Enterprise Governance, Risk & Compliance Industry Overview

The global enterprise governance, risk & compliance market size is projected to reach USD 134.8 billion by 2030, registering a CAGR of 14.0% from 2022 to 2030, according to a new study by Grand View Research Inc. GRC and EGRC benefit an organization by implicating policies and procedures to mitigate risk and adopt a healthy workflow. Enterprise Governance, risk compliances regulate an organization by monitoring risk management, controlling risk, and identifying risk hazards that might occur in the critical business environment. EGRC ensures that the company adheres to the strict norms and maintains the standards for complete growth and prosperity.

Enterprise Governance, Risk & Compliance Market Segmentation

Grand View Research has segmented the global enterprise governance, risk & compliance market report based on component, software, services, organization size, vertical, and region:

Based on the Component Insights, the market is segmented into Software and Services.

- The evolution of risk management software has become a helping hand for businesses to ensure day-to-day compliances and maintain the standards from the bottom to the top of the hierarchical pyramid. The enterprises can tackle the risk related to organizational development and maintain the residual risk with the help of real-time data validation.

- The evolution of technology has upgraded the audit management software combined with Artificial Intelligence. Machine Learning has become a support system for all types of audits, i.e., internal, external, financial, operational, etc.

Based on Software Insights, the market is segmented into Audit Management, Compliance Management, Risk Management, Policy Management, Incident Management and Others.

- Risk management emerged as the largest software category and accounted for over 20.0% of the overall revenue in 2018.

- Audit management emerged as the second-largest software segment, amounting to USD 3.91 billion in 2018.

- Audit management solutions facilitate organizations’ compliance and auditing responsibilities by providing a centralized platform for accessing information about earlier assessments and managing due or ongoing ones.

Based on Service Insights, the market is segmented into Integration, Consulting and Support.

- Consulting services emerged as the largest segment and accounted for over 30.0% of the total market revenue in 2021.

- Big data is also paving the world of enterprise governance risk compliances; it allows organizations to get clear access to more sensitive information by considering safety policies and procedures

- In today’s generation, integration services have gained particular importance in the EGRC sphere; GRC solutions are becoming critical in the future.

- These integration services provide automation of internal operations, so the GRC service providers transfer the view of integration features encapsulated in the design, so basically, integration is a part of GRC.

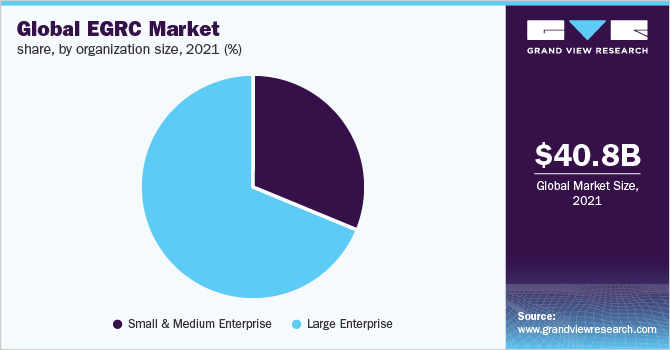

Based on the Organization Insights, the market is segmented into Small and Medium Enterprise (SME) and Large Enterprise.

- Large-scale companies' demand exceeded a demand of USD 20.00 billion in 2021 due to increasing healthy demand for robotics and AI technology. B firms are dealing with challenging competitors who are disruptive to society and disturbing the market volatility.

- SMEs are anticipated to capture over USD 40,000 million of the overall market by 2030. The demand for AI, Internet of Things, and Machine Learning (MI) in small-scale industries to regulate and build a compliance-based roadmap ahead is expected to drive demand.

Based on Vertical Insights, the market is segmented into Construction & Engineering, BFSI, Energy & Utilities, Government, Healthcare, Manufacturing, Retail & Consumer Goods, Telecom & IT, Transportation & Logistics and Others.

- BFSI emerged as the largest segment in 2021 and was valued at over USD 8.0 billion in 2021.

- BFSI sector has witnessed significant growth in Big Data, AI, Machine Learning, and IoT, adopting fintech as a development model.

- To safeguard the stakeholder’s interests, the need to adopt robust EGRC solutions has become a priority.

- IT & Telecom emerged as the fastest-growing segment with demand for GRC expected to exceed a CAGR of 15% over the forecast period.

- The telecom industry has always been on top regarding innovation and adopting emerging technology.

- Cyber-attacks on the telecommunication industry are persistent as the data carry detailed customer information.

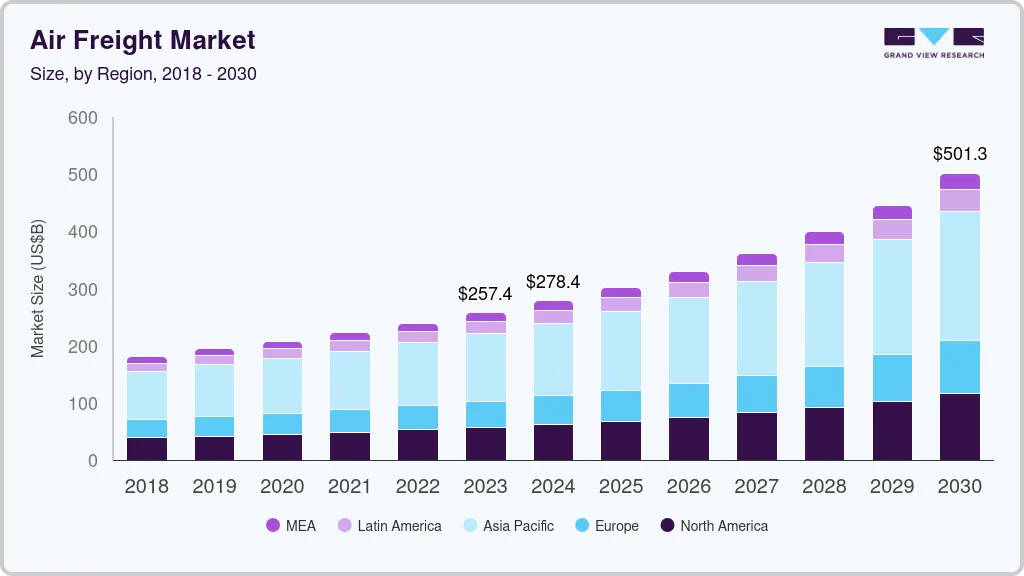

Enterprise Governance, Risk & Compliance Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

The global market is highly competitive and fairly concentrated, with the top five companies accounting for the maximum share in 2021. Leading players have been using strategies such as collaboration, acquisition, and new product development and launch to strengthen their position in the market. Application development and customized software are expected to be key parameters to staying competitive in this market, with frequent mergers and acquisitions being undertaken as an attempt to diversify product portfolio and gain market share.

Some prominent players in the global Enterprise Governance, Risk & Compliance market include:

- Wolters Kluwer

- Thomson Reuters

- SAP SE

- MetricStream Inc.

- Bwise

Order a free sample PDF of the in Enterprise Governance, Risk & Compliance Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment