Wealth Management Software Industry Overview

The global wealth management software market size is expected to reach USD 12.07 billion by 2030, growing at a CAGR of 13.9% over the forecast period, according to a new report by Grand View Research, Inc. The growth of the market can be attributed to the increasing demand for wealth management software from financial advisors to effectively understand the needs of their clients and streamline the financial management of their clients accordingly. The widening scope of wealth management software to cover everything from accounting and investment management to estate planning and retirement planning bodes well for the growth of the market. Advances in technology and the growing adoption of the latest technologies for wealth management are expected to intensify the competition between traditional and non-traditional firms.

Wealth Management Software Market Segmentation

Grand View Research has segmented the global wealth management software market on the basis of advisory mode, deployment, enterprise size, application, end-use, and region:

Based on the Advisory Mode Insights, the market is segmented into Human Advisory, Robo Advisory, and Hybrid.

- The human advisory mode segment dominated the market in 2021 and accounted for the largest share of 58.0% of the global revenue.

- The robo advisory segment is anticipated to register the fastest CAGR over the forecast period. Robo advisors tend to be highly accurate, efficient, and more accessible as compared to other modes.

- Various factors, such as the intensifying competition, evolving client requirements, and rapidly changing market dynamics, are also expected to create new growth opportunities for the robo advisory segment.

Based on the Deployment Insights, the market is segmented into Cloud and On-premise.

- The cloud segment dominated the market in 2021 and accounted for the maximum share of more than 56.0% of the global revenue.

- The on-premise segment is anticipated to witness significant growth over the forecast period. Several organizations still prefer on-premise deployment of solutions to ensure a higher level of control over all the systems and data.

Based on the Enterprise Size Insights, the market is segmented into Large Enterprises, Small & Medium Enterprises.

- The large enterprise's segment dominated the market in 2021 and accounted for the highest revenue share of more than 58.3%.

- The Small & Medium Enterprises(SMEs) segment is anticipated to register the fastest growth rate over the forecast period.

- The growing number of small & medium enterprises in emerging economies is also driving the demand for wealth management solutions.

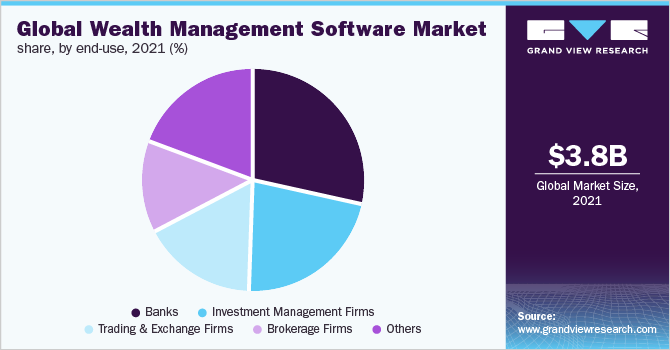

Based on the End-Use Insights, the market is segmented into Banks, Investment Management Firms, Trading & Exchange Firms, Brokerage Firms and Others.

- The bank's segment dominated the market in 2021 and accounted for a revenue share of more than 28.5%. As the global economy continues to strengthen gradually, banks are anticipated to play a key role in managing the growing assets and wealth of individuals.

- The trading & exchange firms segment is anticipated to register the fastest CAGR over the forecast period.

- The growing digitalization across trading firms is efficiently allowing clients to access their trading accounts and effectively understand the progress of their financial portfolio, thereby creating new growth opportunities for the segment.

Based on the Application Insights, the market is segmented into Financial Advice & Management, Portfolio, Accounting, & Trading Management, Performance Management, Risk & Compliance Management, Reporting and Others.

- The portfolio, accounting, & trading management segment dominated the market in 2021 and accounted for a revenue share of more than 23.0%.

- Portfolio, accounting, & trading managers are under severe pressure to handle the data of their existing customers effectively and are hence adopting wealth management solutions aggressively.

- Wealth managers are also using portfolio, accounting, & trading management platforms to handle their clients' financial data and effectively support them with the most profitable decision-making.

Wealth Management Software Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

The market is moderately fragmented. Prominent players are pursuing numerous strategies, such as strategic joint ventures & partnerships, product innovation, geographical expansion, mergers & acquisitions, and research & development initiatives, to cement their foothold in the market. Market players are also focusing on offering cloud-based solutions to both large-sized and Small- & Medium-sizedEnterprises (SMEs). Moreover, these solutions are being particularly designed to help financial firms in managing the assets and wealth of the clients efficiently. Vendors are focusing on offering hybrid services, including personalized and standardized advice, to their clients.

Some prominent players in the Global Wealth Management Software market include:

- Comarch SA

- Dorsum Ltd.

- Fidelity National Information Services, Inc.

- Finantix

- Fiserv, Inc.

- Objectway S.p.A.

- Profile Software

- SEI Investments Company

- SS&C Technologies Holdings, Inc.

- Temenos Headquarters SA

Order a free sample PDF of the Wealth Management Software Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment