Medical Device Outsourcing Industry Overview

The global medical device outsourcing market size was valued at USD 107.92 billion in 2021 and is anticipated to exhibit a compound annual growth rate (CAGR) of 12.1% over the forecast period.

Increasing demand for medical devices combined with the rising price competition and requirement to reduce the cost is expected to drive the market during the forecast period. In addition, growing difficulties in product engineering along with the increasing number of new entrants are anticipated to shape the future of the market. The COVID-19 pandemic had created a significant demand for RT-PCR and COVID-19 antigen test kits for testing. The ongoing pandemic is likely to have a positive impact on the market. The increasing prevalence of chronic disorders is boosting the demand for medical devices.

Gather more insights about the market drivers, restraints, and growth of the Global Medical Device Outsourcing market

This, in turn, is working in favor of the market. Implantable Medical Devices (IMDs) are being used increasingly to improve patients’ medical outcomes. Designers of implantable medical devices have to balance complexity, reliability, power consumption, and costs. Consequently, companies are shifting their focus to innovation rather than non-core activities and therefore outsourcing these activities to launch efficient devices. Amendments in the ISO standards are expected to boost the demand for quality assurance and regulatory affairs service providers in the U.S. and Europe region as Small- and Medium-sized Enterprises (SMEs) would require third-party assistance to comply with new ISO standards.

Subcontractors and Original Equipment Manufacturers (OEMs) in developed countries like the U.S., Canada, Japan, and EU countries are expected to adopt these new standards earlier than those in the developing countries. However, the COVID-19 pandemic had caused a temporary disruption in the supply chain, which had led to shortages and a severe slowing of production. It has stressed the need for scalable manufacturing operations among OEMs, particularly those undertaking production associated to test kits & diagnostic systems. However, the current pandemic was a booster for product sterilization services.

The demand to sterilize single-use medical instruments and Personal Protective Equipment (PPE) remains high as long as the pandemic continues. The pandemic also created an urgent need for COVID-19 test kits, different public organizations also provided funding for scaling the production of these devices, apart from this, regulatory agencies like the U.S. FDA and the European Union had provided Emergency Use Authorization (EUA) for the test kits, which have further boosted the market growth.

Browse through Grand View Research's Medical Devices Industry Related Reports

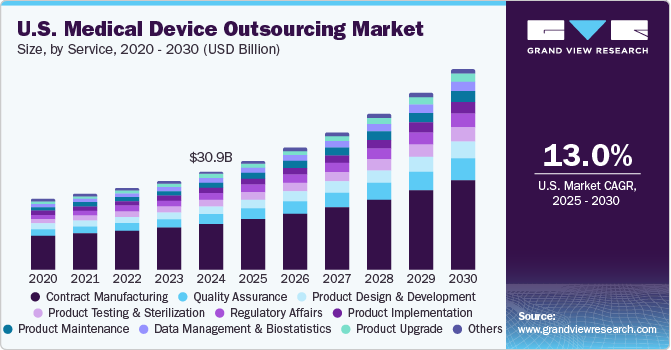

U.S. Medical Device Outsourcing Market - The U.S. medical device outsourcing market size was valued at USD 23.3 billion in 2021 and is anticipated to exhibit a compound annual growth rate (CAGR) of 11.2% over the forecast period.

Medical Devices Reimbursement Market - The global medical devices reimbursement market size was valued at USD 374.4 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 10.8% from 2021 to 2028.

Market Share Insights

December 2021 - The life sciences company, Labcorp, acquired a CRO, Toxikon Inc., to expand its offerings by providing testing services for medical devices, pharmaceuticals, and other industries.

January 2021 - SGS SA received the FDA approval to participate & provide services for third-party 510(k) premarket submissions for medical devices.

Key Companies profiled:

Some prominent players in the global Medical Device Outsourcing market include

- SGS SA

- Labcorp

- Eurofins Scientific

- Pace Analytical Services, Inc.

- Intertek Group Plc

- WuXi AppTec, Inc.

- North American Science Associates, Inc.

- TUV SUD AG

- American Preclinical Services

- Sterigenics International LLC

- Charles River Laboratories International, Inc.

- Medical Device Testing Services

- RJR Consulting, Inc.

- Mandala International.

Order a free sample PDF of the Medical Device Outsourcing Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment