Endoscopy Devices Industry Overview

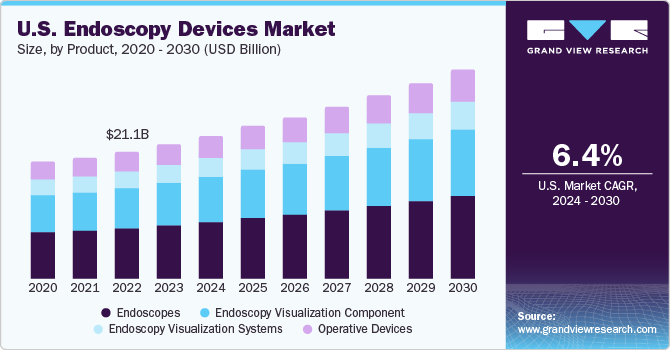

The endoscopy devices market size was valued at USD 42.7 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 7.4% from 2022 to 2030.

The less invasive properties and affordable post and pre-procedure cost of endoscopy devices are the major factors anticipated to boost the market growth over the forecast period. Furthermore, a shift in trend to use disposable endoscopic components to minimize the procedure cost as well as the chance of cross-contamination is also expected to accelerate market growth over the years.

In addition, the growing chronic disease burden and increasing geriatric population all over the globe are also anticipated to fuel the adoption of endoscopic devices during the coming years. Moreover, growing medical conditions due to the increasing geriatric population often require endoscopic intervention such as liver abscess, gall stones, endometriosis, and intestinal perforation, which in turn are anticipated to drive the market for endoscopy devices over the forecast years. For instance, as per the Administration on Aging (AoA) of the U.S. Department of Health and Human Services report, about 16% of the population were aged above 65 years during 2019. This number is expected to increase to 21.6% by 2040.

Gather more insights about the market drivers, restraints, and growth of the Global Endoscopy Devices market

In addition, increasing preference by medical professionals to use technologically advanced endoscopy devices equipped with a high-definition camera and light sources to help physicians analyze internal organs of interest also drives the market. The shift of preference towards minimally invasive surgical procedures than traditional surgeries to reduce hospital stay and minimize post-procedure complications are the major factors anticipated to fuel the demand for endoscopy devices. Hence, factors such as higher patient satisfaction, increased economic viability, and lesser hospital stay are expected to increase the demand for minimally invasive endoscopic interventions in the coming years, thereby accelerating market growth.

Furthermore, the growing burden of cancer all over the world also fuels the adoption of endoscopy devices for the early diagnosis and treatment of the disease. For instance, according to GLOBOCAN 2020 estimates 19.3 million new cancer cases worldwide and almost 10 million deaths occurred in 2020 due to cancer. In addition, the increasing preference for biopsies for diagnosis and detection of cancer in recent years is also likely to increase the adoption of endoscopic devices, which in turn is anticipated to drive the market for endoscopy devices over the years.

Technological advancement to develop innovative endoscopic devices is also anticipated to accelerate market growth during forecast periods. The key manufacturers are continuously looking forward to innovating advanced endoscopic solutions for better treatment and diagnosis of several chronic disorders. For instance, in August 2021, Fujifilm Holdings Corporation announced the commercial launch of the ELUXEO 7000X endoscopic Imaging System. This advanced imaging system enables real-time visualization of hemoglobin oxygen saturation (StO2) levels in tissue during laparoscopic and/or end luminal imaging procedures.

In addition, the endoscopy devices market has been significantly impacted by the COVID-19 pandemic. The reduction and postponement of elective surgeries due to the fear of COVID-19 infection have negatively impacted the growth of the market for endoscopy devices. In addition, supply chain disruptions, changing regulations for surgical procedures, are some of the factors that also hampered market growth in 2020. For instance, according to an international study published in the Arab Journal of Gastroenterology, Elsevier in 2020, the endoscopic procedure volume was reduced by over 50% of the 85% of the responded countries all over the world during the COVID-19 pandemic.

Browse through Grand View Research's Medical Devices Industry Related Reports

Disposable Endoscopes Market - The global disposable endoscopes market size was valued at USD 1.7 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 17.0% from 2022 to 2030. The growing cross-contamination issue of reusable endoscopes is one of the major factors expected to drive market growth.

Endoscopy Operative Devices Market - The global endoscopy operative devices market size was valued at USD 8.0 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 5.1% from 2021 to 2028.

Market Share Insights

August 2021 - Fujifilm Holdings Corporation announced the commercial launch of the ELUXEO 7000X endoscopic Imaging System. This advanced imaging system enables real-time visualization of hemoglobin oxygen saturation (StO2) levels in tissue during laparoscopic and/or end luminal imaging procedures.

September 2020 - PENTAX Medical announced to launch new Ultrasound Video Gastro scopes J10 Series in the U.S. These advanced gastro scopes enable better image quality, increase diagnostic capabilities, and help in effective disease management of the patient.

Key Companies profiled:

Some prominent players in the global Endoscopy Devices market include

- Olympus Corporation

- Ethicon Endo-surgery, LLC.

- FUJIFILM Holdings Corporation

- Stryker Corporation

- Boston Scientific Corporation

- Karl Storz GmbH & Co. KG

- Smith & Nephew Inc.

- Richard Wolf GmbH

- Medtronic Plc (Covidien)

- PENTAX Medical

- Machida Endoscope Co., Ltd.

Order a free sample PDF of the Endoscopy Devices Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment