U.S. Office Furniture Industry Overview

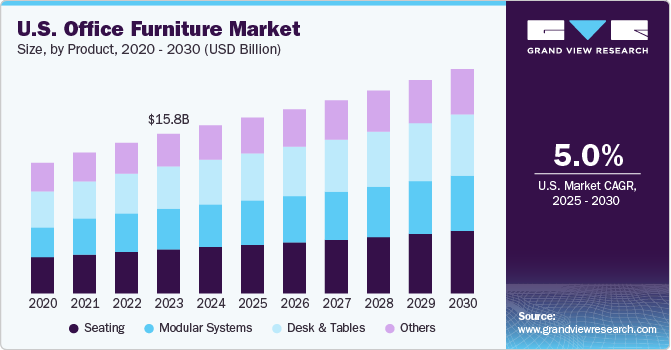

The U.S. office furniture market size is expected to reach USD 22.2 billion by 2030, according to a new report by Grand View Research, Inc. It is expected to expand at a CAGR of 5.3% from 2022 to 2030. Various factors such as rising disposable incomes, the growth of the real estate industry, the growth of businesses, and consumer desire for luxury and premium furnishings are driving the market. Furthermore, the growing popularity of hybrid working cultures and the expansion of ed-tech platforms are driving the U.S. office furniture industry forward.

Due to social distancing norms, the COVID-19 pandemic has pushed millions of Americans to work from home. Work-from-home (WFH) has become the norm and is expected to continue for the foreseeable future, making it stressful for working professionals who are not equipped with comfortable office furniture. During the COVID-19 pandemic, the demand to work and study at home has resulted in a surge in office furniture purchases. For example, HOM Furniture, based in Minneapolis, sells home office in all 17 of its locations and has noticed a boost in the category since the stay-at-home orders were implemented. Smaller scale workstations that can accommodate both laptops and tablets are one of the most popular varieties.

U.S. Office Furniture Market Segmentation

Grand View Research has segmented the U.S. office furniture market on the basis of product and distribution channel:

Based on the Product Insights, the market is segmented into Seating, Modular Systems, Desks & Tables, and Others

- The seating segment accounted for the largest revenue share of over 25.0% in 2021. Proper seating has become increasingly important as employees spend more than 8-10 hours every day at work.

- To minimize illness and fatigue, office chairs must be designed according to scientific principles as the optimal posture while working has a significant impact on health.

- Customers in the U.S. want to purchase high-quality furniture that not only looks good but is also composed of high-quality materials.

- When it came to selecting office furniture in the U.S. in 2021, about a third of buyers prioritized desks and tables.

- As a result of the COVID-19 outbreak, which resulted in widespread lockdowns and stay-at-home orders across the U.S., the demand for office furniture used in the home increased.

- Obesity is also a factor that is causing manufacturers to change the design of office furniture, especially chairs and other seating products.

Based on the Distribution Channel Insights, the market is segmented into Online and Offline

- The offline distribution channel segment led the market and accounted for a revenue share of over 65.0% in 2021.

- The online distribution channel segment is expected to register the fastest CAGR of 9.9% from 2022 to 2030.

- The segment is driven by the emergence of e-commerce retail channels and online furniture merchants.

Key Companies Profile & Market Share Insights

The market includes both international and domestic participants. Key market players focus on strategies such as innovation and new product launches to enhance their portfolio offering in the market. In April 2021, PPG Industries, Inc. introduced PPG ERGOLUXE powder coatings for metal office furniture. The new coatings, which include a novel polyester-hybrid technology, provide style and sustainability advantages over typical liquid or solvent-based coatings for chairs, desks, cabinets, and more.

Some prominent players in the U.S. Office Furniture market include:

- Haworth

- Herman Miller Inc.

- HNI Corporation

- Knoll

- Steelcase

- Ashley Furniture Industries Inc.

- Global Furniture Group

- Kimball International Inc.

- Okamura Corp.

- Interior Systems, Inc.

Order a free sample PDF of the U.S. Office Furniture Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment