Retail Logistics Industry Overview

The global retail logistics market size was valued at USD 227.61 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 12.3% from 2022 to 2030. Due to increased worldwide trade activity, particularly in emerging economies, and global transportation infrastructure expansion, the market is likely to rise incrementally. The retail logistics system ensures a smooth flow of durable and non-durable goods to customers. Furthermore, logistics has resulted in quicker delivery times, lower fulfillment costs, and a more significant opportunity to focus on customer care rather than administrative operations in the retail industry.

As a result of increased globalization, international retailers have grown fiercely competitive. International retailers constructing new outlets in developing economies such as Asia Pacific, face fierce competition. This is causing a rise in economic activity and making transportation between regions easier. Hence, the demand for retail and logistic services to speed product delivery has increased. International retailing helps countries improve their economies by increasing tax revenue through importing and exporting commodities, which contributes to market growth. Similarly, the growing use of the internet has increased the number of trade and e-commerce opportunities available to international retailers.

Gather more insights about the market drivers, restraints, and growth of the Global Retail Logistics Market

Multimodal transportation has gained significant traction due to lowered costs per vehicle, decreased cargo-handling time, and reduced customs controls. Inclination to opt for multiple means of transportation is one of the significant trends in the retail logistics market. It involves using a combination of trucks, ships, railcars, or aircraft. Integrating this multimodal transportation allows for minimizing inventory costs and enables inventory operators to control the merchandise costs. Multimodal transportation helps merchants transfer goods efficiently and affordably during outbound logistics.

Furthermore, the retail e-commerce market's last-mile delivery strategy is predicted to boost the retail logistics business in near future. Customers can evaluate products from several online sources, which is a disadvantage for distributors or brick-and-mortar businesses because an e-commerce platform allows them to compare products based on delivery time, prices, features, specs, and compatibility requirements. These advantages over brick-and-mortar stores are propelling the retail e-commerce industry forward, and this trend is projected to continue in the future years.

Browse through Grand View Research's Automotive & Transportation Industry Related Reports

Logistics Automation Market - The global logistics automation market size is expected to reach USD 30.90 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 14.7% from 2023 to 2030.

Transportation Management Systems Market - The global transportation management systems market size was valued at USD 10.45 billion in 2022 and is expected to register a compound annual growth rate (CAGR) of 14.8% from 2023 to 2030.

Retail Logistics Industry Segmentation

Grand View Research has segmented the global retail logistics market based on type, solution, mode of transport, and region:

Retail Logistics Type Outlook (Revenue, USD Billion, 2017 - 2030)

- Conventional Retail Logistics

- E-commerce Retail Logistics

Retail Logistics Solution Outlook (Revenue, USD Billion, 2017 - 2030)

- Commerce Enablement

- Supply Chain Solutions

- Reverse Logistics & Liquidation

- Transportation Management

- Others

Retail Logistics Mode of Transport Outlook (Revenue, USD Billion, 2017 - 2030)

- Railways

- Airways

- Roadways

- Waterways

Retail Logistics Regional Outlook (Revenue, USD Billion, 2017 - 2030)

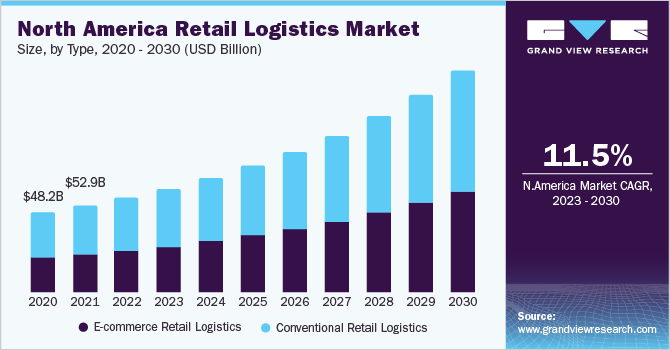

- North America

- Europe

- Asia Pacific

- Latin America

- MEA (Middle East & Africa)

Market Share Insights:

December 2020: FedEx, announced the acquisition of ShopRunner, an e-commerce platform. The purchase was made to allow FedEx to utilize ShopRunner's e-commerce capabilities, allowing it to expand its e-commerce portfolio and client base.

April 2020: FedEx partnered with an open SaaS e-commerce platform provider, BigCommerce Pty. Ltd., enabling small and medium enterprises to sell online and connect to commerce and delivery. This collaboration has allowed the customers of BigCommerce Pty. Ltd. can now use FedEx shipping services within the existing platform at a low cost and with ease.

Key Companies profiled:

Some prominent players in the global Retail Logistics Industry include

- XPO Logistics, Inc.

- DSV

- Kuehne + Nagel International

- C.H. Robinson Worldwide, Inc.

- Nippon Express

- FedEx

- Schneider

- United Parcel Service

- APL Logistics Ltd

- DHL International GmbH

- A.P. Moller - Maersk

Order a free sample PDF of the Retail Logistics Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment