Food Service Disposable Industry Overview

The global food service disposable market size is expected to reach USD 79.2 billion by 2028, according to a new report by Grand View Research, Inc., expanding at a CAGR of 4.9% over the forecast period. The increasing popularity of Quick-Service Restaurants (QSRs), especially in the developing regions, such as Asia Pacific, owing to hectic work schedules is expected to aid the market growth over the forecast period. The online food delivery application segment is expected to register the highest CAGR over the forecast period, which is propelled by the outbreak of COVID-19 causing a rise in online food delivery across the globe.

The lockdowns imposed in various regions to limit the spread of the disease played a major role in the exponential growth of the market in 2020. Moreover, increased awareness regarding food delivery platforms during the COVID-19 pandemic is expected to augment the growth of online food delivery platforms in the coming years, which, in turn, is likely to drive the market. Food service disposable products are also used in fast service restaurants and establishments, such as food trucks, unlike hotels that mainly use reusable cutlery. The rapid shift of consumer preference from restaurants, hotels, and café to food trucks as a result of rising popularity is expected to benefit the market growth. In 2020, the online food delivery services sector was valued at over USD 21.3 billion, which is expected to increase rapidly in the future. Disposable products, such as aluminum foil containers, paper cups, and paperboard boxes, are largely used in the packaging of online food delivery.

Food Service Disposable Market Segmentation

Grand View Research has segmented the global food service disposable market on the basis of packaging type, material, application, and region:

Based on the Packaging Type Insights, the market is segmented into Rigid, Flexible, Wraps & Films, and Others.

- The rigid packaging type segment led the largest revenue share of more than 77% in 2020. Rigid packaging is mainly used to protect food from spillage and for the convenience of consumers.

- The flexible packaging type segment is estimated to record the fastest CAGR from 2021 to 2028. The high growth is attributed to the rising demand for flexible paper packaging as a result of government restrictions on single-use plastic products in many regions, such as Europe.

Based on the Material Insights, the market is segmented into Plastic, Paper & Paperboard, Bagasse, Polylactic Acid, and Others.

- The plastic material segment led the market accounting for more than 53% share of the global revenue in 2020.

- The segment will retain the dominant position throughout the forecast period as plastic is the most preferred choice of material in the packaging industry due to its low cost, ease of use, lightness, temperature resistance, etc.

- Paper and paperboard packaging has been witnessing high growth over the past few years, especially replacing popular disposables, such as plastic cups.

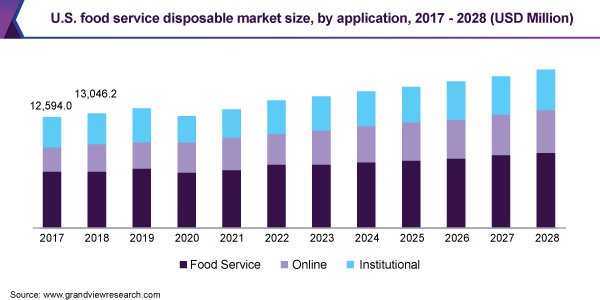

Based on the Application Insights, the market is segmented into Food Service, Full Service, Quick Service, Others, Online Delivery, and Institutional.

- The food service application segment led the market with a revenue share of more than 51% in 2020.

- The dynamics of the food service industry are changing rapidly, which is expected to aid in the growth of the food service disposables market.

Food Service Disposable Regional Outlook

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East & Africa (MEA)

Key Companies & Market Share Insights

The market players are adopting several business strategies to gain a competitive edge over others. For instance, Berry Global Inc. introduced pivot clear cups. As the consumption of niche beverages, such as frozen, blended, and mixed, is increasing so is the requirement for cost-effective, high-quality, single-use clear cups. These cups are made from an exclusive polypropylene blend that offers advantages over clear cups in the market. The COVID-19 pandemic adversely affected the market and companies faced a decline in product demand due to restrictions on import & export and transportation in the first quarter of 2020. However, with ease in lockdown restrictions, the product demand witnessed a swift rise. In addition, the product application scope has increased as consumers are preferring disposables over re-usable food containers due to safety concerns.

Some of the prominent players in the global food service disposable market include:

- Huhtamaki Food Service

- Graphic Packaging International LLC

- Sonoco Products Company

- Sabert Corp.

- Genpak LLC

- Pactiv LLC

- Contital Srl

- Go Pak Group

- R+R Packaging Ltd.

- Interplast Group

Order a free sample PDF of the Food Service Disposable Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment