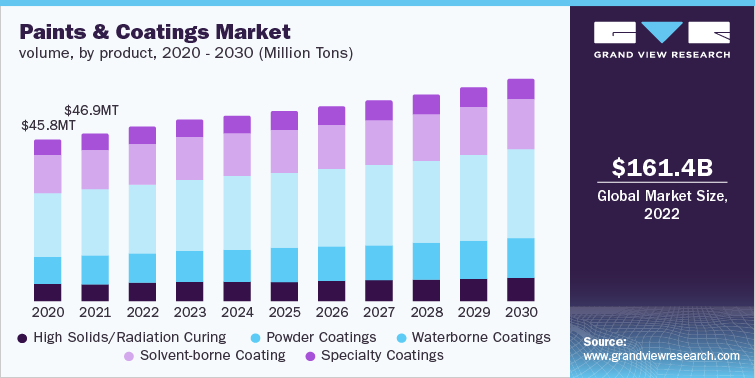

The global paints and coatings industry size stood at USD 48.16 million tons in 2022 and will exhibit a CAGR of 3.2% from 2023 to 2030, according to the "Paints and Coatings Industry Data Book, 2023 - 2030," published by Grand View Research. Favorable policies to minimize VOC, along with surging demand from oil & gas, construction and automotive industries, will reinforce the market growth. Producers have emphasized improving corrosion resistance, gloss retention and limiting emissions of hazardous air pollutants (HAPs) amidst soaring raw material and solvent costs.

An uptick in the construction industry has seen architectural coating grow in stature across advanced and emerging marketplaces. Lately, commercial, residential and institutional buildings have sought water- and solvent-based architectural coating to underscore their environmental profiles. Moreover, the do-it-yourself (DIY) trend could encourage consumers to protect, preserve and enhance the interiors and exteriors of buildings.

Order your copy of the Free Sample of "Paints and Coatings Industry Data Book - Powder Coatings, Waterborne Coatings, Solvent-borne Coatings and High Solids/Radiation Curing Coatings Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030" Data Book, published by Grand View Research

Powder coating technology has gained ground with the rising penetration of the automobile, construction and furniture markets. Predominantly, the emergence of electric vehicles from Tesla, Audi, GM, Hyundai, Toyota and Nissan, among others, has strengthened the position of powder makers. EV original equipment manufacturers (OEMs) seeking sustainability (zero-emission coatings and coatings having no-to-low VOC) are likely to inject funds into the landscape. The global powder coatings market generated USD 8.52 million tons in 2022 and will exhibit a 3.9% CAGR during the forecast period. The growth outlook is partly due to the demand for sustainable solutions and the prevention of corrosion across business verticals.

Forward-looking companies have upped focus on waterborne paints and coatings on the back of rigorous environmental regulations. The low level of VOC, durability, and performance have made these paints sought-after among manufacturers. Some of the upsides, such as better color retention, higher temperature resistance, tremendous adhesion, low odor and less flammability, have made water-based formulations favorable for paints and coatings. The waterborne paints and coatings market size was valued at USD 18.92 million tons in 2022 and could depict a CAGR of 3.4% through 2030.

Trends and opportunities that are likely to steer the industry growth are delineated below:

- Smart paint and antimicrobial coating are poised to be the next big things following the technological advancements in touchscreens and gesture commands. The latter gained ground on the back of the COVID-19 pandemic, compelling manufacturers to invest in technology to help negate lethal microbes.

- Stakeholders expect solvent-borne coatings to be sought-after in the industrial and architectural sectors for better functionality and reduced drying time. Besides, physical properties, including viscosity, boiling point, conductivity and surface tension, have augured growth for solvent coating.

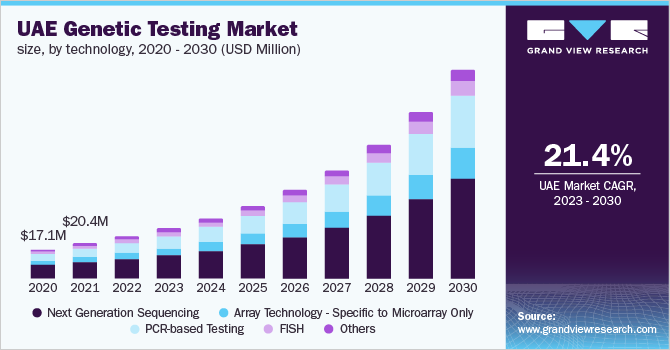

- The Asia Pacific market will witness notable growth against the backdrop of the flourishing construction industry across China and India. In addition, automotive paints and coatings have observed bullish demand, prompting industry leaders to expand their regional penetration.

The U.S. and Canada are poised to provide opportunities galore with industrial paints and coatings gaining ground across oil & gas, construction, automotive, aerospace, mining, marine, electronics and home appliances applications. For instance, marine coatings are sought-after on Navy ships to enhance anti-fouling and anti-corrosive properties. The paints and coatings industry in North America has emerged as a happy hunting ground to enhance aesthetic appeal, performance enhancement and durability. Of late, technology-powered paints & coatings have become more sustainable and resilient, suggesting their indispensable role in North America's infrastructural developments.

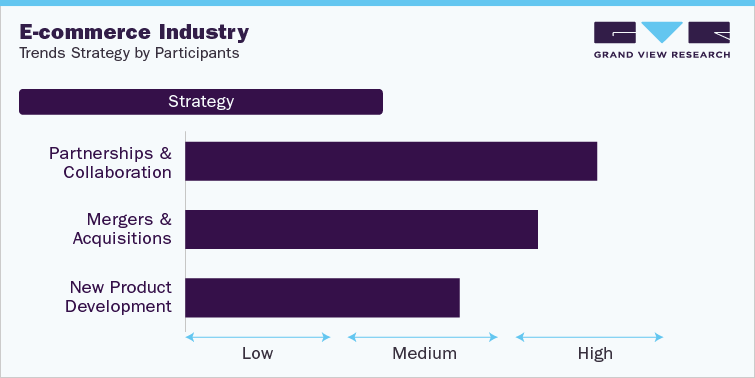

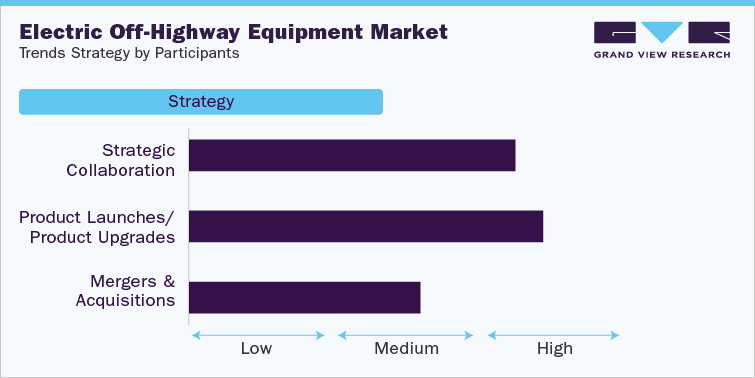

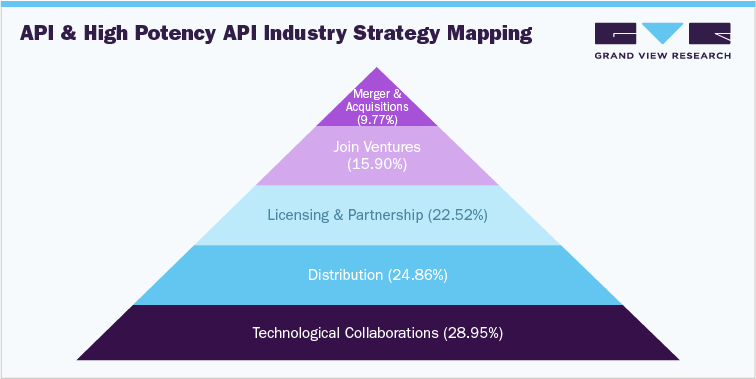

The competitive landscape indicates incumbent players could inject funds into organic and inorganic strategies, including innovation, research & developments, product offerings, technological advancements, partnerships, mergers & acquisitions and geographical expansion. To illustrate, in April 2022, Akzo Nobel completed the acquisition of Grupo Orbis to bolster its footprint in the Latin America market. In August 2022, PPG announced pouring USD 11 million to increase the powder coating capacity by two-fold in Mexico.

Check out more Industry Data Books, published by Grand View Research

About Grand View Research

Grand View Research, U.S.-based market research and consulting company, provides syndicated as well as customized research reports and consulting services. Registered in California and headquartered in San Francisco, the company comprises over 425 analysts and consultants, adding more than 1200 market research reports to its vast database each year. These reports offer in-depth analysis on 46 industries across 25 major countries worldwide. With the help of an interactive market intelligence platform, Grand View Research Helps Fortune 500 companies and renowned academic institutes understand the global and regional business environment and gauge the opportunities that lie ahead.

Contact:

Sherry James

Corporate Sales Specialist, USA

Grand View Research, Inc.

Phone: 1-415-349-0058

Toll Free: 1-888-202-9519

Email: sales@grandviewresearch.com

Web: https://www.grandviewresearch.com/sector-reports-list

Follow Us: LinkedIn | Twitter