Polypropylene Compounds Industry Overview

The global polypropylene compounds market size is anticipated to reach USD 35.19 billion by 2028, according to a new report by Grand View Research, Inc., growing at a CAGR of 7.6% over the forecast period. Increasing requirement for flame retardancy and improved heat resistance and serviceability of plastics in the electrical & electronics industry is the primary factor driving the growth of the global market. In addition, regulations in western markets, including the EU and the U.S., which are aimed at vehicular weight reduction are further fueling the demand for polypropylene (PP) compounds in the automotive industry.

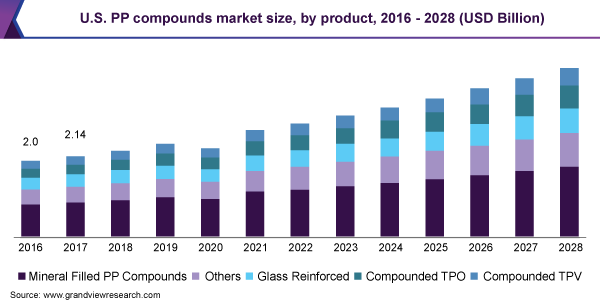

The mineral-filled product segment is expected to hold a dominant market share owing to the superior properties of these products, such as higher heat distortion and rigidity. The most widely used minerals in the PP compound include talc, glass beads, mica, silica, and calcium. Low-cost production in China has led to a surge in new polymer production, which is driving the market to oversupply. Furthermore, rising population, rapid industrialization, and increase in consumer disposable income levels are some of the key socio-economic factors supporting market growth in the region.

Polypropylene Compounds Market Segmentation

Grand View Research has segmented the global polypropylene compounds market on the basis of product, end-use, and region:

Based on the Product Insights, the market is segmented into Mineral Filled, Compounded TPO, Compounded TPV, Glass Reinforced, and Others.

- The mineral-filled PP compound product segment led the market in 2020 and accounted for the largest revenue share of more than 43%.

- The most widely used minerals in PP compounds include talc, glass beads, mica, silica, and calcium. The improved thermal stability and mechanical stiffness enable their extensive use in several applications, such as automotive and electrical & electronics.

Based on the End-use Insights, the market is segmented into Automotive, Building & Construction, Electrical & Electronics, Textiles, and Others.

- The automotive end-use segment led the global market and accounted for more than 56% of the global revenue share in 2020.

- The growing popularity of PP as an alternative for engineering plastics and metal in automotive applications is projected to boost the product demand in this segment over the forecast period.

Polypropylene Compounds Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

The global market is fragmented in nature with the presence of various key players. Major players, in particular, compete on the basis of production capacity expansions, product portfolio developments, and methods to implement new technologies in product manufacturing. Integration across the stages of the value chain results in continuous raw material supply as well as low manufacturing costs. R&D initiatives by a few companies to enhance their product specifications and expand the market reach are expected to further augment intensify the market competition in the years to come.

Some of the prominent players in the global polypropylene (PP) compounds market include:

- LyondellBasell Industries Holdings B.V.

- Solvay

- ExxonMobil Corp.

- Trinseo

- Sumitomo Chemical Co., Ltd.

- Washington Penn Plastics Co., Ltd.

- Rhetech, Inc.

- Avient Corp.

Order a free sample PDF of the Polypropylene Compounds Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment