U.S. and Canada Travel Industry Overview

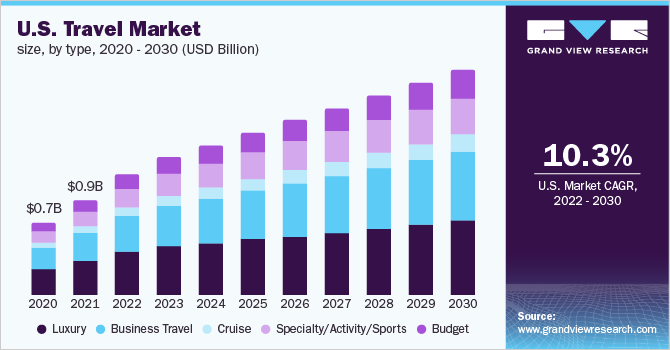

The U.S. and Canada travel market size was valued at USD 951.8 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 10.3% from 2022 to 2030. Increasing government steps to resuscitate the economy by funneling funds into the system is assisting various businesses in launching new ventures, which will have a beneficial impact on the expansion of the travel market in the U.S. and Canada. Furthermore, throughout the projection period, the evolving trend of transformational travel centered on wellness journeys to restore, balance, and transform the mind, spirit, and body is predicted to drive the market. The COVID-19 pandemic has resulted in accelerated socio-economic changes that would continue to affect businesses and communities.

In addition, the effects of long-term issues, such as climate change and economic instability, are becoming more apparent. COVID-19 has resulted in uncertainty ranging from differing entry rules at global borders, such as the number of nationals that can be admitted, under what circumstances, and with what quarantine or related requirements, to refund policies (airfares, hotels, and business event planners. Expedia Group conducted a study of 2,200 Americans in the U.S. in March 2021 to understand the evolution of the travel industry since the onset of the COVID-19 pandemic.

Gather more insights about the market drivers, restraints, and growth of the U.S. and Canada Travel Market

The study concluded that 67% of families in the U.S. took a flexi-cation trip (working and schooling remotely) in 2021 and 13% of people in the U.S. booked an international trip that year. There has been an increasing popularity of value-driven trips that offer money’s worth and brands that are based on price and convenience, especially among millennial and younger travelers. However, travel has been one of the first and hardest-hit industries since the coronavirus outbreak. Strict lockdowns and shelter-at-home orders in most parts of the world have adversely impacted the travel industry and the assorted ecosystems that rely on it.

Personalized services, reliable transport, exclusivity, and positive & professional interaction with staff are what set the benchmark for travel. Traveling around the world is being greatly influenced by favorable factors, such as growing political stability, improving attitudes toward gender, ethnicity, sexual orientation, and race, and more accommodating visa regulations. Travelers are looking to create their own unique experiences through flexible itineraries that combine entertainment as well as relaxation.

Browse through Grand View Research's Homecare & Decor Industry Related Reports

Safari Tourism Market - The global safari tourism market size was valued at USD 33.37 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2030.

Bleisure Travel Market - The global bleisure travel market size was valued at USD 933.31 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 12.1% from 2023 to 2030.

U.S. and Canada Travel Industry Segmentation

Grand View Research has segmented the U.S. and Canada travel market based on type, age group, and country:

U.S. & Canada Travel Type Outlook (Revenue, USD Million, 2017 - 2030)

- Luxury

- Business Travel

- Cruise

- Specialty/Activity/Sports

- Budget

U.S. & Canada Travel Age Group Outlook (Revenue, USD Million, 2017 - 2030)

- Millennial

- Generation X

- Baby Boomers

Market Share Insights:

December 2021: American Express Global Business Travel (GBT) and Sabre formed a multi-faceted strategic relationship aimed at creating technologies that helped shape the future of corporate travel distribution. The company enhanced its commitment to Sabre and made a multi-million-dollar, long-term yearly investment in cooperative technology development with Sabre under the terms of the agreement, which took effect in January 2022.

December 2021: Booking Holdings Inc. announced that it had completed its previously announced acquisition of Getaroom from Court Square Capital Partners for USD 1.2 billion. Getaroom is a B2B hotel room distributor that merged with Booking Holdings Inc. The Priceline brand developed a new strategic partnerships business unit, which operates with the Priceline Partner Network.

Key Companies profiled:

Some prominent players in the U.S. and Canada Travel Industry include

- Expedia, Inc.

- Booking Holdings Inc.

- American Express Global Business Travel (GBT)

- TCS World Travel

- Abercrombie & Kent USA, LLC

- Exodus Travels Limited

- BCD Travel, Intrepid Travel

- Topdeck Travel Ltd.

- Trafalgar

Order a free sample PDF of the U.S. and Canada Travel Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment