Online Video Platform Industry Overview

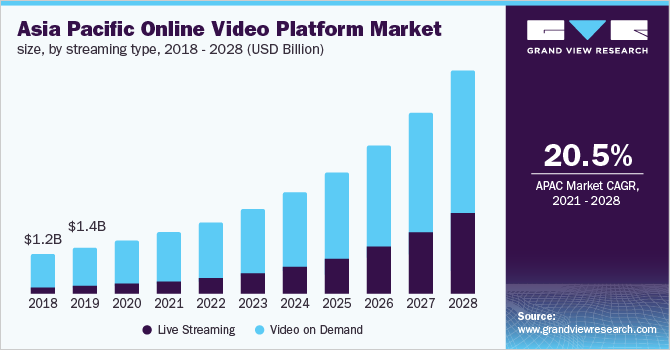

The global online video platform market size was valued at USD 6.13 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 18.4% from 2021 to 2028. An online video platform is fee-based software that provides a function to the content owners and publishers to trans code, manage, store, publish, track, and monetize online video content on their channel.

In addition, the platform also facilitates users to stream live videos and simultaneously record the live broadcasting, and host videos as per the demand. At present, the online video platform is getting significant traction from handheld devices such as smartphones and tablets, as the gadgets are compatible to play live or pre-uploaded video content at any place and at any time.

Gather more insights about the market drivers, restraints and growth of the Global Online Video Platform market

The market has recorded significant growth over the past few years due to the rising popularity of online videos, with viewership steadily surpassing traditional video content platforms such as cable and satellite television. The trend is positively impacting the online video platforms market, majorly in developed regions, including North America and Europe. For instance, in 2018, AT&T-owned DirecTV, a U.S.-based satellite pay television provider, lost 1.2 million PayTV customers worldwide. This was largely attributed to the competition created by Over the Top (OTT) and Video on Demand (VOD) players. On the contrary, DirecTV Now, AT&T's online version of DirecTV, gained 436,000 new subscribers globally the same year, thanks to shifting preference toward online video content.

Moreover, the increased penetration of advanced wireless telecom networks and easy internet access, across developing regions, is shifting mass users toward online video platforms. For instance, the high penetration of 4G networks across the globe is making seamless access to high-quality online video content possible for many users. The global introduction and adoption of the 5G network in the next few years are expected to significantly increase video content consumption on online platforms in near future. The super-fast internet browsing speed promised by the network (nearly 13 times the average network connection at present) is expected to play a key role in the increased demand for video content on online platforms globally.

The growing practice of designing video-based marketing content to increase brand awareness among users is attracting more enterprises toward online video platforms. For instance, in 2016, Toyota launched the Feeling the Street campaign that invited street musicians from across the world to capture their acts and post videos on the social media platform. The whole experience was shared with fans on the social medial platform. The campaign was a major success and increased the company’s user engagement by about 440% compared to the previous year.

An increasing number of brands are using live video shopping events to attract more customers via digital platforms. A recent instance of this would be the live event hosted by Samsung Sweden in Sept 2020 to help its customers learn more about its latest foldable series of smartphones, the Galaxy Z Fold2. In 2019, a similar launch event had yielded the company around USD 60 billion in revenue across the globe. The entire online video campaign was managed by Bambuser, a live-streaming video company headquartered in Stockholm. Other prominent players providing similar solutions include Alphabet Inc.; Endavo Media.; Frame.io, Inc.; JW player; Facebook; and MediaMelon Inc.

According to media reports, it is estimated that nearly 1/4thof the world’s population has been locked in their homes due to the COVID-19 pandemic and the corresponding social distancing norms issued by local governments. This has significantly limited the entertainment options for individuals. This has resulted in a significant spike in the worldwide viewership of online video platforms, such as Netflix, Amazon Prime Video, YouTube, and Disney+, and the consumption rate of online video content. For instance, in March 2020, Netflix registered an increase of more than 50% in the number of first-time installations of its mobile application in Italy and more than 30% in Spain.

In the education sector, the e-learning business has recorded notable business growth in recent times, thanks to stringent lockdown policies of governments globally compelling schools and colleges to conduct classes online. The ongoing lockdown has also attracted several working professionals to enroll in online learning programs to enhance their skills and stay relevant in their respective industries. For instance, in March 2020, LinkedIn recorded a 130% surge in total memberships over its online learning platform and a 26% increase in its total ad revenue.

Browse through Grand View Research's Technology Industry Related Reports

Video Streaming Market - The global video streaming market size was valued at USD 59.14 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 21.3% from 2022 to 2030.

Video Analytics Market - The global video analytics market size was valued at USD 1.6 billion in 2016. This growth can be primarily attributed to increasing concerns regarding the safety and security of the public.

Online Video Platform Industry Segmentation

For this report, Grand View Research has segmented the global online video platform market based on component, type, streaming type, end-user, and region:

Online Video Platform Component Outlook (Revenue, USD Million, 2018 - 2028)

- Solution

- Services

Online Video Platform Type Outlook (Revenue, USD Million, 2018 - 2028)

- Video Processing

- Video Management

- Video Distribution

- Video Analytics

- Others

Online Video Platform Streaming Type Outlook (Revenue, USD Million, 2018 - 2028)

- Live Streaming

- Video on Demand

Online Video Platform End-user Outlook (Revenue, USD Million, 2018 - 2028)

- Media & Entertainment

- BFSI

- Retail

- Education

- IT and Telecom

- Others

Online Video Platform Regional Outlook (Revenue, USD Million, 2018 - 2028)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Market Share Insights:

April 2020: Akamai, a U.S.-based content delivery network company, announced a partnership with Verimatrix, a cyber-security company based in the U.S. The partnership is aimed to provide secure watermarking capabilities.

March 2020: Netflix registered an increase of more than 50% in the number of first-time installations of its mobile application in Italy and more than 30% in Spain.

Key Companies profiled:

Some prominent players in the global Online Video Platform Industry include

- Akamai Technologies

- Brightcove Inc.

- Comcast Cable Communications Management, LLC

- Endavo Media.

- io, Inc.

- Kaltura, Inc.

- Limelight Networks

- Longtail Ad Solutions, Inc.(JW Player)

- Ooyala (Telstra)

- MediaMelon Inc.

- Panopto

- SpotX, Inc.

- Wistia Inc.

Order a free sample PDF of the Online Video Platform Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment