North America Processed Meat Industry Overview

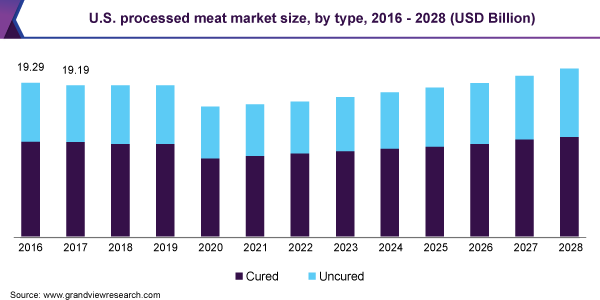

The North America processed meat market size was valued at USD 26.40 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 3.5% from 2021 to 2028. The market is expected to witness decent growth in the years to come because of a surge in the demand for convenient and easy-to-eat food, leading to the growth of the meat manufacturing sector. The rising disposable income of consumers, coupled with an increase in the number of working professionals, will propel the market growth over the forecast period. The COVID-19 pandemic has caused disruptions in the market. The limited availability of some products in retail stores resulted in a price rise. COVID-19 outbreaks have taken place in numerous meat production facilities operating in the U.S. and Canada. These outbreaks affected a large number of plants, which led to the disruption of the supply chain, closure of some factories, and posed a substantial threat to the product supply in the region.

The U.S. market is projected to witness steady growth over the forecast period on account of the changing lifestyles of consumers and rising urbanization, which affect the consumption pattern of the consumers. According to the United States Department of Agriculture (USDA), the U.S. was the top consumer of meat in 2019 and has been at the top spot since 2017.

Gather more insights about the market drivers, restraints and growth of the North America Processed Meat market

With the rising awareness regarding the proper intake of protein among consumers in the country, protein-rich processed products have been witnessing high demand. According to the estimates provided by the National Chicken Council, U.S., the total consumption of meat, which includes beef, pork, chicken, and turkey, was around 199 pounds per person per year back in 2012, which rose to 223 pounds per person per year in 2019.

Innovative product launches, such as Benny's Original Meat Straws, are expected to propel the market growth. In order to attract targeted customers, manufacturers are also coming up with gender-specific products, such as Tillamook Country Smoker’s All Natural Cranberry Turkey Jerky, which specifically targets female consumers, and barbecue-flavored meatballs launched by Kerry Foods, which are aimed at the adult male demographic.

The demand for protein is witnessing an increase on account of the growing consumer awareness regarding the consumption of high nutritional food. The fast-paced lives of these individuals in developed parts of the country have led to the preferential shift of the working class from conventional to processed products. In addition to this, with an increasing gym-going population in the U.S., Canada, and Mexico, the demand for animal-based protein has risen significantly over the past few years.

Browse through Grand View Research's Consumer Goods Industry Related Reports

Cultured Meat Market - The global cultured meat market size was valued at USD 163.6 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 11.4% from 2022 to 2028.

Frozen Meat Market - The global frozen meat market size was valued at USD 73.3 billion in 2018 and is anticipated to expand at a CAGR of 4.4% from 2019 to 2025.

North America Processed Meat Industry Segmentation

Grand View Research has segmented the North America processed meat market on the basis of meat type, type, product, and region:

North America Processed Meat Type Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2028)

- Poultry

- Beef

- Pork

- Mutton

- Others

North America Processed Meat Type Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2028)

- Cured

- Uncured

North America Processed Meat Product Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2028)

- Chilled

- Frozen

- Canned

- Dry & Fermented

North America Processed Meat Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2028)

- U.S.

- Canada

- Mexico

Market Share Insights:

August 2020: Conagra Brands, Inc. invested USD 100 million to expand its meat snacks processing facility in Troy, Ohio, U.S. This plant produces Duke's and Slim Jim branded products.

Key Companies profiled:

Some prominent players in the North America Processed Meat Industry include

- Tyson Foods, Inc.

- Conagra Brands, Inc.

- Sysco Corporation

- Smithfield Foods, Inc.

- Perdue Farms

- Cargill, Incorporated

- JBS USA

- Hormel Foods Corporation

- National Beef Packing Company, LLC

- OSI Group

Order a free sample PDF of the North America Processed Meat Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment