Clear Aligners Industry Overview

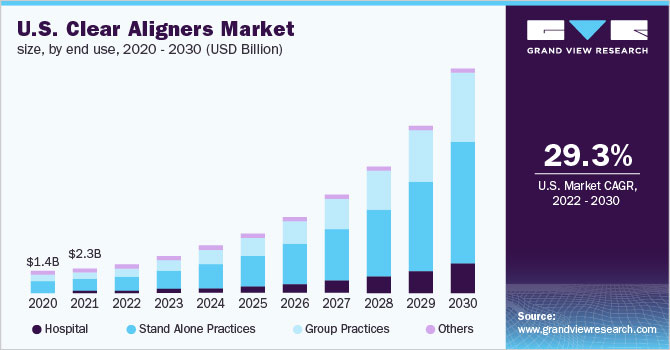

The global clear aligners’ market size was valued at USD 4.7 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 29.5% from 2022 to 2030.

Clear aligners are a series of tight-fitting custom-made mouthpieces or orthodontic systems that are useful in correcting misaligned or crooked teeth. Clear aligners are virtually discreet and removable alternatives to braces designed around patients’ convenience and flexibility. Factors such as the growing patient population suffering from malocclusions, rising technological advancements of dental treatment, and growing demand for customized clear aligners are driving the overall market. The pandemic had a positive impact on the market globally and key players recovered with high revenues in 2020 as compared to the previous years.

Gather more insights about the market drivers, restraints, and growth of the Global Clear Aligners market

For instance, according to Dental Tribune, Align Technology sold a record 1.6 million cases of clear aligners in 2020 as compared to 1.5 million cases in 2019. The company also stated that the adoption of Invisalign aligners by adults and teenagers increased by 36.7% and 38.7%, respectively in 2020 and the adoption of aligners among teens or younger patients was the highest during the pandemic. The major factor for the growth of this market was that people were more reluctant to go to an orthodontist’s office to get traditional teeth braces, which increased the adoption of clear aligners. The advent of the pandemic helped the industry prosper in terms of adoption, sales, and revenue, and this trend is expected to continue in the future.

In the advent of escalating dental disorders, advancements like 3D impression systems, additive fabrication, Nickel and Copper-Titanium Wires, digital scanning technology, CAD/CAM appliances, temporary anchorage devices, and incognito lingual braces, clear aligners are among the latest advancements that are making orthodontic treatments more efficient, predictable, and effective. The dental treatments have become customized and technologies like a digital impression system like iTero by Align Technology is assisting in developing accurate and customized clear aligner systems to treat mild to moderate misalignment conditions.

These invisible aligners are developed through virtual digital models, computer-aided design (CAD-CAM), and thermoformed plastic materials like copolyester or polycarbonate plastic. Inconvenience caused by the metal and ceramic braces and the long-term gum sensitivity they can cause has increased the adoption of clear aligners by the patients and dentists. The Aligner is designed with the wearer’s comfort and is flexible. According to Dental Tribune, clear aligner technology has quickly become an increasingly popular alternative to fixed appliances for tooth straightening since it is an aesthetically appealing and comfortable choice. Invisalign is the largest producer of clear aligners and other brands include Clear Correct, Inman Aligner, and Smart Moves. However, factors like the high cost of clear aligners, less number of dentists in emerging areas, and limited insurance coverage on orthodontic treatments are likely to hinder the market growth.

The advent of Covid-19 was eminent on the dental market as the majority of elective procedures were postponed. As dentistry is considered an elective and high contact service, most of the dental practices were closed. However, In the U.S., 27 states allowed dental offices to open for elective care by May 2020, and by June, around 48 states opened for elective dental care. The American Dental Association predicts spending projections to be more optimistic in the future due to the resuming of dental practices and recovering patient volume. The ADA also predicts that dental expenditures will grow and bounce back completely to pre-pandemic levels or 80% of pre-pandemic volume by October 2020 or January 2021, depending on the future scenario.

Browse through Grand View Research's Medical Devices Industry Related Reports

Dental Bone Grafts And Substitutes Market - The global dental bone grafts and substitutes market size was estimated at USD 645.2 million in 2021 and is expected to witness a CAGR of 9.4% during the forecast period. The increasing use of bone grafts and a growing number of dental implant surgeries are propelling the revenue.

Dental Implant Market - The global dental implant market size was valued at USD 3.6 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 11.0% from 2021 to 2028.

Clear Aligners Market Segmentation

Grand View Research has segmented the global clear aligners market on the basis of age, end-use, and region:

Clear Aligners Age Outlook (Revenue, USD Million, 2017 - 2030)

- Adults

- Teens

Clear Aligners End-use Outlook (Revenue, USD Million, 2017 - 2030)

- Hospitals

- Standalone Practices

- Group Practices

- Others

Clear Aligners Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Market Share Insights

April 2021 - Align Technology expanded its global operations by opening a manufacturing plant in Poland. This expansion will allow the company to cater to a large and underpenetrated market for Invisalign in Europe and the Middle East and Africa region.

April 2021 - Envista Holdings Corporation announced a partnership with Curaeos Clinics to provide them with the latest dental technologies. Curaeos Clinics has a wide network of dental clinics across the Netherlands, Belgium, Denmark, Germany, and Italy.

Key Companies profiled:

Some prominent players in the global Clear Aligners market include

- Align Technology

- Dentsply Sirona

- Patterson Companies Inc.

- Institute Straumann

- Danaher Corporation

- 3M EPSE

- Argen Corporation

- Henry Schein Inc.

- TP Orthodontics Inc.

Order a free sample PDF of the Clear Aligners Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment