Canned Seafood Industry Overview

The global canned seafood market size is expected to reach USD 50.47 billion by 2030, expanding at a CAGR of 5.9%, according to a new report by Grand View Research, Inc. Increasing demand for essential fatty acids and proteins in consumer diets has contributed to the growth of canned seafood in the recent years. Moreover, the growing popularity of chemical-free packaged seafood with higher shelf life has promoted the adoption of canned seafood among consumers.

Technological advancements in tuna fishing coupled with Fish Aggregating devices and advanced packaging technology for fish products are anticipated to drive the industry growth during the forecast period. In addition, improved packaging procedures with the use of RFID tags to improve product traceability and agglomeration are expected to increase product adoption by the consumers, thereby contributing to the market growth. For instance, in March 2021, Thai Union Frozen products SPACE-F announced FoodsTech Accelerator and Incubator Program that allow food processing at a faster pace and preserve the quality of its food.

Canned Seafood Market Segmentation

Grand View Research has segmented the canned seafood market based on product, distribution channel, and region:

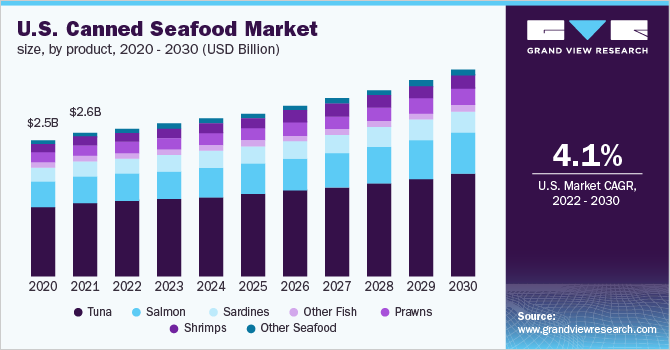

Based on the Product Insights, the market is segmented into Tuna, Salmon, Sardines, Other Fish, Prawns, Shrimps, and Other Seafood

- The tuna segment held the largest market share of 42.22% in 2021 and is expected to maintain dominance during the forecast period due to the predominant consumption of ready meals among working-class people around the globe.

- Further, the segment is expected to grow on account of new product launches. For instance, in August 2021, Mind Fish Co. launched the first Fair Trade Certifiedä canned tuna product available for purchase in the North American market.

- However, sardines are projected to register a CAGR of 7.8% from 2022 to 2030. As a portable snack, canned sardines have become more popular than fresh ones since they do not need to be cooked.

Based on the Distribution Channel Insights, the market is segmented into Foodservice and Retail

- Retail was the largest distribution channel, with a market share of around 60.0% in the global revenue in 2021. This channel includes supermarkets, hypermarkets, convenience stores, grocery stores, and local shops.

- The increasing number of these stores across various regions has experienced a surge in the distribution of canned seafood in the market.

- According to an article published by Supermarket News, in February 2021, convenience stores are the main drivers of canned seafood, whereas the retail sector holds around 48% of the distribution market.

- The foodservice distribution channel is anticipated to register faster growth during forecast years with a CAGR of 6.3% from 2022 to 2030.

- The segment is poised to emerge as a steady source of revenue during the forecast period. Growth in consumption of canned seafood in restaurants and hotels is likely to drive growth.

Canned Seafood Regional Outlook

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

The canned seafood market is highly fragmented, with the presence of many global players. The market players face intense competition, especially from the top manufacturers of this market, as they have a large consumer base, strong brand recognition, and vast distribution networks. Companies have been implementing various expansion strategies, such as partnerships and new product launches, to stay ahead in the game.

Some prominent players in the global Canned Seafood market include:

- StarKist Co.

- Nippon Suisan Kaisha, Ltd

- Maruha Nichiro Corporation

- Icicle Seafoods Inc.

- LDH (La Doria) Ltd

- Wild Planet Foods

- Thai Union Frozen Products

- American Tuna, Inc.

- Universal Canning, Inc.

- Tri Marine Group

- Trident Seafoods Corporation

- Connors Bros. Ltd. (Brunswick Seafoods)

Order a free sample PDF of the Canned Seafood Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment