Digital Pathology Industry Overview

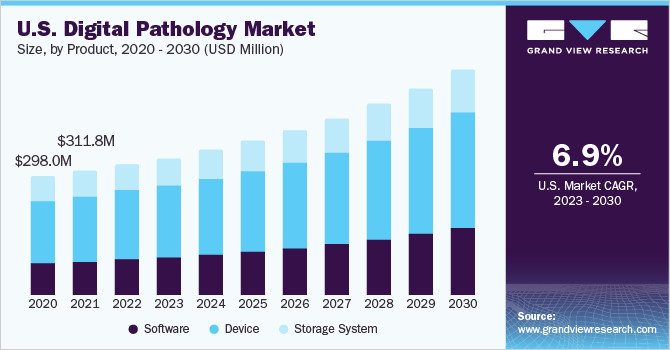

The global digital pathology market size was valued at USD 926.9 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 7.5% from 2022 to 2030.

Increased focus on improving workflow efficiency and demand for faster diagnostic tools for chronic diseases, such as cancer, have been key factors driving the market. The rising prevalence of chronic conditions is anticipated to surge clinical urgency to adopt digital pathology to improve the existing patient diagnostic imaging measures and to reduce the high cost associated with conventional diagnostics. In addition, the increasing geriatric population that is susceptible to chronic conditions is also expected to boost the demand for technologically advanced diagnostic techniques.

Gather more insights about the market drivers, restraints, and growth of the Global Digital Pathology market

According to a study published in Medscape, chronic diseases can be attributed to the high mortality rate. Owing to the high prevalence of Cardiovascular Diseases (CVDs), it becomes imperative to opt for advanced diagnostic and imaging alternatives. The novel coronavirus is having a significant economic impact on most sectors, including the healthcare industry. Government bodies all over the world are responding to the threat of COVID-19 with essential measures, such as nationwide lockdowns, social distancing, and large-scale quarantine, to reduce the spread of the virus. The pandemic created a major growth opportunity for digital pathology.

On March 26, 2020, CMS waived off the stringent regulation pertinent to remote diagnosis temporarily and allowed remote sign-out of pathology cases using digital pathology equipment. During the pandemic, the U.S. FDA’s Center for Devices and Radiological Health released an enforcement policy for remote digital pathology devices intended for pathologists, industry, clinical laboratories, drug administration staff, and healthcare facilities. The document provides a policy framework to expand the availability of remote digital pathology devices during the pandemic. Supportive regulations are anticipated to impact the market positively in the coming few years.

Rapid technological advancements in digital pathology systems are also expected to contribute to market growth. Advancements, such as digital imaging, computerization, robotic light microscopy, and multiple fiber optic communications, are also contributing to the growth. Whole slide imaging is one such technique that has various advantages over conventional light microscopes, which is expected to provide this market with lucrative opportunities. The adoption of AI in healthcare is growing with a rising focus on improving the quality of patient care by utilizing AI in various aspects of healthcare services, such as pathological diagnosis.

The AI-based tools, such as clinical decision support systems, aid in streamlining workflow processes in hospitals and improving medical care, thereby enhancing the patient experience. In October 2021, Roche proclaimed that it has entered a contract with PathAI, a global frontrunner in AI-powered technology for pathology. Under this development and distribution contract, the corporations will jointly develop an embedded image analysis workflow for pathologists. This partnership is expected to bring together all of the components required to deliver and commercialize a distinguished AI-based digital pathology medical device comprising a scanner, assay, image management system, and algorithm.

The rising need for collaborations between researchers and growing digital documentation across all scientific disciplines are leading to increased adoption. Increasing penetration of healthcare IT solutions is further boosting the demand for digital pathology solutions. A rising number of organizations are adopting these solutions to decrease costs, reduce resource bottlenecks, automate processes, and share content effectively. In addition, advancements, such as microarrays and the incorporation of a wide range of predictive models, such as hybrid models and API algorithms, are expected to fuel the demand for digital image analysis.

Rising preference for computer-aided diagnosis that integrates image processing, physics, mathematics, & computing algorithms, facilitates efficient disease detection, and helps evaluate anatomic structures of interest & quantification of disease progression, as well as risk assessment, will boost the market growth. Companies, such as Olympus, are offering a wide range of tools for remote slide sharing and image processing, which is expected to fuel market growth over the coming years. In April 2020, Leica Biosystems received FDA approval for Aperio AT2 DX Scanner and Aperio WebViewer for remote diagnosis during the pandemic. Phillips also received FDA clearance for its IntelliSite Pathology Solution for remote diagnosis during this emergency.

Browse through Grand View Research's Healthcare IT Industry Research Reports.

Artificial Intelligence In Healthcare Market - The global artificial intelligence in healthcare market size was valued at USD 10.4 billion in 2021 is expected to expand at a compound annual growth rate (CAGR) of 38.4% from 2022 to 2030.

North America Digital Pathology Market - The North America digital pathology market size was valued at USD 365.8 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 6.5% from 2021 to 2028. Digital pathology has been classified under Class II devices by the U.S. FDA for primary diagnosis.

Key Companies profiled:

Some prominent players in the global Digital Pathology market include

- Leica Biosystems (Danaher)

- Hamamatsu Photonics, Inc.

- Koninklijke Philips N.V.

- Olympus Corp.

- Hoffmann-La Roche Ltd.

- Mikroscan Technologies

- Inspirata, Inc.

- 3DHISTECH Ltd.

- Visiopharm A/S

- Huron Technologies International, Inc.

- ContextVision AB

Order a free sample PDF of the Digital Pathology Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment