Server Industry Overview

The global server market size is expected to reach USD 145.31 billion by 2028, according to a study conducted by Grand View Research, Inc. It is expected to expand at a CAGR of 7.8% from 2021 to 2028. The rising preference for contactless payments and remote working amid the COVID-19 pandemic is expected to drive the need for high-speed data processing and storage capacity across various industry verticals. Advanced technologies have paved the way for connected appliances and autonomous vehicles, which has prompted IT infrastructure companies to opt for the latest, advanced storage solutions, including flash memory and solid-state drives (SSD), for storing crucial business data. Meanwhile, the demanding and changing configurations required by cloud service providers are driving the demand for servers. For instance, in May 2020, Facebook released its third generation Yosemite scalable server, which is equipped with Cooper Lake CPU and six memory modules. Such developments are expected to cause an increase in the average selling prices of servers, which is expected to subsequently benefit the market growth.

The demand for servers is anticipated to grow considerably over the forecast period owing to the growing focus on the timely update of IT infrastructure worldwide. The rising adoption of data analytics among enterprises to understand consumer trends has resulted in the growing adoption of IT networking equipment. Furthermore, the rollout of 5G networks and technologies such as the Internet of Things (IoT), cloud computing, and virtualization is expected to fuel the demand for high-performance computing servers.

Server Market Segmentation

Grand View Research has segmented the global server market on the basis of product, enterprise size, channel, vertical, and region:

Based on the Product Insights, the market is segmented into Blade, Rack, Tower, Micro, and Open Compute Project (OCP)

- The rack segment dominated the market and accounted for more than 35.0% share of the overall revenue in 2020.

- The Open Compute Project (OCP) segment accounted for the second-largest revenue share in 2020.

- Blade servers are expected to witness healthy growth over the forecast period owing to their compact size and high computing power.

Based on the Enterprise Size Insights, the market is segmented into Micro, Small, Medium, and Large

- Large enterprises accounted for the largest revenue share of over 65.0% in 2020 and are likely to maintain their lead over the forecast period.

- An increased number of product offerings by OEMs and lower-priced products by ODMs have prompted several SMBs to purchase servers, contributing to the promising growth prospects of the micro and small enterprise segments.

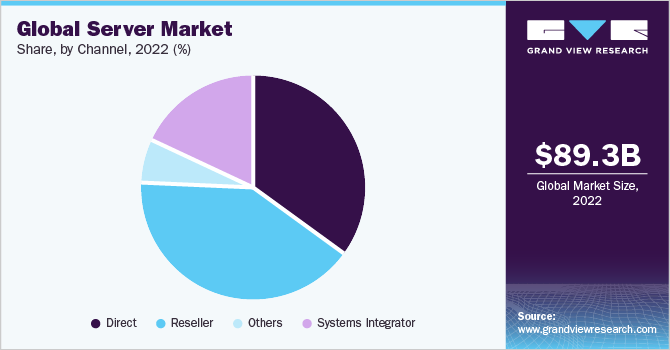

Based on the Channel Insights, the market is segmented into Reseller, Direct, Systems Integrator, and Others

- The reseller segment held the largest revenue share of over 40.0% in 2020.

- The direct channel is expected to expand at the fastest revenue-based CAGR of 9.0% over the forecast period. The segment growth is attributed to the customized designs and competitive prices offered by server ODMs.

Based on the Vertical Insights, the market is segmented into IT & Telecom, BFSI, Government & Defense, Healthcare, Energy, and Others

- The IT and telecom segment accounted for the largest revenue share of over 38.0% in 2020. This can be attributed to the rise in network connections and the high penetration of smartphones globally.

- The government and defense sector is likely to expand at a promising pace over the forecast period. This can be attributed to an increase in government initiatives promoting the digitization of government services.

Server Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

Favorable government initiatives to reduce barriers on IT companies to operate across the borders are yielding positive results for the network infrastructure ecosystem. Several market players are focusing on forming alliances to introduce new techniques to increase server capacities and speed.

Some prominent players in the global Server market include:

- IBM

- Hewlett Packard Enterprise Development LP

- Dell

- Lenovo

- Fujitsu

- Inspur Technologies Co. Ltd.

- Huawei Technologies Co. Ltd.

Order a free sample PDF of the Server Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment