Air Purifier Industry Overview

The global air purifier market size was valued at USD 12.26 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 8.1% from 2022 to 2030.

The market is expected to be driven by the rising airborne diseases and increasing pollution levels in urban areas. Moreover, growing health consciousness, coupled with the improving standard of living and rising disposable income, is expected to boost the market growth. The lockdown measures implemented by the governments of various countries, in light of the onset of the COVID-19 pandemic in 2020, have resulted in boosting the sales of home appliances such as air purifiers, cleaning appliances, kitchen appliances, and water filtration devices. Rising awareness regarding healthy living has contributed to the increased sales of air purifiers across the globe.

Gather more insights about the market drivers, restraints, and growth of the Global Air Purifier market

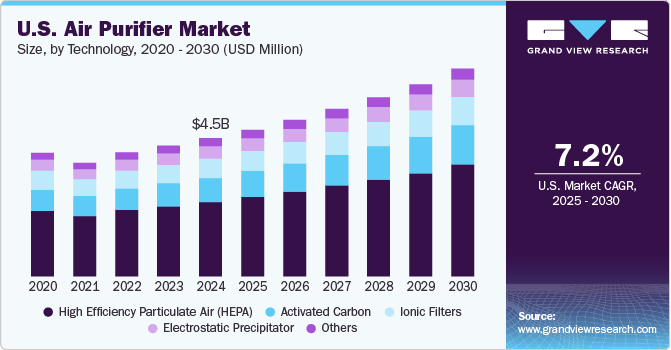

The rising prevalence of airborne diseases, coupled with the increasing air pollution levels in the U.S., is anticipated to influence the market growth over the forecast period positively. The HEPA technology segment is expected to dominate the U.S. market over the forecast period as it is the most effective technology for trapping harmful airborne particles.

Several governments are focusing on regulating air pollution by introducing several stringent regulations and standards for indoor air quality, which are projected to drive the industry over the forecast period. Additionally, numerous air pollution control campaigns undertaken worldwide by governments and NGOs are expected to boost the market growth over the forecast period.

Governments of various countries have introduced lockdown measures to contain the spread of COVID-19. Thus, stay-at-home and work-from-home norms have further intensified the demand for air purifiers. Furthermore, there is a significant demand for air purifiers from hospitals, universities, and government agencies as consumers are exploring ways to avoid the spread of coronavirus.

Several factors such as changing lifestyle preferences, deteriorating indoor air quality, rising health concerns, and increasing awareness among consumers about the benefits associated with air purifiers are likely to fuel the market growth over the coming years. However, the high cost of adoption and maintenance of air purifiers are expected to limit their adoption.

Browse through Grand View Research's Advanced Interior Materials Industry Related Reports

Residential Air Purifier Market - The global residential air purifier market size was valued at USD 3.9 billion in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 6.2% from 2022 to 2030.

U.S. Air Purifier Market - The U.S. air purifier market size was estimated at USD 2.17 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 8.6% from 2020 to 2028. Increasing pollution levels and the rising prevalence of airborne diseases in the country have resulted in rising product demand.

Market Share Insights

November 2021 - iRobot Corporation acquired Aeris Cleantec AG in a USD 72 Million all-cash deal in a bid to strengthen its portfolio of intelligent home innovation solutions.

September 2020 - Aurabeat Technology Limited, a Hong Kong-based company, introduced Aurabeat AG+ Silver Ion Plasma Sterilization Air Purifier, which can eliminate more than 99.9% of COVID-19 within 30 minutes.

Key Companies profiled:

Some prominent players in the global Air Purifier market include

- Honeywell International, Inc.

- IQAir

- Koninklijke Philips N.V.

- Unilever PLC

- Sharp Electronics Corporation

- Samsung Electronics Co., Ltd.

- LG Electronics

- Panasonic Corporation

- Whirlpool Corporation

- Dyson

- Carrier

Order a free sample PDF of the Air Purifier Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment