U.S. Home And Garden Fungicides Industry Overview

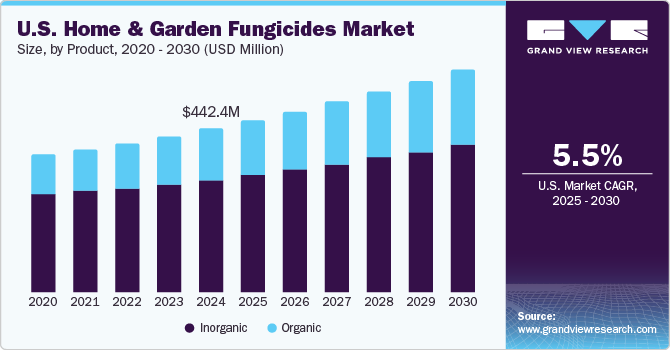

The U.S. home and garden fungicides market size was valued at USD 372.0 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 5.0% from 2021 to 2028. The demand for landscaping projects, such as water fountains, plants, and gazebos, is projected to drive the demand for home and garden fungicides. Furthermore, growing activities for transforming commercial and residential outdoor spaces into areas, such as lawns, outdoor kitchens, and party spots, for entertainment and leisure are boosting the growth of the market. Consumers are adopting larger and more varied vegetation in their lawns and gardens, necessitating the use of home and garden fungicides in order to maintain healthy growth.

Landscaping makes the finest use of available space in a highly attractive way. It involves forming the land as desired to make the best use of a location's natural features. Landscaping involves selecting and growing plants that best fit the design. As a result, increased landscaping activities and investments in residential homes are some of the major factors driving the market.

Gather more insights about the market drivers, restraints and growth of the U.S. Home And Garden Fungicides market

With the rise in housing and commercial construction activities, the market for home and garden fungicides is likely to witness growth in the interior decoration industry as gardening and landscaping are among the leading segments. The rising demand for hardscaping is also projected to bode well for the overall market growth. Hardscaping is witnessing increased acceptance due to the growing demand for paving blocks and stamped concrete plank pavers made up of natural stones and porcelain. These products help prevent water runoff and flooding issues.

The high popularity of playing golf in the U.S. is also benefitting the market for home and garden fungicides through the increased number of golf courses in the country. According to a blog post by Golf Span, the U.S. accounts for 43% of the global golf courses. Some of the most popular states for a variety of golf courses are Florida, Texas, California, Ohio, and New York. With the rising number of golf courses in the country arises the need for effective fungicides, thereby expanding the scope of the market.

Amid the covid-19 pandemic, with the U.S. observing quarantine orders and consumers in the country avoiding human contact, market players are grappling to become accustomed to the change in the system. With people spending more time at home, a number of them are drawn toward gardening as a hobby. An increased number of people turning toward gardening and yard work during the pandemic has positively influenced the market growth.

Browse through Grand View Research's Consumer Goods Industry Related Reports

Fungicides Market - The global fungicides market size was valued at USD 16.35 billion in 2019 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.3% from 2020 to 2027.

Home And Garden Pesticides Market - The global home and garden pesticides market size was valued at USD 7.7 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.9% from 2022 to 2030.

U.S. Home And Garden Fungicides Industry Segmentation

Grand View Research has segmented the U.S. home and garden fungicides market on the basis of product, form, and application:

U.S. Home & Garden Fungicides Product Outlook (Revenue, USD Million, 2016 - 2028)

- Organic

- Inorganic

U.S. Home & Garden Fungicides Form Outlook (Revenue, USD Million, 2016 - 2028)

- Dry

- Liquid

U.S. Home & Garden Fungicides Application Outlook (Revenue, USD Million, 2016 - 2028)

- Home Garden

- Turf & Ornamentals

Market Share Insights:

May 2019: Syngenta AG launched the Appear II fungicide to control Pythium and anthracnose diseases and improve stress tolerance and turf quality in all seasons.

January 2018: Nufarm launched an all-terrain golf course fungicide in sponsorship with Land Rover during the Golf Industry Show (GIS) to attract new customers.

Key Companies profiled:

Some prominent players in the U.S. Home And Garden Fungicides Industry include

- Bayer AG

- Syngenta AG

- BASF SE

- Nufarm

- Corteva Agriscience

- Spectrum Brands Holdings, Inc.

- Certis USA L.L.C.

- Central Garden & Pet Company

- The ScottsMiracle-Gro Company

Order a free sample PDF of the U.S. Home And Garden Fungicides Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment