Gallium Nitride Semiconductor Devices Industry Overview

The global gallium nitride semiconductor devices market size is expected to reach USD 12.47 billion by 2030, according to a new study conducted by Grand View Research, Inc. It is expected to expand at a CAGR of 24.4% from 2022 to 2030. The growing demand for fast chargers used in various consumer electronics applications worldwide is expected to drive the market. Various smartphone companies such as Apple and Samsung are making efforts to develop fast chargers to enhance their customer experience and gain a competitive edge.

Gallium Nitride Semiconductor Devices Market Segmentation

Grand View Research has segmented the global Gallium Nitride (GaN) semiconductor devices market based on product, component, wafer size, end-use, and region:

Based on the Product Insights, the market is segmented into GaN Radio Frequency Devices, Opto-semiconductors and Power Semiconductors.

- The opto-semiconductors segment dominated the market in 2021 and accounted for more than 35.0% share of the global revenue. This can be largely attributed to the application of opto-semiconductors in devices such as LEDs, solar cells, photodiodes, lasers, and optoelectronics.

- The Opto-semiconductors are being widely used in applications such as Light Detection and Ranging (LiDAR) and pulsed laser, which bodes well for the growth of the segment.

- The GaN radio frequency devices segment is anticipated to expand at the highest CAGR over the forecast period.

Based on the Component Insights, the market is segmented into Transistor, Diode, Rectifier, Power IC and Others.

- The transistor segment dominated the market in 2021 and accounted for more than 35.0% share of the global revenue.

- The power IC segment is anticipated to witness steady growth over the forecast period. The segment growth can be attributed to the increasing usage of GaN-based power ICs that offer features such as efficient navigation, collision avoidance, and real-time air traffic control.

Based on the Wafer Size Insights, the market is segmented into 2-inch, 4-inch, 6-inch and 8-inch.

- The 4-inch segment dominated the market in 2021 and accounted for more than 35.0% share of the global revenue. This is because 4-inch wafers facilitate the large-scale production of semiconductor devices.

- The implementation of 4-inch wafers is increasing rapidly as these wafers help overcome the limitations of 2-inch wafers and are widely used in semiconductor product-based industries.

- The 6-inch segment is anticipated to expand at the highest CAGR over the forecast period. Benefits such as uniform voltage supply and precise current control offered by 6-inch wafers are driving the segment.

![]()

Based on the End-use Insights, the market is segmented into Automotive, Consumer Electronics, Defense & Aerospace, Healthcare, Industrial & Power, Information & Communication Technology and Others.

- The Information & Communication Technology (ICT) segment dominated the market in 2021 and accounted for more than 20.0% share of the global revenue. The segment growth can be attributed to the increasing adoption of Internet-of-Things (IoT) technology globally.

- GaN-based semiconductors are used in data centers, servers, base stations, transmission lines, satellite communication, and base transceiver stations, among others.

- The growth of the defense and aerospace segment can be attributed to the increasing applications of GaN technology in the defense and aerospace sector to increase the bandwidth and performance reliability in communications, electronic warfare, and radars.

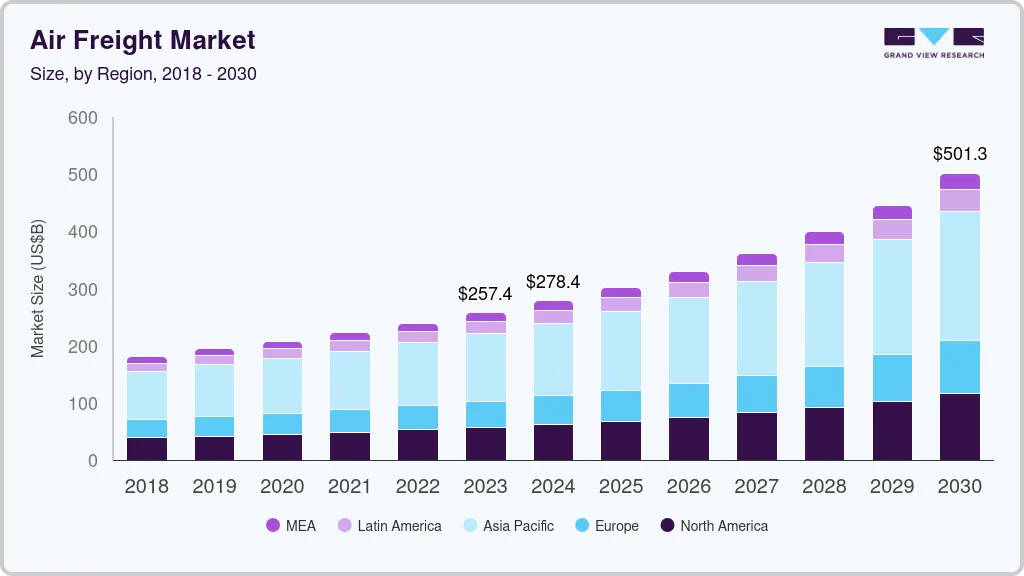

Gallium Nitride Semiconductor Devices Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

The industry is characterized by the presence of dominant players holding a significant market share. The key players are opting for strategic partnerships, collaborations, and mergers & acquisitions to acquire a greater market share and the necessary capabilities for manufacturing GaN-based semiconductors.

Some prominent players in the Global Gallium Nitride Semiconductor Devices market include:

- Cree, Inc.

- Efficient Power Conversion Corporation

- Fujitsu Ltd.

- GaN Systems

- Infineon Technologies AG

- NexgenPowerSystems

- NXP Semiconductor

- Qorvo, Inc.

- Texas Instruments Incorporated

- Toshiba Corporation

Order a free sample PDF of the Gallium Nitride Semiconductor Devices Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment