Diabetes Devices Industry Overview

The global diabetes devices market size is expected to reach USD 54.16 billion by 2030, according to a new report by Grand View Research, Inc., registering a CAGR of 8.2% from 2022 to 2030. The market is primarily driven by factors such as the increasing incidence of diabetes, coupled with technological advancements and innovative product launches.

Rising adoption of advanced diabetes management solutions in developing regions, government policies, and rising medical tourism are some of the major factors contributing to the market growth. Furthermore, the rising government initiative to spread diabetes awareness and increasing R&D expenditure of major market players are the factors expected to ensure long-term market growth. According to the NCBI report, global health expenditure on diabetes is expected to reach USD 490 billion in 2030 from 376 billion in 2010.

Diabetes Devices Market Segmentation

Grand View Research has segmented the global diabetes devices market based on type, distribution channel, end use, and region:

Based on the Type Insights, the market is segmented into BGM Devices and Insulin delivery devices.

- Insulin delivery devices are identified as the fastest growing segment in the global diabetes devices market and accounted for over 56.9% share in 2021.

- Based on, insulin delivery device, the market has been segmented into pens, pumps, syringes and jet injectors.

- Pens held a larger share of the diabetes devices market in 2021. However, the pump segment is expected to gain substantial market share as it is estimated to grow at fastest CAGR during the forecast period.

- The adoption of blood glucose meters is gradually increasing due to advantages such as portability and accuracy.

Based on the Distribution Channel Insights, the market is segmented into Hospitals Pharmacies, Retail Pharmacies, Diabetes Clinics/ Centers, Online Pharmacies and Others.

- In 2021, hospital pharmacies accounted for over 54.0% of the market penetration owing to high footfall and availability of products.

- As online pharmacies directly procure diabetes devices from the manufacturers, it helps them avail lucrative deals for customers.

- The increasing patient awareness about online pharmacies and increased public-private funding are key factors driving the segment.

- The COVID-19 pandemic has positively impacted the e-pharmacies business; the sales volume of diabetes devices is observed to have increased through this platform.

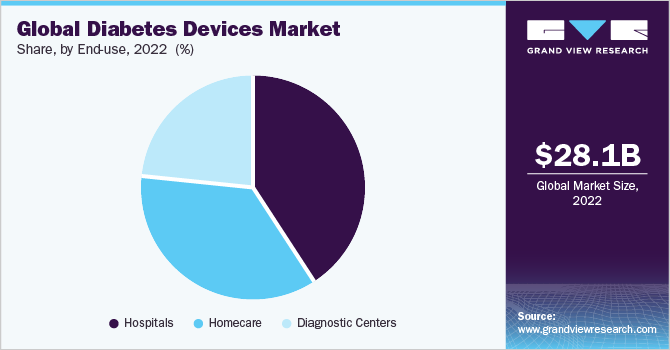

Based on the End-use Insights, the market is segmented into Hospitals, Homecare and Diagnostic Centers.

- Hospital segment dominated the market with largest market share of 40.9% in 2021. Increasing number of hospital admissions of diabetes patients is boosting the demand for the segment.

- Homecare segment is anticipated to lucrative growth rate at 7.4% compound annual growth rate(CAGR) during the forecast period. This growth is attributed to growing awareness about diabetes preventive care.

Diabetes Devices Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

Market leaders are focusing on product launches and technological collaboration to increase their foothold in the market.

Some prominent players in the Diabetes Devices market include

- Medtronic plc

- Abbott Laboratories

- Hoffmann-La-Ltd.

- Bayer AG

- Lifescan, Inc.

- B Braun Melsungen AG

- Lifescan, Inc.

- Dexcom Inc.

- Insulet Corporation

- Ypsomed Holdings

- Companion Medical

- Sanofi

- Valeritas Holding Inc.

- Novo Nordisk

- Arkray, Inc.

Order a free sample PDF of the Diabetes Devices Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment