COVID-19 Diagnostics Industry Overview

The global COVID-19 diagnostics market size is expected to reach USD 50.1 billion by 2030, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 7.7% from 2022 to 2030. Since testing is pivotal for effective management of the rising burden of coronavirus cases, the rate at which testing is performed has witnessed a steep increase. More than 150 million tests have been performed in the U.S. as of November 2020, followed by more than 100 million tests conducted in India, and around 20 million tests performed in Brazil.

COVID-19 Diagnostics Market Segmentation

Grand View Research has segmented the global COVID-19 diagnostics market on the basis of product and service, sample type, test type, mode, end-use, and region:

Based on the Product & Service Insights, the market is segmented into Instruments, Reagents & Kits, and Services.

- The services segment is estimated to dominate the market for Covid-19 diagnostics and accounted for revenue share of 47.8% in 2021.

- The reagents and kits segment is expected to register a CAGR of (7.2%) from 2020 to 2030. The reduction in the number of active COVID-19 cases is responsible for the declining market growth of this segment.

Based on the Sample Type Insights, the market is segmented into Nasopharyngeal (NP) swabs, Oropharyngeal (OP) swabs, Nasal Swabs, Blood and Others

- The nasopharyngeal swabs segment accounted for the largest revenue share of 43.9% in 2021.

- The blood sample type segment is estimated to register a growth rate of (7.3%) from 2020 to 2030. This is attributed to the significant decrease in the COVID-19 incidence rate.

Based on the Test Type Insights, the market is segmented into Molecular (PCR) Testing, Antigen-based Testing, Antibody (Serology) Testing and Others.

- Molecular (PCR) testing dominated the market and accounted for a revenue share of 67.1% in 2021.

- The antigen-based testing is expected to witness a CAGR of (6.1%) from 2020 to 2030.

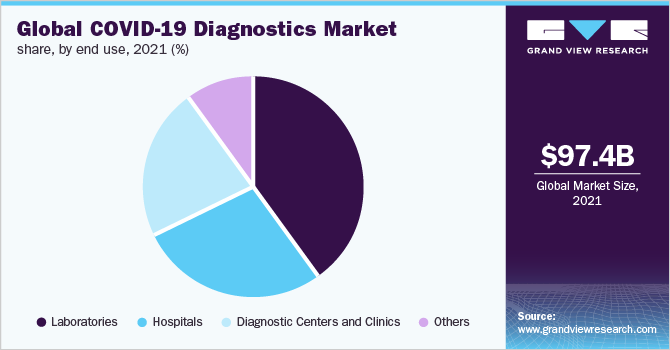

Based on the End-Use Insights, the market is segmented into Laboratories, Hospitals, Diagnostic Centers and Clinics and Others.

- The laboratories segment dominated the market and accounted for the largest revenue share of 39.6% in 2021.

- This is driven by the effective implementation of favorable reimbursement policies in developed economies.

- The diagnostic centers and clinics segment is expected to register a growth rate of 6.9% from 2022 to 2030. According to NHS England, up to 20% of patients have hospital-acquired COVID-19 infection.

Based on the Mode Insights, the market is segmented into Point-of-Care (PoC) and Non-Point-of-Care (Non-PoC).

- The non-POC (centralized) testing segment dominated the market and accounted for revenue share of 64.5% in 2021.

- Currently, most of the COVID-19 tests are carried out in the laboratory environment, thus centralized or laboratory testing is currently the key testing mode in the market.

COVID-19 Diagnostics Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

Key industry participants constantly accelerated the supply and production of diagnostic tests to address the rising need for the effective containment of the COVID-19 pandemic.

Some prominent players in the Global COVID-19 Diagnostics market include:

- F. Hoffmann-La Roche Ltd.

- Thermo Fisher Scientific, Inc.

- Perkin Elmer, Inc.

- Neuberg Diagnostics

- 1drop Inc.

- Veredus Laboratories

- ADT Biotech Sdn Bhd

- altona Diagnostics GmbH

- bioMérieux SA

- Danaher

- Mylab Discovery Solutions Pvt. Ltd.

- ALDATU BIOSCIENCES

- Quidel Corporation

- Quest Diagnostics

- Hologic Inc.

- Laboratory Corporation of America Holdings

- Luminex Corporation

- Abbott

Order a free sample PDF of the COVID-19 Diagnostics Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment