U.S. Cold Storage Industry Overview

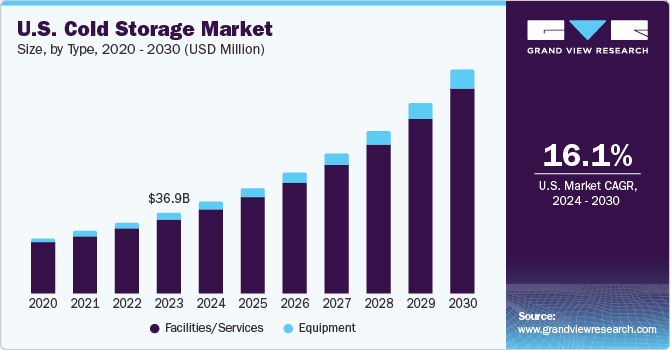

The U.S. cold storage market size was valued at USD 30.26 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 9.2% from 2022 to 2030.

The growth can be attributed to several critical factors, such as technological advancements in packaging, processing, and storage of perishable food products and temperature-sensitive items. The market has also benefitted significantly from the stringent government regulation toward the production and supply of temperature-sensitive products. The industry is poised for unprecedented growth in the next seven years owing to growing organized retail sectors in the emerging economies which will create opportunities for the service providers over the forecast period.

Gather more insights about the market drivers, restraints, and growth of the U.S. Cold Storage market

Growing demand for connected trucks, high-cube refrigerated trailers, and vehicles that facilitate cross-product transportation is likely to drive demand for cold chain services. Ever-increasing health consciousness among consumers has inspired healthier eating habits and resulted in a rising demand for quality food packaging and storage solutions. Outsourcing services have been gaining popularity among businesses owing to factors such as increasing competition, a rapid rise in operational costs, and stringent quality standards. Numerous benefits of outsourcing these services, such as reduced operational costs, improved flexibility, higher efficiency, and expertise, have also encouraged its widespread adoption.

Service providers in the U.S. cold storage market have enhanced their efforts to protect temperature-controlled products from potential tampering or malicious actions. Securing the facility encompasses not only refrigerated warehouses but employees and visitors as well. This has resulted in increasing demand for the adoption of monitoring components such as telematics and telemetry devices, sensors, data loggers, and networking devices. Such components significantly improve the performance and efficiency of refrigerated storage and transportation.

Industry players are relying on RFID and Automatic Identification and Data Capture (AIDC) for enhancing the efficiency of the order fulfillment process. The growing penetration of Bluetooth technology and RFID sensors, across the logistics industry, is expected to spur the adoption of AIDC technology. Furthermore, cold storage operators focus on maximizing their throughput and order accuracy by using robotics applications, high-speed conveyor systems, and automated materials handling equipment. These technological advancements are in turn expected to boost the growth of the market over the forecast period.

Browse through Grand View Research's Processed & Frozen Foods Industry Related Reports

Processed & Frozen Vegetables Market - The global processed & frozen vegetables market size was valued at USD 77.97 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 3.9% from 2022 to 2028.

Plant-based Meat Market - The global plant-based meat market size was valued at USD 5.06 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 19.3% from 2022 to 2030. Growing consumer interest in plant-based diets, coupled with the rising consciousness for animal rights through various welfare organizations is expected to drive the market.

Key Companies profiled:

Some prominent players in the U.S. Cold Storage market include

- Americold

- AGRO Merchants Group North America

- Burris Logistics

- Henningsen Cold Storage Co.

- Lineage Logistics Holdings, LLC

- Nordic Logistics

- Preferred Freezer Services

- VersaCold Logistics Services

- United States Cold Storage

- Wabash National Corporation

Order a free sample PDF of the U.S. Cold Storage Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment