Household Cooking Appliance Industry Overview

The global household cooking appliance market size is expected to reach USD 431.61 billion by 2028, registering a CAGR of 6.5% from 2021 to 2028, according to a new report by Grand View Research, Inc. Changing consumer spending patterns, rising levels of disposable income, an increasing number of working women, growing number of nuclear household families, and rising preference for home automation are some of the factors that are expected to drive market growth.

Advances in the latest technologies, such as Internet of Things (IoT) and Artificial Intelligence (AI), have been playing a vital role in driving the growth of the market. The demand for smart, energy-efficient, and easy-to-use cooking appliances has been particularly on the rise in households over the past few years. Household cooking appliances integrated with IoT can be controlled remotely using smartphones and tablets via Bluetooth or Wi-Fi. On the other hand, AI-powered household cooking appliances can potentially ease meal preparation for individuals. For instance, Robert Bosch GmbH’s smart ovens support Wi-Fi connectivity. Consumers can give cooking instructions to these ovens using Alexa, the cloud-based voice service by Amazon, Inc.

Household Cooking Appliance Market Segmentation

Grand View Research has segmented the global household cooking appliance market based on product, structure, distribution channel, and region:

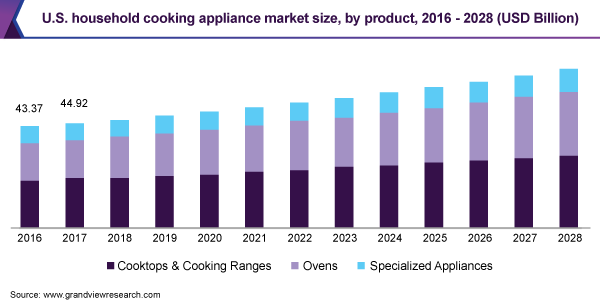

Based on the Product Insights, the market is segmented into Cooktops & Cooking Ranges, Ovens, and Specialized Appliances

- The cooktops and cooking ranges segment accounted for the largest revenue share of over 45.0% of the overall household cooking appliance market in 2020.

- Induction cooktops feature digital temperature control panels that help in saving time and reducing energy consumption. Hence, modern households particularly prefer induction cooktops.

- The ovens segment is anticipated to register the highest CAGR over the forecast period. The oven’s capability of cooking restaurant-quality in households’ meals bodes well for the growth of the segment.

Based on the Structure Insights, the market is segmented into Built-in and Freestanding

- The freestanding segment accounted for a revenue share of 60.0% in 2020.

- On the contrary, built-in household cooking appliance is preferred for smaller kitchens. They occupy lesser space as they are added to modular kitchens as designing elements. Hence, the built-in segment is expected to grow over the forecast period.

Based on the Distribution Channel Insights, the market is segmented into Brick & Mortar and E-commerce

- The e-commerce segment is anticipated to register the highest CAGR of around 10.0% over the forecast period.

- The e-commerce channel is anticipated to outpace retail sales in recent years, and hence, turning out to be a major concern for retailers.

- However, a significant number of household consumers will still prefer the brick and mortar channel and purchase cooking appliances from retail and other specialty stores.

Household Cooking Appliance Regional Outlook

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

Some of the major market players are consistently upgrading their product line with advanced and innovative equipment. They are also investing aggressively in R&D to manufacture products featuring state-of-the-art technologies, such as Artificial Intelligence (AI) and the Internet of Things (IoT).

Some prominent players in the global Household Cooking Appliance market include:

- Whirlpool Corporation

- AB Electrolux

- Haier Group

- Samsung

- LG Electronics

- Robert Bosch GmbH

Order a free sample PDF of the Household Cooking Appliance Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment