Meat Substitute Industry Overview

The global meat substitute market size is expected to reach USD 234.7 billion by 2030, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 42.1% from 2022 to 2030. Growing preference for a vegan diet coupled with rising health awareness is expected to fuel market demand in the forecast period.

Furthermore, growing awareness of environmental and ethical issues has also accelerated market growth. Plant-based meat is a healthier alternative to traditional meat products. Over half of protein users prefer to consume natural sources in their protein, which is boosting the shift in demand for easily identifiable and clean substances.

Meat Substitute Market Segmentation

Grand View Research has segmented the global meat substitute market on the basis of source, distribution channel, and region:

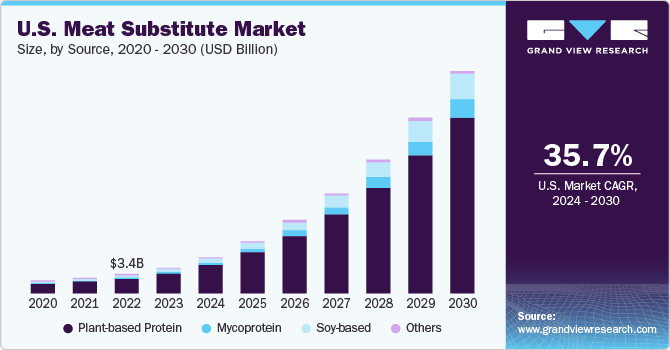

Based on the Source Insights, the market is segmented into Plant-based Protein, Mycoprotein, Soy-based, and Others

- The plant-based protein segment held the largest revenue share of 34.8% in 2021 and is expected to maintain dominance over the forecast period.

- Protein inputs for new plant-based meat are plentiful and reasonably priced. Hence, the volume of meat substitutes from plant-based protein sources is high and is the main factor for the dominance of the segment.

- Meat shortages in different regions of the world, environmental concerns, and a desire to eat a healthier diet are some of the reasons driving the growth of this segment.

- The mycoprotein segment is projected to register the fastest CAGR of 43.2% from 2022 to 2030. Owing to the higher content of nutrients like fiber that helps in controlling blood cholesterol and blood sugar, consumers prefer mycoprotein food.

- For vegans and vegetarians, meat alternatives were earlier limited to soya chunks and mushrooms, and cottage cheese.

Based on the Distribution Channel Insights, the market is segmented into Foodservice and Retail

- The retail segment led the market for meat substitutes and accounted for the largest revenue share of 67.3% in 2021. The segment includes all retail outlets such as hypermarkets, supermarkets, convenience stores, mini markets, and departmental stores.

- The foodservice segment is anticipated to register a CAGR of 43.0% from 2022 to 2030. The category includes outlets such as restaurants, hotels, and lounges. The COVID-19 pandemic has led to lockdowns and shutdowns across the world.

- One of the key factors driving the global foodservice market is the growing demand for customization and innovation in food menu options. Consumers have a wide range of options for customizing their meals based on their taste, dietary, and financial preferences.

- Plant proteins are experiencing huge demand, with retailers offering plant-based protein products and restaurants introducing plant-protein menu innovations.

Meat Substitute Regional Outlook

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

The market for meat substitutes comprises companies with a stronghold in meat substitutes and is still developing, where new entrants are launching products and other key players in the market are planning to launch their products due to the increasing health concern owing to rising animal-borne diseases across the globe.

Some prominent players in the global Meat Substitute market include:

- Amy’s Kitchen

- Beyond Meat

- Impossible Foods Inc.

- Quorn Foods

- The Kellogg Company

- Unilever

- Meatless B.V.

- VBites Foods Ltd.

- Sunfed

- Tyson Foods, Inc.

Order a free sample PDF of the Meat Substitute Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment