Life Sciences BPO Industry Overview

The global life sciences BPO market size was valued at USD 366.3 billion in 2021 and is anticipated to exhibit a compound annual growth rate (CAGR) of 9.2% over the forecast period. Pharmaceutical and medical device companies are now trying to focus on their core competencies; Outsourcing manufacturing, research, and marketing help them save time and money, which is one of the key factors driving the market. During the COVID-19 pandemic, pharmaceutical and medical device companies were heavily dependent on the CMOs and CROs for the development and manufacturing of test kits and vaccines.

This significantly boosted the market to a great extent. Owing to the decline in the cases of COVID-19 due to the growing vaccination drive, the CDMOs are focusing on developing drugs for cancer and other chronic and infectious diseases due to the high disease prevalence. For instance, in January 2022, Lonza partnered with HaemaLogiX, a developer of monoclonal antibodies, to manufacture myeloma drug candidate KappaMab, a monoclonal antibody. This is expected to improve the demand for the development and manufacturing of these drugs in the coming years. In recent years, there has been a rise in mergers and acquisitions between CROs and CDMOs to strengthen their capabilities.

Gather more insights about the market drivers, restraints, and growth of the Global Life Sciences BPO Market

For instance, in December 2021, Thermo Fisher Scientific, Inc. completed the acquisition of PPD, a clinical research services provider, to expand its service portfolio to include clinical research, analytical testing, and laboratory services, among others. In February 2021, Charles River CRO acquired Cognate BioServices to strengthen its research capabilities in cell and gene therapy. Such strategies were implemented by the market players to expand their value chain in research and to provide end-to-CRO services, this has improved the customer reach of the companies and hence is expected to have a positive impact on the market growth.

Pharmaceutical organizations are increasingly focusing on their R&D activities to stay competitive & flexible. As per the estimates of Evaluate Pharma, the pharmaceutical R&D spending accounted for USD 182 billion, in 2018, whereas in 2021 it increased by 16.5% and accounted for USD 212 billion. The growing R&D spending is expected to improve the demand for life sciences BPO services. Growing demand for outsourcing drug development and manufacturing activities, particularly in emerging countries, such as China, India, and South Korea, where outsourcing is more cost-effective than in developed countries, is expected to boost the market growth in the developing economies.

Browse through Grand View Research's Medical Devices Industry Related Reports

Product Design and Development Services Market - The product design and development services market size was valued at USD 9.4 billion in 2022 and is anticipated to exhibit a compound annual growth rate (CAGR) of 12.5% from 2023 to 2030.

Drug Discovery Outsourcing Market - The global drug discovery outsourcing market size was valued at USD 3.5 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 7.3% from 2023 to 2030.

Life Sciences BPO Industry Segmentation

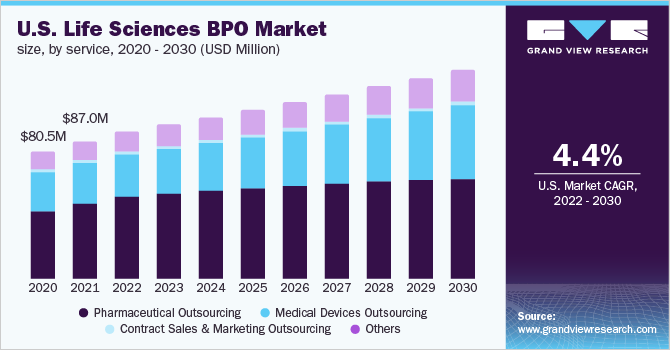

Grand View Research has segmented the global life sciences BPO market based on service and region:

Life Sciences BPO Services Outlook (Revenue, USD Million, 2018 - 2030)

- Pharmaceutical outsourcing

- Medical devices outsourcing

- Contract sales and marketing outsourcing

- Others

Life Sciences BPO Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA (Middle East & Africa)

Market Share Insights:

April 2022: Aenova Group developed a new facility for manufacturing highly potent drugs with an investment of EUR 10 million.

April 2022: Labcorp collaborated with Xcell Biosciences to support the company in developing cell and gene therapies for treating cancer, Parkinson’s, and other rare diseases.

Key Companies profiled:

Some prominent players in the global Life Sciences BPO Industry include

- Accenture plc

- Atos SE

- Boehringer Ingelheim GmbH

- Catalent, Inc.

- Covance, Inc. (Labcorp)

- Genpact Ltd.

- ICON plc

- Infosys Ltd.

- Lonza Group

- PAREXEL International Corp.

- IQVIA

- International Business Machines Corp.

Order a free sample PDF of the Life Sciences BPO Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment