U.S. School Furniture Industry Overview

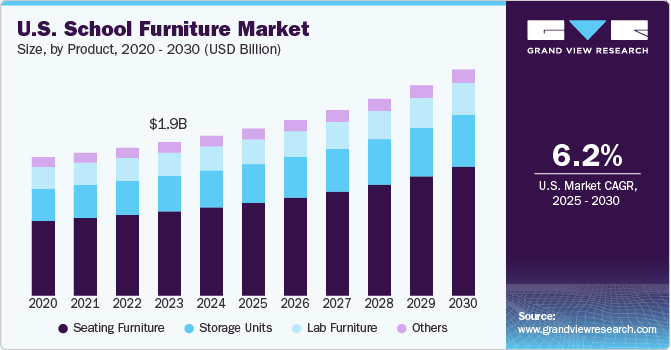

The U.S. school furniture market size was valued at USD 1.96 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 6.6% from 2021 to 2028. Increasing focus on improving the availability of education across cities, suburbs, towns, and rural areas has been promoting the growth of the market. According to the National Center for Education Statistics, the number of schools in cities of the U.S. increased from 2.3 million in fall 2009 to 2.5 million in fall 2017. Moreover, the number of schools in suburbs increased from 2.1 million in fall 2009 to 2.3 million in fall 2017.

The nationwide closure of educational institutions including schools and colleges has been adversely affecting the school furniture market in the U.S. Education officials have been forced to cancel classes and close the doors to campuses across the country in response to the coronavirus outbreak. In addition, schools and colleges have switched classes to online learning, which has omitted the need for students and teachers to visit physical classrooms, thereby curbing the need for school furniture. Additionally, the shutting down of physical classes has led to a significant dip in enrollment, which has further reduced the demand for school furniture.

The U.S. government, too, has been contributing immensely to the growth of the industry. Programs pertaining to education have been regularly promoting the number of schools in a given locality as well as the enrollment of students in these schools. The Obama administration that set out in 2009 invested USD 1 billion to provide preschool education to every child, and more than half of the U.S. states dramatically boosted their own investments in early learning.

Gather more insights about the market drivers, restraints and growth of the U.S. School Furniture market

Now in 2021, President Joe Biden plans to reinstate the educational initiatives undertaken by the Obama Administration. These programs focus on providing high-quality, universal pre-kindergarten education to all three- and four-year-olds in the country. They also aim to build the best, most innovative schools in the country in low-income communities and communities of color. Consequently, such programs are expected to propel the revenue of the market.

The growing awareness regarding the value of education, along with an increasing number of government programs making education available for all, is expected to inflate the number of schools in the U.S. According to the National Center of Education Statistics, the number of schools and degree colleges is expected to rise. The source predicts that the number of schools in the country and enrollments is going to grow rapidly.

Browse through Grand View Research's Consumer Goods Industry Related Reports

School Furniture Market - The global school furniture market size was valued at USD 4.2 billion in 2018 and is expected to grow at a compound annual growth rate (CAGR) of 6.0% from 2019 to 2025.

Smart Furniture Market - The global smart furniture market size was valued at USD 143.6 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 12.4% from 2021 to 2028.

U.S. School Furniture Industry Segmentation

Grand View Research has segmented the U.S. school furniture market on the basis of product and application:

U.S. School Furniture Product Outlook (Revenue, USD Million, 2016 - 2028)

- Seating Furniture

- Storage Units

- Lab Furniture

- Others

U.S. School Furniture Application Outlook (Revenue, USD Million, 2016 - 2028)

- Classroom

- Library & Labs

- Others

Market Share Insights:

January 2019: VS America, Inc. announced the launch of the JUMPER suite of chairs for the American and Canadian markets. These products are available in two models-JUMPER Air and JUMPER Ply.

Key Companies profiled:

Some prominent players in the U.S. School Furniture Industry include

- Smith System Mfg. Co.

- Knoll, Inc.

- The HON Company

- Virco

- Fleetwood Group

- VS America, Inc.

- Hertz Furniture

- Paragon Furniture Inc.

- Haskell Education

- Marco Group

Order a free sample PDF of the U.S. School Furniture Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment