Drug Discovery Outsourcing Industry Overview

The global drug discovery outsourcing market size is expected to reach USD 6.3 billion by 2030 at a CAGR of 7.4% over the forecast period, according to a new report by Grand View Research, Inc. The COVID-19 pandemic has brought pharmaceutical companies in limelight. Drug discovery is a costly and lengthy process. This has urged pharmaceutical and biotech companies to opt for outsourcing their research activities to academic and private Contract Research Organizations (CROs). Rising partnerships between public or private entities accelerate drug discovery processes, which, in turn, increase the global demand for outsourcing services for drug discovery.

Drug Discovery Outsourcing Market Segmentation

Grand View Research has segmented the global drug discovery outsourcing market on the basis of workflow, therapeutics area, drug type, and region:

Based on the Workflow Insights, the market is segmented into Target Identification & Screening, Target Validation & Functional Informatics, Lead Identification & Candidate Optimization, Preclinical Development and Other Associated Workflow.

- Lead identification & candidate optimization dominated the workflow segment with a revenue share of more than 32.00% in 2021.

- The introduction of advanced in silico techniques to improve the lead identification process, such as Computer-Aided Drug Discovery (CADD) and structure-based drug designs, support segment growth.

- The rising need for skilled resources with combinational knowledge of metabolism, analytical chemistry, and computer software, along with the high cost associated with the integration of the latest computation technology, is enabling higher outsourcing for lead identification services.

Based on the Therapeutics Area Insights, the market is segmented into Respiratory System, Pain and Anesthesia, Oncology, Ophthalmology, Hematology, Cardiovascular, Endocrine, Gastrointestinal, Immunomodulation, Anti-infective, Central Nervous System, Dermatology and Genitourinary System.

- The respiratory systems segment accounted for the largest share of over 13.8% of the global revenue in 2021.

- High incidence of respiratory disorders, such as bronchitis, tuberculosis, Chronic Obstructive Pulmonary Diseases (COPD), and asthma, coupled with increasing cases of drug resistance, has influenced the segment growth.

- The oncology and anti-infective segments are both projected to witness significant CAGRs over the forecast period.

- Increased focus on the identification of novel targets to support cancer treatment contributes to the lucrative growth of the oncology segment.

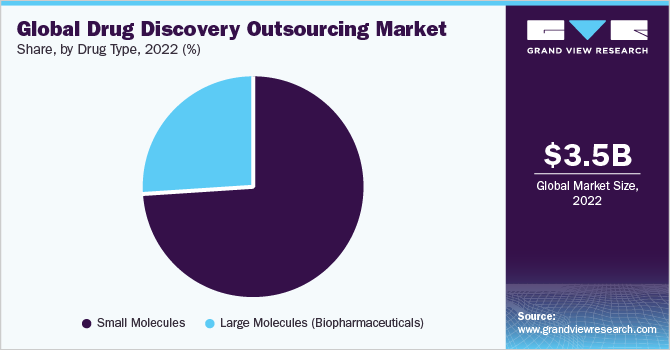

Based on the Drug Type Insights, the market is segmented into Small Molecules and Large Molecules.

- The small molecules/pharmaceuticals segment accounted for the largest share of over 77.3% in 2021 and is projected to expand further at the fastest CAGR during the forecast period.

- Increased significance and highly effective components add up to the potential of small molecules in the pharmaceutical portfolio. Owing to this, the small molecules segment held the largest share in the market.

Drug Discovery Outsourcing Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

Key Companies Profile & Market Share Insights

Some prominent players in the Drug Discovery Outsourcing market include

- Albany Molecular Research Inc.

- EVOTEC

- Laboratory Corporation of America Holdings

- GenScript

- Pharmaceutical Product Development, LLC

- Charles River

- WuXi AppTec

- Merck & Co., Inc.

- Thermo Fisher Scientific Inc.

- Dalton Pharma Services

- Oncodesign

- Jubilant Biosys

- DiscoverX Corp.

- QIAGEN

Order a free sample PDF of the Drug Discovery Outsourcing Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment