Fertilizer Catalyst Industry Overview

The global fertilizer catalyst market size was valued at USD 2.8 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 2.4% from 2021 to 2027. Catalysts are organometallic compounds that find widespread application in fertilizer and refinery applications. The market is majorly driven by product innovation aimed at reducing greenhouse emissions and improving process efficiency. The implementation of new pollution norms is expected to provide a positive impetus to market growth. Haldor Topsoe and Clariant have developed products that aim at reducing greenhouse emissions, along with improving material recovery. Major governments globally are implementing regulations on the production of ammonia, ammonium nitrate, and calcium ammonium nitrate, complex fertilizers, and nitric acid plants. The implementation of these norms is expected to force manufacturers to procure catalysts that help counter these problems and make the process sustainable.

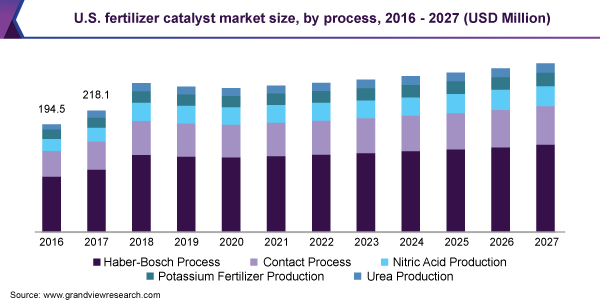

The U.S. dominated the North American market in 2020. It is the largest producer and exporter of phosphorus and ammonia in the world. The U.S. is the fourth-largest manufacturer of nitrogen fertilizers and the second-largest producer of phosphate globally. The U.S. market is largely driven by the sustainability initiatives undertaken by the local governments. In the last three years, manufacturers in the U.S. have invested around USD 3.8 billion in capital expansions aimed at achieving sustainability initiatives formulated for the fertilizer industry.

Gather more insights about the market drivers, restraints and growth of the Global Fertilizer Catalyst Market

Fertilizer production across the globe is growing at a steady pace backed by rising yields and the growing demand for food. It is estimated that around 60% of the global food supply is facilitated by synthetic fertilizer production. However, rising sustainability initiatives undertaken by the local manufacturers have called for the implementation of efficient manufacturing practices globally. Catalysts play an important role in improving process efficiency by reducing the formation of by-products, along with improving the selectivity of the processes.

The raw materials used in the production of fertilizer catalysts are base metals such as iron, nickel, zinc, vanadium, chromium, and copper, along with precious metals such as platinum, rhodium, palladium, and ruthenium. The prices of most base metals have fallen, but the drop in prices is substantially lower than that of oil prices. The largest declines have been observed in the prices of copper and zinc, which have fallen by around 15% since January 2019.

The slowdown in global activities, particularly in China, which accounts for more than half of the global consumption of metals, has impacted the market scenario of base metals. Production disruptions resulting from shutdowns of mines and refineries due to the outbreak of COVID-19 are also impacting supply. As per the current estimates, 15% of copper mines and 20% of zinc mines are currently either offline or operating at reduced capacities. However, major iron ore operations in Australia and Brazil have been impacted to a lower extent because of their highly automated and remote operations.

Browse through Grand View Research's Bulk Chemicals Industry Related Reports

Ammonia Market - The global ammonia market size was worth USD 45.50 billion in 2019 and is expected to expand at a compound annual growth rate (CAGR) of 7.8% from 2020 to 2025.

Ammonium Nitrate Market - The global ammonium nitrate market size was estimated at USD 4.67 billion in 2016. The increasing demand for the product in fertilizers as a nitrogen source is expected to propel the market growth.

Fertilizer Catalyst Industry Segmentation

Grand View Research has segmented the global fertilizer catalyst market on the basis of product, process, and region:

Fertilizer Catalyst Product Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

- Iron-based

- Vanadium based

- Platinum-based

- Rhodium based

- Nickel-based

- Palladium based

- Ruthenium based

- Zinc based

- Cobalt-based

- Molybdenum based

- Chromium-based

- Copper Chromite

Fertilizer Catalyst Process Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

- Haber-Bosch Process

- Contact Process

- Nitric Acid Production

- Potassium Fertilizer Production

- Urea Production

Fertilizer Catalyst Regional Outlook (Revenue, USD Million, 2016 - 2027)

- North America

- Europe

- Asia Pacific

- Central & South America

- MEA (Middle East & Africa)

Key Companies profiled:

Some prominent players in the global Fertilizer Catalyst Industry include

- Süd-Chemie India Pvt. Ltd.

- Thyssenkrupp AG

- BASF SE

- LKAB Minerals AB

- Albemarle Corporation

- Unicat Catalyst Technologies, Inc.

- Clariant AG

- Johnson Matthey

- Haldor Topsoe

- Quality Magnetite

Order a free sample PDF of the Fertilizer Catalyst Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment