Orthopedic Navigation Systems Industry Overview

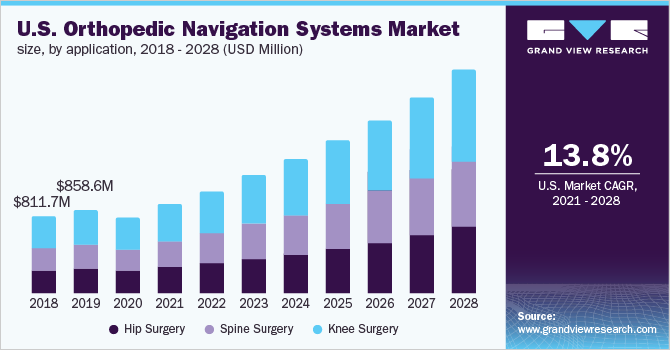

The global orthopedic navigation systems market size is expected to reach USD 6.05 billion by 2028, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 14.4% from 2021 to 2028. The increasing geriatric population prone to orthopedic diseases is a key contributing factor propelling the demand for orthopedic navigation systems. Osteoarthritis and osteoporosis are the most common disorders in the population aged 70 years and above. The growing prevalence of these disorders results in an increased economic burden on many countries.

Due to the COVID-19 pandemic, non-emergency procedures were canceled or postponed, which adversely affected the global market as restrictions resulted in delays to a number of procedures. In the U.K., the number of individuals waiting for surgical procedures has increased to approximately 10 million from 4 million before the pandemic. While the U.S. is expected to have a backlog of more than 1 million joint and spinal surgeries by mid-2022. Currently, most nations have elevated restrictions on elective surgery. As a result of the recommencement of surgical procedures at full force, the market is anticipated to catch up the pace over the forecast years.

Orthopedic Navigation Systems Market Segmentation

Grand View Research has segmented the global orthopedic navigation systems market on the basis of application, technology, end-use, and region:

Based on the Application Insights, the market is segmented into Knee, Hip, and Spine

- The knee segment dominated the overall market accounting for a revenue share of over 46% in 2020 and will expand further at a steady CAGR in the forecast years.

- On the other hand, the spine segment is expected to register the fastest CAGR of over 14% from 2021 to 2028.

Based on the Technology Insights, the market is segmented into Electromagnetic, Optical, and Others

- The optical segment dominated the market with a revenue share of over 57% in 2020 and is expected to maintain its dominance throughout the forecast period.

- Electromagnetic navigation systems involve electromagnetic techniques that comprise magnetic field producers as well as magnetic field detectors to create a live image of the body. This system of navigation is particularly important for elderly people, as they are extremely vulnerable to numerous physical conditions. This is expected to support the segment growth in the coming years.

Based on the End-use Insights, the market is segmented into Hospitals and Ambulatory Surgical Centers (ASCs)

- The hospitals end-use segment held the largest share of more than 75.0% in 2020.

- The Ambulatory Surgical Centers (ASCs) end-use segment is expected to witness the fastest CAGR over the forecast period.

Orthopedic Navigation Systems Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

Key factors that can be attributed to the dominance of a few players include the presence of an extensive product portfolio and a wide global distribution network. However, other players are also gaining significant market share due to mergers & acquisitions and new product development activities.

Some prominent players in the global Orthopedic Navigation Systems market include:

- Braun Melsungen AG

- Stryker

- Medtronic

- Smith+Nephew

- Johnson & Johnson Services, Inc. (DePuy Synthes)

- Zimmer Biomet

- Amplitude Surgical

- Kinamed, Inc.

- Globus Medical

- OrthAlign

Order a free sample PDF of the Orthopedic Navigation Systems Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment