Nebulizer Industry Overview

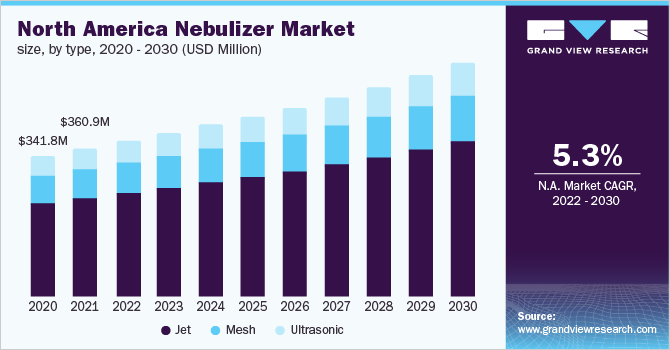

The global nebulizer market size was valued at USD 1.04 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 6.2% from 2022 to 2030.

The high growth is attributed to the rising incidence rate of chronic respiratory diseases, increasing demand for home healthcare devices, and the rising geriatric population. As per the Centers for Disease Control and Prevention, Chronic Obstructive Pulmonary Disease (COPD) is the fourth leading cause of death in the U.S.

Gather more insights about the market drivers, restraints, and growth of the Global Nebulizer market

Moreover, the rising consumption of alcohol, tobacco, and ultra-processed products, including sugar-sweetened beverages, is a major cause behind the increasing prevalence of respiratory diseases in North America. According to the Centers for Disease Control and Prevention (CDC) data, about 14% of deaths in adults aged 30 to 70 years in North America are caused due to tobacco consumption. Thus, an increase in the number of smokers and environmental pollution are anticipated to increase the demand for nebulizers. In addition, as per the WHO, in 2019, there were around 3.23 million deaths worldwide due to COPD. However, initiatives such as the “Global Alliance against Chronic Respiratory Diseases” are likely to improve diagnosis and treatment rates of respiratory disorders, which may, in turn, drive the market for nebulizers.

The COVID-19 outbreak has affected millions of people around the world. The pandemic has compelled the healthcare industry to take emergency actions, with a race to develop both therapeutic and preventive interventions. Asthma or COPD patients, who were aware of the risk of airborne transmission of COVID-19, were hesitant with regard to the use of inhaled medications, which are considered a potential source of viral transmission and immunosuppression. However, medical practitioners advised all such patients to continue using their prescribed inhaled medications, including nebulizers. Nebulized albuterol was recommended in some parts of the U.S. as an alternative to albuterol rescue inhalers when pharmacies faced a shortage of albuterol inhalers.

In addition, many pharmaceutical corporations are focusing on developing effective treatments to treat the COVID-19 viruses, which will be primarily administered via a nebulizer. For instance, in May 2021, Inspira Pharmaceuticals and Vectura declared a collaboration to develop a potential inhalation-based COVID-19 therapy. Under this contract, Vectura will test IPX formulation delivery to lungs through its FOX vibrating mesh nebulizer.

The market for nebulizers and respiratory devices is quite mature with the jet segment dominating the market due to the low cost. Hence, other nebulization devices are expected to experience high competition. Furthermore, it is a challenge for new technology or device to gain momentum in mature markets, particularly with the intricacies of different reimbursement and national regulatory systems that need to be followed for both drugs as well as devices.

Furthermore, it is a challenge for new technology or device to gain momentum in mature markets, particularly with the intricacies of different reimbursement and national regulatory systems that need to be followed for both drugs as well as devices. Mesh nebulizers are more expensive than jet nebulizers because of the increased number of tolerances, components, critical parts, and assembly related to both mesh and electronic control circuits. Besides, increasing applications of mesh nebulizers in clinical trials since 2006 by major companies such as Philips, Vectura, and Pari Gmbh are expected to boost the market growth in the near future.

Medicare Part B covers the cost of nebulizers and the cost of a few nebulizer medicines that are considered necessary. Under Part C, coverage is provided for medically-necessary nebulizers. Medicare reimburses 75% of the manufacturer’s suggested retail price for durable medical equipment. Nebulizers are classified as durable medical equipment by Medicare. Initiatives are being undertaken by government and non-government organizations to streamline the diagnosis and treatment of respiratory disorders, thus further supporting the market growth. For instance, the GARD is a voluntary alliance of national and international organizations to cure respiratory disorders.

Browse through Grand View Research's Medical Devices Industry Related Reports

Home Healthcare Market - The global home healthcare market size was valued at USD 320.6 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 7.9% from 2022 to 2030.

U.S. Nebulizer Market - The U.S. nebulizer market size was valued at USD 254.2 million in 2016 and is expected to expand at a CAGR of 6.2% over the forecast period.

Market Share Insights

May 2021 - Inspira Pharmaceuticals and Vectura declared a collaboration to develop a potential inhalation-based COVID-19 therapy. Under this contract, Vectura will test IPX formulation delivery to lungs through its FOX vibrating mesh nebulizer.

March 2021 - PARI Pharma GmbH revealed the LAMIRA Nebulizer System authorization for the delivery of Insmed's drug product ARIKAYCE in Japan

Key Companies profiled:

Some prominent players in the global Nebulizer market include

- Omron Corporation

- GE Healthcare

- Koninklijke Philips N.V.

- Allied Healthcare

- Vectura Group Plc.

- PARI Respiratory Equipment, Inc.

- Aerogen

- DeVilbiss Healthcare LLC

- Briggs Healthcare

- Beurer GmBH

Order a free sample PDF of the Nebulizer Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment