U.S. HVAC Systems Industry Overview

The U.S. HVAC systems market size is anticipated to reach USD 26.93 billion by 2030, registering a CAGR of 5.6% over the forecast period, according to a new study by Grand View Research, Inc. Diverse and changing climatic conditions across the U.S. remain the prime factor favoring the HVAC equipment demand. Furthermore, to this the U.S. is a large country in terms of a geographic area as such the weather changes from extreme cold to extreme hot throughout the year across states, cities, or coasts, making HVAC installation in residential spaces a mandate. The need to control building temperature irrespective of the outdoor conditions helps the HVAC business thrive in the country. From the supply-side, stringent norms by regulatory bodies in the country to lower power consumption and carbon emission will play a key role in driving the market growth.

U.S. HVAC Systems Market Segmentation

Grand View Research has segmented the U.S. HVAC systems market on the basis of product, end-use, and region:

Based on the Product Insights, the market is segmented into Heating, Ventilation and Cooling.

- The cooling product segment dominated the market in 2021. The segment accounted for the largest share of more than 56.7% of the total revenue in the same year.

- The cooling segment is further projected to retain its dominant market position expanding at the fastest growth rate during the forecast period.

- The ventilation product segment is estimated to register a significant growth rate over the next eight years as the ventilation is pivotal to any closed space to remove odor, pollutants, humidity, etc.

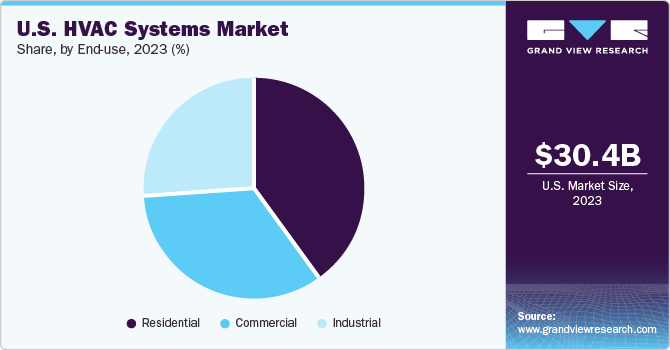

Based on the End-use Insights, the market is segmented into Residential, Commercial and Industrial.

- The demand for HVAC systems in the commercial end-use sector is anticipated to witness the fastest growth rate of more than 6.00% from 2022 to 2030.

- The growth of the commercial segment can be attributed to the rapidly expanding real-estate sector in the U.S., particularly commercial spaces, such as malls, hotels, airports, and offices.

- HVAC also forms an integral part of the industrial sector, particularly in manufacturing plants or cold chain storage spaces.

- It is critical to maintaining the temperature in such spaces to maintain the quality of the products and, hence, the demand for HVAC systems is gaining traction in the industrial end-use segment.

U.S. HVAC Systems Regional Outlook

- Northeast

- Southeast

- Midwest

- Southwest

- West

Key Companies Profile & Market Share Insights

The industry is competitive and moderately consolidated with vendors with a global presence dominating the space. In addition, companies are also engaging in inorganic growth strategies, such as mergers & acquisitions, strategic partnerships, and geographical expansions, to stay afloat in the competitive market scenario.

Some prominent players in the U.S. HVAC Systems market include

- Carrier Corp.

- Daikin Industries, Ltd.

- Emerson Electric Co.

- Johnson Controls International plc

- Lennox International, Inc.

- Trane Technologies

Order a free sample PDF of the U.S. HVAC Systems Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment