Enterprise Video Industry Overview

The global enterprise video market size was valued at USD 16.39 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 13.8% from 2022 to 2030. The growth of this market can be mainly attributed to the increased application of enterprise video solutions across organizations to enhance collaboration among their global workforces. The enterprise video has become a crucial part of the content marketing strategies of various companies. As a result, several companies are now focusing on developing Content Delivery Networks (CDNs) that speed up the delivery of multimedia internet content and provide better video streaming capabilities to enterprises. For instance, in April 2022, Google Cloud introduced its new multimedia CDN named Media CDN which enables businesses to leverage Google’s YouTube network. It also offers additional capabilities including ecosystem integrations, custom ad insertion, and platform extensibility.

The expansion of the market is being further expedited by the increasing demand for on-demand video streaming for learning and development training across various organizations. The on-demand videos help employees attain detailed information which is previously recorded by trainers, colleagues, and executives. Besides, many businesses are using enterprise video platforms for conducting external activities such as sales, marketing, training of customers and partners, and broadcasting of public events.

Gather more insights about the market drivers, restraints, and growth of the Global Enterprise Video Market

The ongoing technological advancements in video streaming, such as the introduction of Application Programming Interfaces (APIs), are significantly favoring the market expansion. The APIs have allowed organizations to combine multiple technological platforms, delivering an omnichannel experience to their customers. Moreover, APIs also help develop apps for on-demand video content which is further propelling the growth of the market.

The global outbreak of the COVID-19 crisis has positively influenced the market space due to the increased need for enterprise collaboration software as several companies implemented remote working models during the pandemic. The growing remote working trend created a dynamic demand for video conferencing and content management. This urged the major tech companies such as Microsoft, Google LLC, and Zoom Video Communications, Inc. to develop video conferencing solutions to meet the rising demand for team collaboration tools.

Browse through Grand View Research's Next Generation Technologies Industry Related Reports

Cloud Gaming Market - The global cloud gaming market size accounted for USD 691.6 million in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 45.8% from 2022 to 2030.

AI Video Generator Market - The global AI video generator market size was estimated at USD 472.9 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 19.7% from 2023 to 2030.

Enterprise Video Industry Segmentation

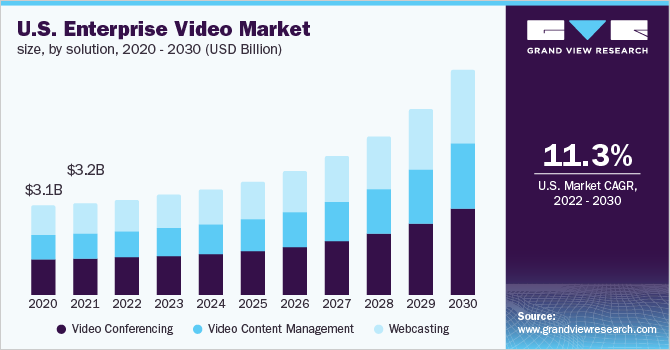

Grand View Research has segmented the global enterprise video market based on solution, services, application, deployment, delivery technique, organization size, end-use, and region:

Enterprise Video Solution Outlook (Revenue, USD Billion, 2018 - 2030)

- Video Conferencing

- Video Content Management

- Webcasting

Enterprise Video Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Integration & Deployment

- Managed Service

- Professional Service

Enterprise Video Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premises

Enterprise Video Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Corporate Communications

- Training & Development

- Marketing & Client Engagement

Enterprise Video Delivery Technique Outlook (Revenue, USD Billion, 2018 - 2030)

- Downloading/ Traditional Streaming

- Adaptive Streaming

- Progressive Downloading

Enterprise Video Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprise

- Small & Medium Enterprise (SME)

Enterprise Video End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- IT & Telecom

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare & Life Sciences

- Media & Entertainment

- Education

- Retail & Consumer Goods

- Others

Enterprise Video Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA (Middle East & Africa)

Market Share Insights:

July 2021: Prominent telecom operator Tata Teleservices partnered with one of the leading web-based video conferencing solutions providers Zoom Video Communications, Inc, to deliver unified communications solutions to enterprises and individuals. This partnership will help the latter reach around 60 cities in India where Tata Teleservices has a presence.

April 2020: Avaya, Inc. delivered its collaboration and communications solutions to the renowned online video platform iQIYI which has more than 500 million monthly active users.

Key Companies profiled:

Some prominent players in the global Enterprise Video Industry include

- Adobe

- Avaya Inc.

- Brightcove Inc.

- Cisco Systems, Inc.

- IBM Corporation

- Kaltura, Inc.

- Microsoft

- Polycom, Inc. (Plantronics, Inc.)

- VBrick

- Vidyo, Inc.

Order a free sample PDF of the Enterprise Video Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment