U.S. Office-based Labs Industry Overview

The U.S. office-based labs market size is expected to reach USD 18.3 billion by 2030 expanding at a CAGR of 7.46% over the forecast period, according to a new report by Grand View Research, Inc. The increasing prevalence of vascular diseases and rising preference for minimally invasive procedures in outpatient settings are the major factors driving the demand for office-based labs (OBL) in the U.S. High prevalence of risk factors, such as smoking, high blood pressure, diabetes, and high cholesterol, along with the growing geriatric population, is expected to increase the incidence of Peripheral Artery Diseases (PADs).

U.S. Office-based Labs Market Segmentation

Grand View Research has segmented the U.S. office-based labs market based on modality, specialty, and service:

Based on the Modality Insights, the market is segmented into Single-specialty Labs, Multi-specialty Labs, and Hybrid Labs.

- The hybrid labs segment is expected to register the fastest CAGR of more than 8.50% during the forecast period owing to technological advancements, an increase in reimbursement rates, and a rise in the number of minimally invasive procedures.

- Hybrid labs increase the volume of procedures & reimbursement for providers and significantly enhance the efficiency and utilization of OBL/ASC.

- Single specialty centers are growing at a significant rate due to their investment-friendly model and importance in specified specialties, such as ophthalmology, urology, plastics, and gastroenterology.

Based on the Services Insights, the market is segmented into Peripheral Vascular Intervention, Endovascular Interventions, Cardiac, Interventional Radiology, Venous, and Others.

- The OBLs market has been categorized into peripheral vascular intervention, endovascular intervention, cardiac, interventional radiology, venous, and others.

- The interventional radiology segment is estimated to register the fastest CAGR of more than 8.00% from 2022 to 2030.

- It utilizes image-guided procedures, such as MRI, CT, and ultrasound, to guide minimally invasive procedures to diagnose and treat diseases in every organ system

- According to Cardiovascular Disease Management Annual Symposium, around 12% of interventional radiologists performed office-based interventions in the U.S.

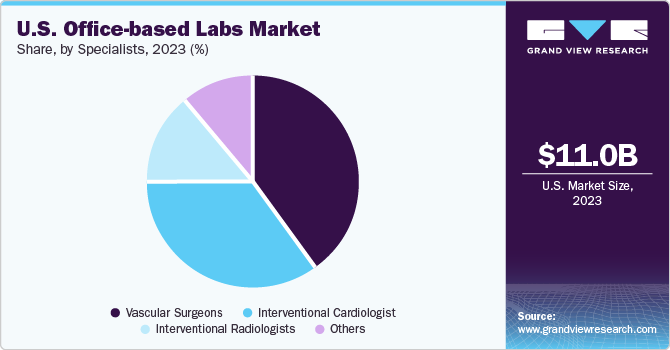

Based on the Specialist Insights, the market is segmented into Vascular Surgeons, Interventional Cardiologist, Interventional Radiologists and Others.

- The interventional radiologist segment is expected to grow at the fastest growth rate of 8.6% during the forecast period on account of the increasing use of minimally invasive image-guided techniques for the diagnosis and treatment of diseases.

- The vascular surgeon's segment led the market in 2021 and accounted for the largest revenue share owing to the advancements in medical technology, an increase in the demand for specialists, and a shift in preference from hospital settings to OBLs for better & more efficient care.

Key Companies Profile & Market Share Insights

The vendor landscape of this market can be divided into three different sectors: medical imaging device manufacturers, vascular intervention device manufacturers, and service providers who offer end-to-end services to physicians for setting up labs.

Some prominent players in the U.S. Office-based Labs market include:

Manufacturers

- Koninklijke Philips N.V

- GE Healthcare

- Siemens Healthineers AG

- Medtronic PLC

- Boston Scientific Corp.

- Abbott

- Cardiovascular Systems, Inc.

Service Providers

- Envision Healthcare

- Surgery Care Associates, Inc. (SCA)

- Surgery Partners

- National Cardiovascular Partners

- Cardiovascular Coalition

- TH Medical

Order a free sample PDF of the U.S. Office-based Labs Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment