Smokeless Cigarettes Industry Overview

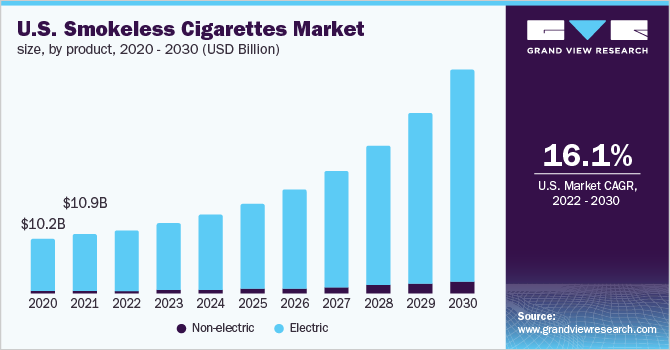

The global smokeless cigarettes market size was valued at USD 24.5 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 16.0% from 2022 to 2030. Growing consumer awareness about degenerating effect of tobacco consumption is expected to drive the market in the forecast period. According to the Centers for Disease Control and Prevention, 2020, more than 2 in every 100 (2.3%) adults aged 18 or older reported current use of smokeless tobacco products in the U.S. i.e. 5.7 million adults in the country. Furthermore, technological advancements by key players in the market for smokeless cigarettes would also promote expansion.

Shifting consumer preference toward nicotine-free cigarettes owing to the risk of cancer of the head, throat, neck, esophagus, and oral cavity is expected to drive the market for smokeless cigarettes. Hence, manufacturers are launching innovative products to cater to such issues. For instance, in January 2019, Juul Labs Inc, a U.S.-based electronic cigarette company launched e-cigarettes in India. The initiative was taken in response to expanding the company’s market presence in the Asia-Pacific region. Similarly, in February 2021, TAAT(TM) Lifestyle and Wellness Ltd. launched TAAT, a nicotine-free and tobacco-free cigarette, which will be available in Ohio, on various e-commerce websites.

Gather more insights about the market drivers, restraints, and growth of the Global Smokeless Cigarettes Market

The growing inclination of consumers towards different flavored products such as cinnamon, berry, vanilla, saffron, and apple would provide a lucrative opportunity for the players operating in the market. For instance, in July 2021, BIDI Stick, a disposable e-cigarette brand unveiled new flavor names as direct translations from its previous flavors such as Marigold, (formerly Icy Mango), Arctic (formerly Mint Freeze), and Solar (formerly Berry Blast), among others. The approach was designed to subvert future restrictions on the sale of flavored disposable e-cigarettes that were not in accordance with government policy and modify its existing product characteristics.

Rising awareness among consumers especially millennials and Gen Z regarding the health hazards associated with smoking has resulted in high demand for alternatives to traditional cigarettes, such as e-cigarettes, which will adapt well to market growth. According to an article published in Truth Initiative, in July 2021, the use of disposable e-cigarettes increased about 1,000% (from 2.4% to 26.5%) among high school e-cigarette users and more than 400% (from 3% to 15.2%) among middle school e-cigarette users during 2019-2020. Such data provided by various official websites suggest a positive growth trend for the market.

Browse through Grand View Research's Alcohol & Tobacco Industry Related Reports

Disposable E-cigarettes Market - The global disposable e-cigarettes market size was valued at USD 5.7 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 11.2% from 2022 to 2030.

Smoking Accessories Market - The global smoking accessories market size was valued at USD 64.4 billion in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 4.0% from 2022 to 2030.

Smokeless Cigarettes Industry Segmentation

Grand View Research has segmented the global smokeless cigarettes market based on product, distribution channel, and region:

Smokeless Cigarettes Product Outlook (Revenue, USD Million, 2017 - 2030)

- Non-electric

- Electric

Smokeless Cigarettes Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

- Offline

- Online

Smokeless Cigarettes Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Central & South America

- MEA (Middle East & Africa)

Market Share Insights:

August 2021: RELX, a premium vape brand was launched in Saudi Arabia.

January 2021: BAT launched its first CBD vaping product, VUSE CBD Zone.

Key Companies profiled:

Some prominent players in the global Smokeless Cigarettes Industry include

- JUUL Labs Inc.

- British American Tobacco Plc

- RELX Technology Co Ltd.

- Imperial Brands Plc

- Japan Tobacco Inc.

- Shenzhen Joye Technology Co. Ltd.

- Shenzhen IVPS Technology Co. Ltd.

- Shenzhen Kanger Technology Co. Ltd.

- Shenzhen Eigate Technology Co. Ltd.

- Flavourart Srl

Order a free sample PDF of the Smokeless Cigarettes Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment