

- The normal semen segment dominated the market for veterinary artificial insemination and accounted for the revenue share of 79.5% in 2021. The market is expected to maintain its position during the forecast period.

- The sexed semen segment is expected to show the fastest growth in the market for veterinary artificial insemination over the forecast period. This is due to increasing adoption to promote the rate of herd expansion and supportive government policies.

Based on the End-user Insights, the market is segmented into Animal Husbandry and Others.

- The animal husbandry segment dominated the market for veterinary artificial insemination and accounted for the largest revenue share of around 78.1% in 2021.

- The growth can be attributed to the majority of the semen collection and AI procedures being performed on-site in breeding farms. Moreover, increasing government initiatives, technological advancements, and demand for milk and protein are further increasing the adoption of AI technology.

- The others segment comprising of veterinary hospitals and clinics is anticipated to grow at the fastest rate in the market for veterinary artificial insemination in the coming years.

Veterinary Artificial Insemination Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

The market for veterinary artificial insemination is competitive in nature. Market players implement strategic initiatives, such as R&D, product development and launches, expansion of distribution network, and global footprint. In addition, owing to growing mergers and acquisitions, and establishment of co-operatives, the market is undergoing consolidation. The continuous demand from the food industry is further propelling the market growth for genetically superior animals to increase productivity.

Some prominent players in the Global Veterinary Artificial Insemination market include:

- Genus

- URUS Group LP

- CRV

- SEMEX

- Viking Genetics

- Select Sires Inc.

- Swine Genetics International

- Shipley Swine Genetics

- Stallion AI Services Ltd

- STgenetics

Order a free sample PDF of the Veterinary Artificial Insemination Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment