Polypropylene Nonwoven Fabric Industry Overview

The global polypropylene nonwoven fabric market size is expected to reach USD 39.23 billion by 2028, registering a CAGR of 6.7% over the forecast period, according to a new report by Grand View Research, Inc. Rising product demand in end-use industries including hygiene, medical, automotive, agriculture, and furnishing is anticipated to benefit the market growth over the forecast period. High product demand in the hygiene industry for manufacturing sanitary products for babies, women, and adults is likely to drive industry growth. In addition, rising innovation in the production of hygiene products developed to aid in discomfort, contamination, and odor by controlling microbial activity is boosting the product demand in hygiene applications.

The market is experiencing trends, such as slow down of conventional petrochemical growth, private companies expanding their market share, major state-owned enterprises losing their market share, and rising demand from South and East Asia, which have a significant impact on the global market. Prominent players in the market are focusing on enhancements in business by expanding their geographical reach and introducing application-specified products. Mergers, acquisitions, joint ventures, and agreements are considered by these players to expand their portfolio and business reach, thereby benefiting the market growth over the forecast period.

Polypropylene Nonwoven Fabric Market Segmentation

Grand View Research has segmented the global polypropylene (PP) nonwoven fabric market on the basis of product, application, and region:

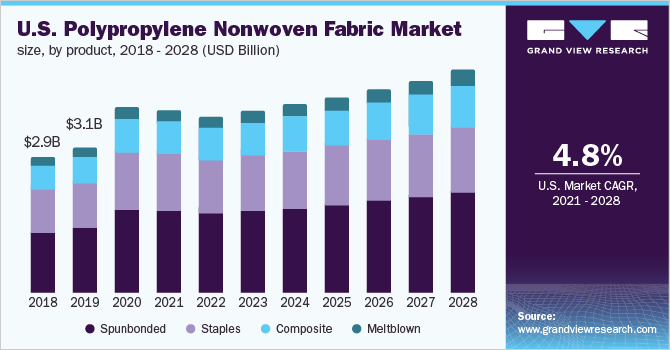

Based on the Product Insights, the market is segmented into Spunbonded, Staples, Meltblown, and Composites.

- The spunbonded product segment led the market and accounted for more than 45% share of the global revenue in 2020.

- Excellent properties offered by spunbonded nonwoven fabrics coupled with high process efficiency associated with this technology are likely to drive the product demand in various applications.

- The eco-friendliness associated with the technology and recyclability of the spunbonded woven fabrics is likely to propel their demand over the projected period.

- Staples PP nonwoven fabrics are gaining importance in medical application over other PP nonwoven fabrics on account of their finer filtration and low-pressure drop properties.

Based on the Application Insights, the market is segmented into Hygiene, Industrial, Medical, Geotextiles, Furnishings, Carpet, Agriculture, Automotive, and Others.

- The hygiene application segment led the market and accounted for more than 44% of the global revenue share in 2020, owing to the improved consumer lifestyle and increasing awareness about skin health.

- PP nonwoven fabrics are used for manufacturing coated fabrics, display felts, tapes, conveyor belts, cable insulation, air conditioner filters, semiconductor polishing pads, noise absorber felt, etc. in industrial applications.

- Increasing investment in the industrial sector across developing economies is expected to have a positive impact on market growth.

- These fabrics are also used in the production of asphalt overlay, golf and tennis courts, road and railroad beds, artificial turf, soil stabilization, sedimentation and erosion control, drainage system, and dam and stream embankments.

PP Nonwoven Fabric Regional Outlook

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East & Africa (MEA)

Key Companies & Market Share Insights

The innovation, development, and production of PP nonwovens are influenced by major companies in the market, which contribute a large share to the market. In addition, many companies based in emerging economies in Asia Pacific continue to invest and increase their share in the market. Prominent companies are focusing on offerings related to application-specific products. For instance, major companies have started face mask production in light of the growing need to tackle the COVID-19 infection. Several manufacturers have enhanced their facilities for the production of masks and other essentials.

Some prominent players in the global Polypropylene nonwoven fabric market include:

- Kimberly-Clark Corp.

- Berry Global Group, Inc.

- Lydall, Inc.

- First Quality Nonwovens, Inc.

- Pegas Nonwovens A.S.

- Schouw & Co.

- Mitsui Chemicals, Inc.

- FITESA

- Toray Industries, Inc.

- Freudenberg Group

- Ahlstrom-MunksjoOyj

- Johns Manville Corp.

- Suominen Corp.

- Asahi Kasei Corp.

Order a free sample PDF of the Polypropylene Nonwoven Fabric Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment